Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Feb 04, 2015

ECB QE brings Cocos to the forefront

The ECB's decision to introduce full blown QE has encouraged demand for riskier assets, leading to a surge in the popularity of Contingent Convertible bonds.

- Recent QE steps have seen Contingent Convertible bonds spreads tighten significantly, but they still offer a large premium over other capital classes

- The iBoxx EUR Contingent Convertible index has outperformed Stoxx 600 bank equity by over 10% in the last year

- Issuances accelerated over 2014 with over $90bn of issues now tracked by the iBoxx Contingent Convertible index family

Contingent Convertible bonds, better known as Cocos, were first introduced in 2009 as a consequence of the financial crisis when taxpayers were obliged to foot the bill when banks fell in distress. Regulators have since clamped down on the sector and forced banks to hold more loss absorbing capital (equity), protecting against future losses and making creditors, who absorb any losses in the first instance, accountable.

Cocos are, essentially, a type of hybrid debt. The instruments act like bonds during the good times, and act like equity when times are bad. They provide a regular income stream; for example Barclays's benchmark 1bn EUR bond provides a 8% coupon, but will be converted into equity should the bank's Tier 1 ratio dip below 7%. They are favourable from a bank's standpoint because they are cheaper to issue than shares.

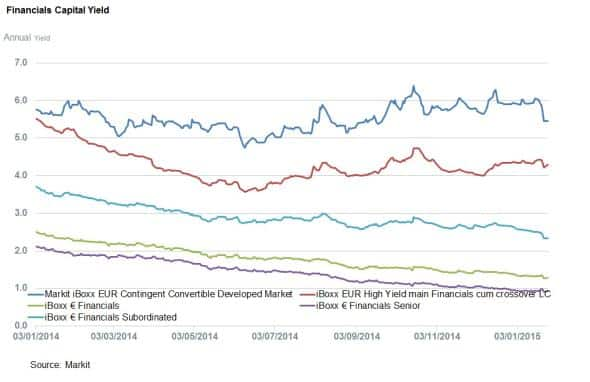

Yields provide relative value

The ECB's decision to introduce QE has been seen as a net positive for European banks. Threats of deflation have been subdued and in theory, borrowing becomes cheaper as interest rates are pushed lower. Securities across the capital structure spectrum benefitted as yields continued to tighten, with the iBoxx € Financials Senior now yielding below 1% a yearly low.

This added perceived safety also impacted strongly on lower ranked securities with Cocos leading the way. The yield in the iBoxx EUR Contingent Convertible index fell 50bps around the QE announcement window. Banks' balance sheets have been getting sturdier over the last few years, and investors seem to have focused on the positive impact of QE rather than the possible fallout from oil and European volatility. This investor sentiment is evident by the recent tightening across all bank capital classes. Riskier, high beta assets such as Cocos have been no exception.

In relative terms, Coco spreads are around 96bps above the iBoxx EUR High Yield main Financials index and 232bps above the iBoxx € Financials Subordinated index.

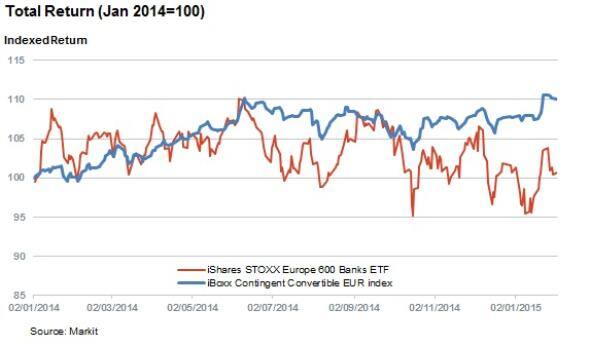

The attractive coupons offered by Cocos in comparison to regular subordinated bank debt, falling government bond yields and fluctuating equity prices, have made the growing asset class a strong performer over the past year.

This is highlighted by the 10% total return delivered by the iBoxx Contingent Convertible EUR index over the past year. This far outperforms equities as evident by the fact that the iShares STOXX Europe 600 Banks has traded roughly flat over the last 12 months.

The two asset classes do have some relationship as the recent surge in Cocos was also mirrored by an uptrend in bank equity values. This makes sense as buoyant share prices make the prospect of conversion less likely as it creates a larger layer of Common equity tier 1 capital.

Issuances accelerating

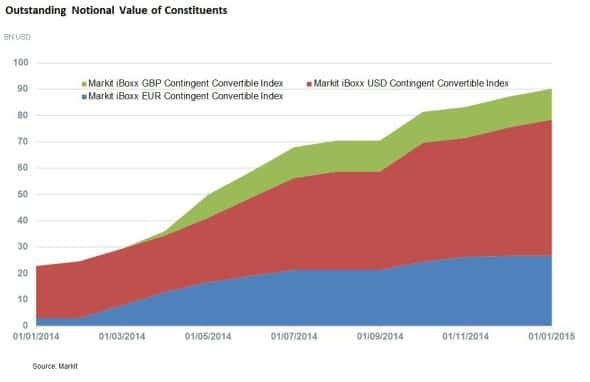

A low interest environment, investor appetite and favourable regulatory terms have led to a whole host of issuers taking the opportunity to issue Cocos.

In 2014 alone, the notional amount outstanding in the iBoxx Contingent Convertible EUR index has risen from around €2bn to over €20bn. Significant increases have also been seen in GBP and USD. The asset class is showing clear momentum but is not without its risks.

Neil Mehta

Analyst

Markit

Tel: +44 207 260 2298

Email: neil.mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04022015-credit-ecb-qe.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04022015-credit-ecb-qe.html&text=ECB+QE+brings+Cocos+to+the+forefront","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04022015-credit-ecb-qe.html","enabled":true},{"name":"email","url":"?subject=ECB QE brings Cocos to the forefront&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04022015-credit-ecb-qe.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=ECB+QE+brings+Cocos+to+the+forefront http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04022015-credit-ecb-qe.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}