Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 04, 2018

Strong December PMI rounds off best year for global manufacturing since 2010

A strong December global PMI rounded off the best year for manufacturing since 2010. While the upturn continued to show signs of broadening out to encompass emerging markets and Asia as trade flows increased towards the end of the year, the growth of factory activity continued to be largely dominated by the developed world and Europe in particular.

Price pressures meanwhile eased slightly but remained among the most elevated seen over the past six years, in part due to rising supply constraints.

Improved output, orders and employment

The headline JPMorgan Manufacturing PMI, compiled by IHS Markit, hit 54.5 in December, its highest since February 2011. The PMI has indicated that manufacturing has now gained growth momentum for six successive months, with output, employment and new orders rising at increased rates towards the end of 2017. All showed the largest monthly gains since early-2011.

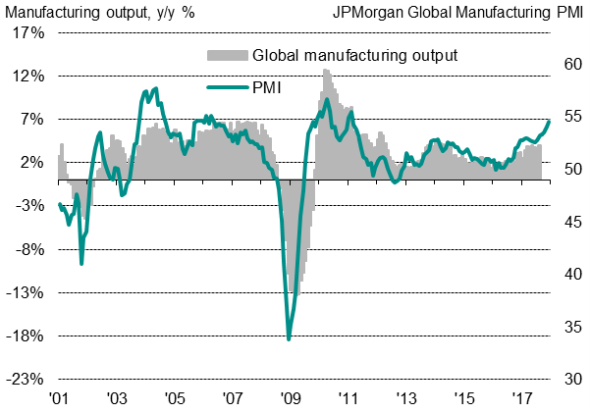

Global manufacturing PMI

The upturn continued to be fuelled in part by rising global trade. The Global PMI New Export Orders Index edged higher in December to likewise register the biggest monthly improvement since February 2011.

Leading indicator

The survey data correlate closely with official data on manufacturing production from statistics offices around the world, with the survey providing an advance indication of the latter. Over the past two decades, the PMI shows an 86% correlation, acting with a four-month lead, on the official manufacturing output data. The latest surveys are running at a pace broadly consistent with global factory production growth accelerating to an annual rate of 6-7%.

Europe takes highest rankings

The December PMI rankings continued to be dominated by European countries, which have seen manufacturing growth boosted through a combination of factors such as monetary stimulus, weakened exchange rates and improved demand. Over 2017 as a whole, the fastest rates of expansion were seen in Austria, Germany and the Netherlands respectively, topping a leader board in which the first seven places were all held by European nations. If the eurozone as a whole was counted as a single country, it would have topped the rankings, followed by neighbouring Czech Republic and the UK.

Australia recorded the fastest growing manufacturing sector outside of Europe in 2017, followed by Canada.

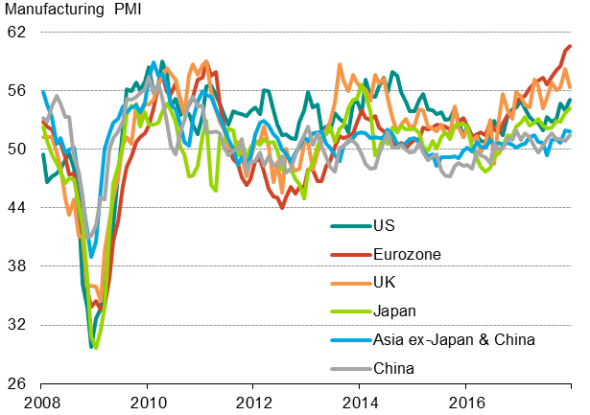

Manufacturing PMIs for major economies

The US and Japan held mid-ranking positions in 2017, registering the fourteenth and sixteenth fastest growing manufacturing economies respectively of the 29 countries in which IHS Markit conducts PMI surveys.

Taiwan was the strongest growing Asian manufacturing economy in 2017, according to the PMI surveys. However, the strength of growth in Taiwan, the Philippines, Japan and Vietnam contrasted with lacklustre performances in many other Asian economies, with South Korea and Malaysia being especially notable as the only two of the 29 countries surveyed to record a sub-50 average PMI in 2017, signalling contraction.

