Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 04, 2018

UK PMI surveys show economy ending 2017 on resilient note

The December PMI™ surveys showed the UK economy ending 2017 with a resilient and steady pace of growth, though a softer increase in new orders and a slowdown in hiring underscored downside risks to the near-term outlook. Price pressures meanwhile remained among the highest seen over the past decade as firms passed higher costs on to customers.

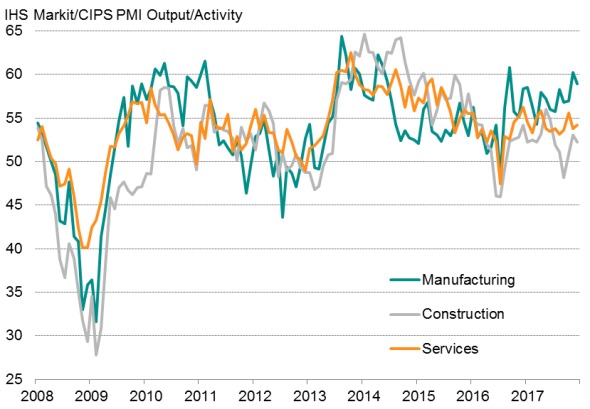

Steady fourth quarter growth

The 'all-sector' IHS Markit/CIPS PMI Output Index head steady at 54.7 in December, indicating a solid end to the year for the UK economy. Historical comparisons suggest that the survey data are consistent with the economy growing at a quarterly rate of 0.4-0.5% in the fourth quarter.

Service sector growth picked up momentum to the second-fastest in the past eight months in December, and was broadly in line with the average for the year, but slower rates of expansion were seen in both manufacturing and construction.

The goods producing sector - buoyed in particular by further solid export gains - nevertheless continued to enjoy by far the strongest rate of growth of the three sectors, as has been the trend throughout the past one and a half years.

Construction growth remained especially lacklustre, though recent gains have represented an improvement on the brief downturn seen back in September. Improved house building activity has provided a fillip to the construction sector in recent months, helping to offset stagnant civil engineering and a marked downturn in commercial building in December.

Growth continued to be led by financial services and the hotels and restaurants sectors, the latter likely buoyed by tourist spending rising on the back of the weak exchange rate. The worst performing sub-sector was again IT and computing, which has seen its worst performance for over five years in recent months, with activity declining throughout the fourth quarter.

Output of the three main sectors

Sources: IHS Markit, CIPS.

Uncertain outlook

Forward looking indicators were mixed. Inflows of new business showed the second-smallest monthly rise since August 2016, when demand slowed in the immediate aftermath of the EU referendum. New order growth hit a 16-month low in services and a three-month low in manufacturing. New business in the construction sector, in contrast, improved to a seven-month high.

Hiring also slowed in December, linked to caution in relation to expanding capacity in the face of the uncertain outlook, though firms also reported hiring to have been curtailed by skill shortages. Employment growth across the three major sectors showed the smallest increase for nine months as a result.

Expectations about companies' business activity levels in a year's time meanwhile perked up to a seven-month high amid brighter outlooks in both services and manufacturing. However, the overall level of optimism remained low by historical standards, principally reflecting widespread uncertainty about Brexit.

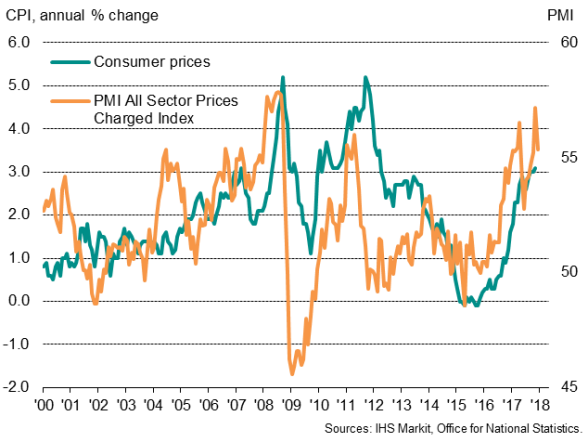

Inflationary pressures ease from near decade high

Another key theme from the surveys was continued elevated price pressures. The three PMI surveys collectively signalled the steepest rise in input costs for three months, with sharp rates of increase recorded across the economy. Higher import costs, emanating from the weak currency, as well as higher oil prices during the month, were widely reported.

Average prices charged for goods and services also rose at a marked pace, as firms sought to pass higher costs on to customers, albeit with the overall rate of increase cooling from November's peak. The rate of inflation was nonetheless still one of the highest since 2008.

Inflation

Chris Williamson, Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04012018-Economics-UK-PMI-surveys-show-economy-ending-2017-on-resilient-note.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04012018-Economics-UK-PMI-surveys-show-economy-ending-2017-on-resilient-note.html&text=UK+PMI+surveys+show+economy+ending+2017+on+resilient+note","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04012018-Economics-UK-PMI-surveys-show-economy-ending-2017-on-resilient-note.html","enabled":true},{"name":"email","url":"?subject=UK PMI surveys show economy ending 2017 on resilient note&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04012018-Economics-UK-PMI-surveys-show-economy-ending-2017-on-resilient-note.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+PMI+surveys+show+economy+ending+2017+on+resilient+note http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04012018-Economics-UK-PMI-surveys-show-economy-ending-2017-on-resilient-note.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}