Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 04, 2018

Strong December Caixin China PMI ends best year since 2010

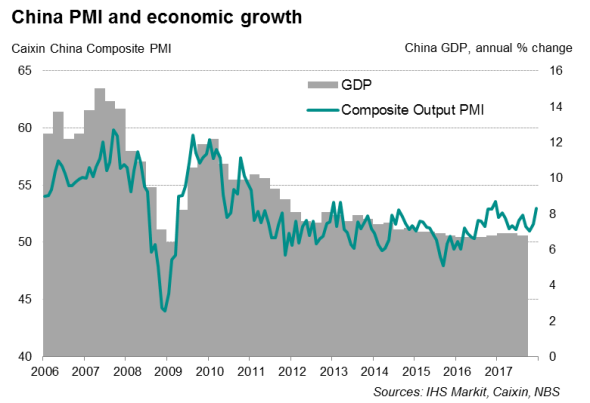

The Chinese economy finished last year on a strong note, marking its best year since 2010, according to the Caixin China PMI surveys. However, the upturn was marred by a sustained pressure on firms' margins, especially in manufacturing.

Best year since 2010

The Caixin Composite PMI™ Output Index, which covers both manufacturing and service sectors, rose to 53.0 in December, up from 51.6 in November. The latest reading was the best seen this year, and brought the 2017 average to the highest for seven years.

Faster output growth was paired with a solid increase in new sales. Inflows of new business saw the strongest monthly rise for nearly five years during December, suggesting a robust start to 2018. Employment levels remained largely stable while business expectations improved from November's two-year low.

No new stimulus amid steady growth

The overall economic performance last year was surprisingly resilient, with Caixin PMI data showing moderate expansions throughout 2017, pointing to a stabilisation of business conditions.

The survey data suggest that economic activity showed no severe adverse reaction to ongoing efforts by the government to reduce excess housing and industrial capacity as well as to tackle pollution, as initially feared. Official data likewise showed the economy expanded by a robust annual rate of 6.9% in the first three quarters of 2017.

Resilient growth momentum also helped steady the job market. PMI data showed broadly stable employment levels in 2017 following a three-year period of decline.

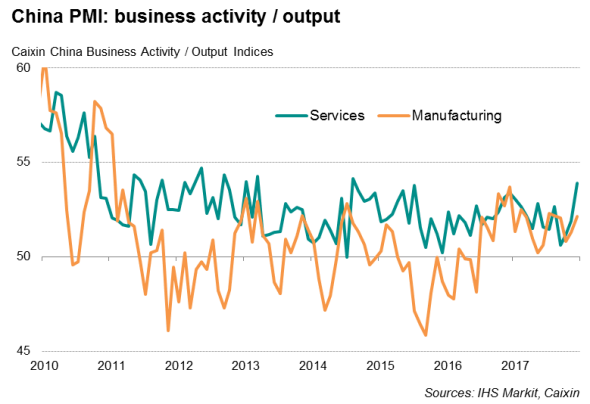

Survey details revealed that jobs growth in the service sector was sufficient to offset the fall in manufacturing employment, suggesting that China's transition to a consumption-based economy has progressed.

With steady growth and stable labour market conditions, the survey data suggest there is less need for additional stimulus to spur economic activity in 2018, thereby allowing the government to focus on fighting financial risks.

Widening gap between manufacturing and services

December survey data not only showed a wider gap in expansion rates between manufacturing and service sectors, but suggest that the divergence may widen in the year ahead, reflecting the government's commitment to supply side reforms.

In the manufacturing sector, expectations for future output improved from November's two-year low but remained well below the historical average. In contrast, business optimism among service providers rose to the highest since June, with the Business Expectations Index above the average seen in the last two years.

Margin squeeze undermines efforts to cut debt

A sustained squeeze on corporate margins, especially in manufacturing, could meanwhile weaken efforts to reduce debt.

Manufacturers' margins remained under pressures as the rate of input cost inflation continued to outstrip that of selling prices noticeably. Higher costs were commonly related to increased commodity prices and transport fee hikes.

At the same time, service providers reported a noticeable pick-up in the rise of input prices. Input cost inflation saw the largest monthly increase for nine months during December, comparing with largely modest inflation seen for most of 2017.

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

Bernard.Aw@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04012018-Economics-Strong-December-Caixin-China-PMI-ends-best-year-since-2010.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04012018-Economics-Strong-December-Caixin-China-PMI-ends-best-year-since-2010.html&text=Strong+December+Caixin+China+PMI+ends+best+year+since+2010","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04012018-Economics-Strong-December-Caixin-China-PMI-ends-best-year-since-2010.html","enabled":true},{"name":"email","url":"?subject=Strong December Caixin China PMI ends best year since 2010&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04012018-Economics-Strong-December-Caixin-China-PMI-ends-best-year-since-2010.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Strong+December+Caixin+China+PMI+ends+best+year+since+2010 http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04012018-Economics-Strong-December-Caixin-China-PMI-ends-best-year-since-2010.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}