Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 03, 2015

UK PMI surveys signal weakest growth for over two years

Even after allowing for the usual seasonal lull in business activity, August saw an unexpectedly sharp slowing in the pace of UK economic growth, which will add to current worries among dovish policymakers at the Bank of England.

Slowest growth for over two years

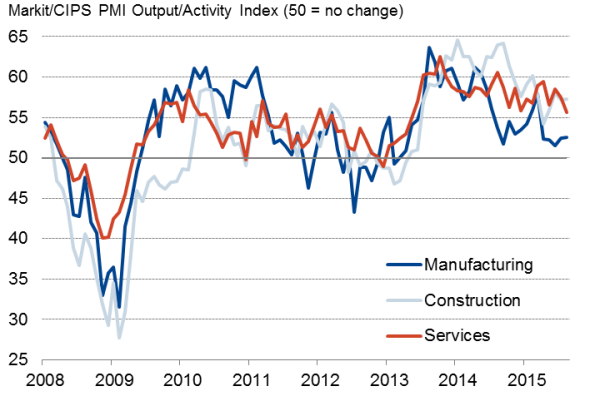

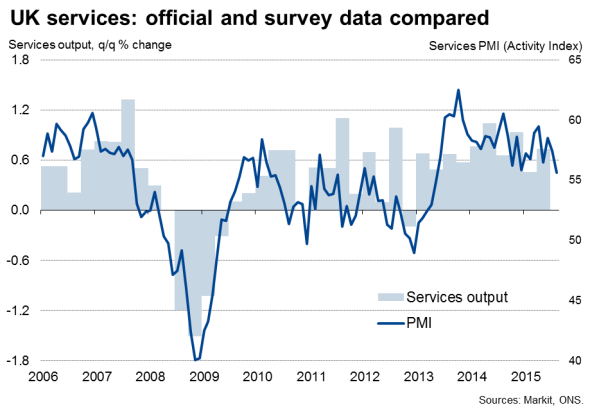

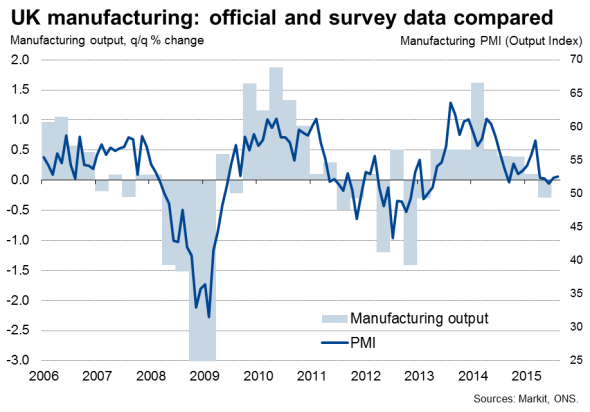

The slowest growth for over two years in the vast service sector was the main cause of the deterioration, with the services PMI coming in at 55.6, down from 57.4 in July and well below even the most pessimistic of economists' forecasts . The slowdown in services followed disappointing news of a near-stagnation of the manufacturing sector earlier in the week, where the survey's output index was largely unchanged at 52.5.

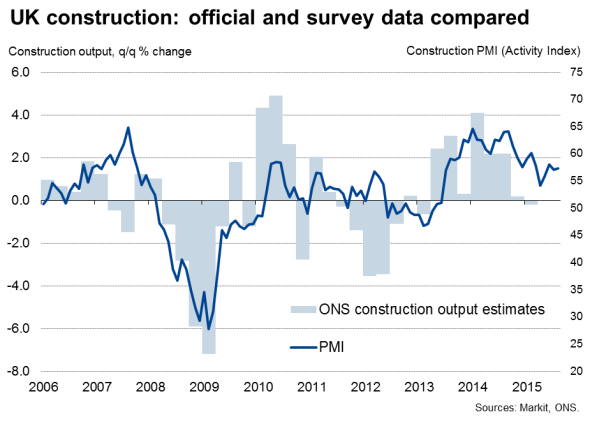

Although construction industry growth remained resilient in August, the sector's PMI inching up to 57.3, the three Markit/CIPS PMI surveys are collectively pointing to the weakest monthly expansion for over two years. The composite "all-sector' index fell from 56.7 in July to 55.3, its lowest since May 2013.