Much of Asia's subdued performance reflected a wider sluggish emerging market trend in 2017. With the sole exception of Greece, the 13 worst-performing manufacturing economies were all found in so-called emerging markets, including all BRIC economies.

Over 2017 as a whole the emerging market manufacturing PMI averaged a mere 51.3 compared to a solid 54.5 in the developed world. However, these nonetheless represented the best annual performances since 2011 and 2010 respectively, highlighting how the global upturn has broadened out.

Manufacturing PMI rankings over 2017

Sources for charts: IHS Markit, JPMorgan, Nikkei, Caixin.

Upward price pressures

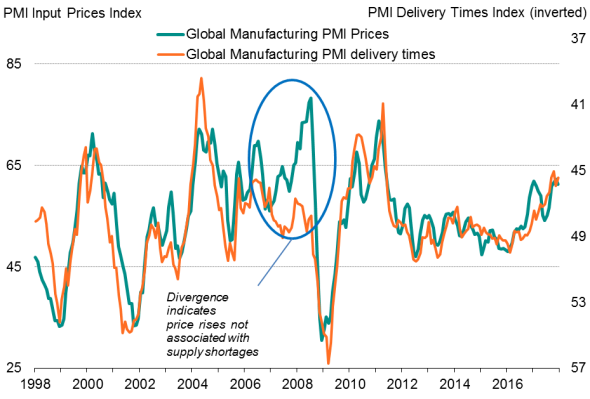

The upturn was again accompanied by elevated price pressures. Average factory selling price inflation cooled only slightly from November, which had seen the largest monthly increase since May 2011. Firms commonly reported the need to pass higher costs on to customers. Average input prices also showed one of the largest increases since mid-2011.

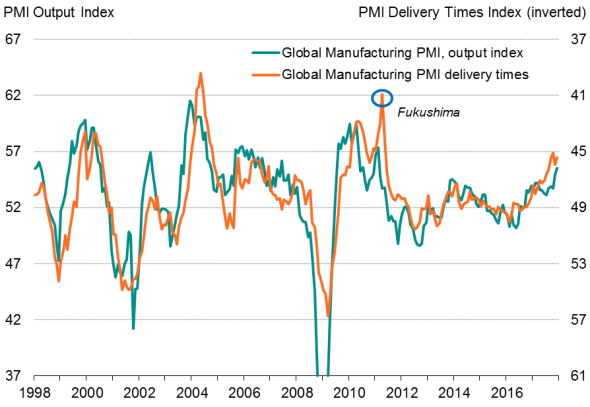

Higher input prices were often linked to demand running ahead of supply. With the surveys showing the amount of goods bought for use in global production rising at the fastest rate since March 2011, average supplier lead times were reportedly lengthening to the greatest extent since 2011 in the closing stages of 2017 as supplies struggled to meet demand.

Price pressures

Global supply delays and prices

Global supply delays and output

Sources for charts: IHS Markit, JPMorgan, Nikkei, Caixin.

Chris Williamson, Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04012018-Economics-Strong-December-PMI-rounds-off-best-year-for-global-manufacturing-since-2010.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04012018-Economics-Strong-December-PMI-rounds-off-best-year-for-global-manufacturing-since-2010.html&text=Strong+December+PMI+rounds+off+best+year+for+global+manufacturing+since+2010","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04012018-Economics-Strong-December-PMI-rounds-off-best-year-for-global-manufacturing-since-2010.html","enabled":true},{"name":"email","url":"?subject=Strong December PMI rounds off best year for global manufacturing since 2010&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04012018-Economics-Strong-December-PMI-rounds-off-best-year-for-global-manufacturing-since-2010.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Strong+December+PMI+rounds+off+best+year+for+global+manufacturing+since+2010 http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04012018-Economics-Strong-December-PMI-rounds-off-best-year-for-global-manufacturing-since-2010.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}