Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 03, 2014

Japanese PMI surveys show strongest economic growth for six months

Japan's economy continued to recover in September, reviving after GDP was hit in the second quarter by an increase in the country's sales tax. The bounce back remains modest, however, and policymakers will be eager to see the pace of expansion pick up further before being comfortable that the upturn looks sufficiently sustainable to help continue to defeat deflation.

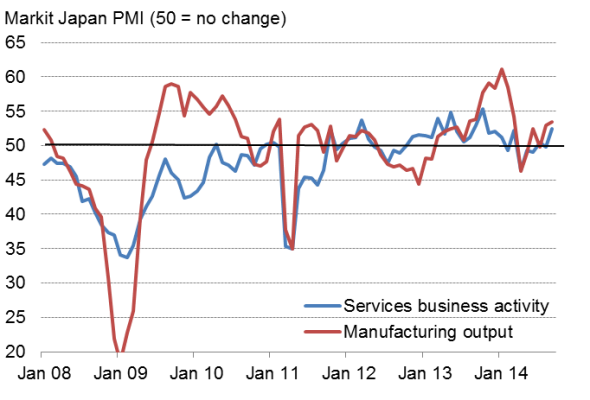

Service sector revival

Service sector PMI data produced by Markit showed business activity growing in September at the fastest rate since October of last year. The service sector upturn accompanied a similar improvement in the manufacturing sector, where the PMI showed output rising at the steepest rate since March.

Output by sector

A GDP-weighted average of the two surveys' output indices hit 52.8, up from 50.8 in August to indicate that the Japanese economy grew in September at the fastest rate since March, just before the sales tax rise caused domestic consumption to slump.

The surveys therefore indicate that the GDP will have rebounded in the third quarter after the 1.8% decline recorded in the three months to June. But the government, which has pledged to rid the country of the deflation that has plagued the economy for well over a decade, still has plenty to worry about.

Subdued upturn

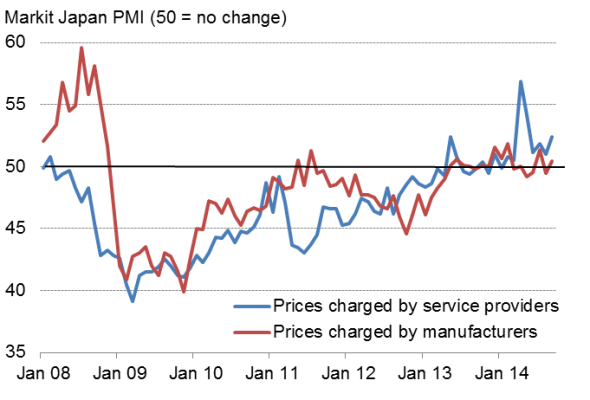

A key area of concern remains prices. Prices charged for goods and services rose in September to the greatest extent seen in the survey's history with the exception of April and May of this year; rises attributed to the tax rise. However, as with the output measures from the survey, the rate of increase of prices charged remained relatively subdued, especially in manufacturing where the increase was only marginal.

The PMI data therefore point to only limited upward pressure on consumer prices, the rate of inflation of which already showed signs of slowing in August. Excluding the effect of the sales tax, annual core inflation slowed to 1.1% in August from 1.3% percent in July.

PMI Prices Charged Indices

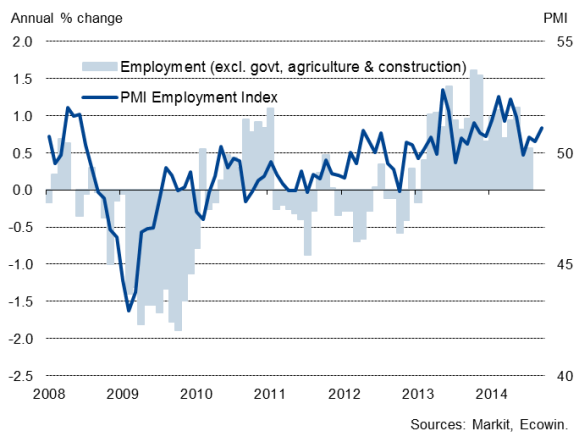

A further worry is that employment continued to grow at only a very subdued pace in September. Although hiring in services picked up to a modest four-month high, manufacturers cut their headcounts for the first time since July of last year, albeit only marginally. Stronger job creation will be required to boost the labour market and drive up wages, which is seen as a necessary ingredient of the battle to beat deflation in the longer term.

Employment

Such weak growth of employment and prices is especially disappointing given the huge stimulus that Japan has already injected into the economy. Back in December 2013, the government announced a "5.5 trillion spending programme, intended to offset the impact of the sales tax rise. A "10.3 trillion package had already been announced in January of last year as part Prime Minister Abe's new policies dubbed "Abenomics". The spending initiatives were accompanied by announcements of a planned doubling of the central bank's balance sheet to help push inflation up to 2% within two years. A so-called "third arrow" is a longer-term programme of structural reforms, which are designed in particular to introduce more flexibility in the labour market, boost wage growth and increase competition in many key markets.

More stimulus?

The relative ongoing weakness of output, prices and employment in Japan suggest that the Japanese authorities may need to do more to boost the economy, especially ahead of a further planned rise in the country's sales tax in October of next year. The government is keen to see third quarter GDP data, to be finalised in December, before making any decisions in this respect. PMI data suggest they should expect to see a welcome rebound, but more importantly by December will have also provided further insights into whether the rebound will have gained or lost momentum in the fourth quarter.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03102014-Economics-Japanese-PMI-surveys-show-strongest-economic-growth-for-six-months.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03102014-Economics-Japanese-PMI-surveys-show-strongest-economic-growth-for-six-months.html&text=Japanese+PMI+surveys+show+strongest+economic+growth+for+six+months","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03102014-Economics-Japanese-PMI-surveys-show-strongest-economic-growth-for-six-months.html","enabled":true},{"name":"email","url":"?subject=Japanese PMI surveys show strongest economic growth for six months&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03102014-Economics-Japanese-PMI-surveys-show-strongest-economic-growth-for-six-months.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Japanese+PMI+surveys+show+strongest+economic+growth+for+six+months http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03102014-Economics-Japanese-PMI-surveys-show-strongest-economic-growth-for-six-months.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}