Business activity by sector

Source: Markit.

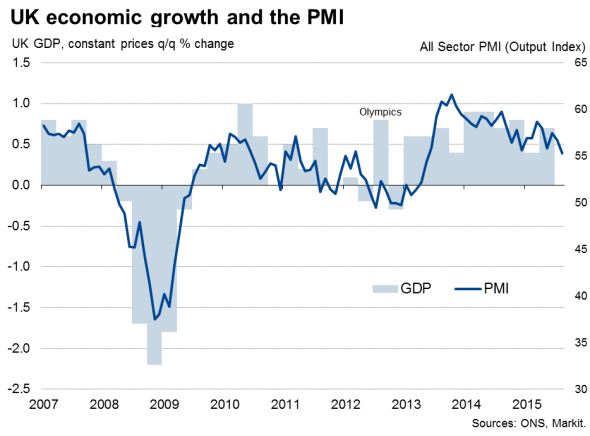

As such, the economy looks set to grow by 0.5% in the third quarter, down from 0.7% in the three months to June, with the ongoing upturn almost entirely dependent on the service sector, aided by the far smaller construction sector (see our research note explaining how to interpret the PMI readings for economic growth).

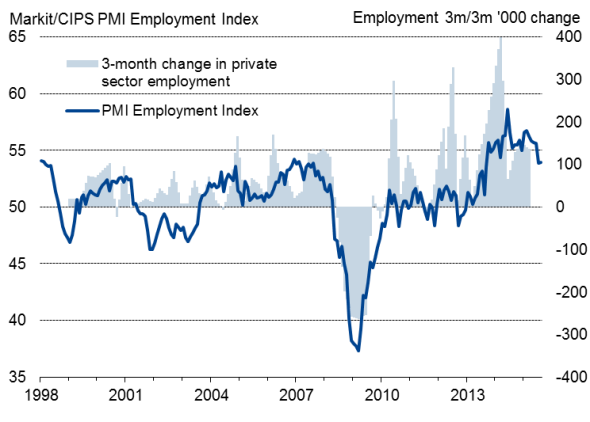

Hiring trends close to two-year low

The surveys showed new orders across the three sectors growing at the slowest rate since April 2013. On a brighter note, the rate of job creation picked up marginally, though continued to run at one of the weakest rates seen over the past two years.

While still-solid rates of job creation were seen in services and construction, manufacturing headcounts were trimmed (albeit only marginally) for the first time since April 2013.

Employment

Sources: Markit, ONS.

Costs rise at slowest rate for seven months

Inflationary pressures also eased substantially during the month. Average input costs across the three sectors rose at one of the weakest rates seen over the past six years, weighed on by a particularly steep drop in manufacturing. Goods producers' input prices showed one of the largest drops seen over the past 16 years due to falling global commodity prices.

Average selling prices for goods and services more or less stagnated, having risen at the fastest rate for ten months in July, as lower costs fed through to the customer.

Survey data to add to worries among Bank of England doves

While some policymakers may be concerned by the slowing pace of expansion and the unbalanced nature of growth, others will be reassured that the economy continues to grow at a reasonably robust pace by historical standards. An upturn in employment growth could also put further upward pressure on wages. However, a marked waning of price pressures other than wages during the month suggests the inflation outlook is benign and is therefore likely to help tip the argument towards postponing any rate hikes until the wider global economic picture becomes clearer.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03092015-Economics-UK-PMI-surveys-signal-weakest-growth-for-over-two-years.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03092015-Economics-UK-PMI-surveys-signal-weakest-growth-for-over-two-years.html&text=UK+PMI+surveys+signal+weakest+growth+for+over+two+years","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03092015-Economics-UK-PMI-surveys-signal-weakest-growth-for-over-two-years.html","enabled":true},{"name":"email","url":"?subject=UK PMI surveys signal weakest growth for over two years&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03092015-Economics-UK-PMI-surveys-signal-weakest-growth-for-over-two-years.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+PMI+surveys+signal+weakest+growth+for+over+two+years http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03092015-Economics-UK-PMI-surveys-signal-weakest-growth-for-over-two-years.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}