Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 03, 2014

UK economy picks up speed in August despite slowdown in manufacturing

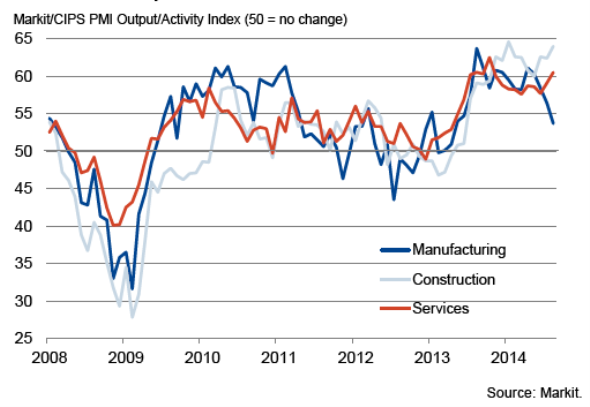

The rate of UK economic growth accelerated in August, according to the Markit/CIPS PMI" surveys, but the upturn became ever more dependent on the domestically-oriented services and construction sectors as growth slowed sharply in manufacturing. The weakness of the more internationally-focused goods producing sector was linked in part to the escalating crisis in the Ukraine.

The data send mixed signals to policy makers, suggesting the debate over whether the economy can withstand higher interest rates will remain intense.

The weighted average Output Index from the three Markit/CIPS PMI surveys rose from 59.0 in July to 59.8 in August, its highest since November of last year. The pace of growth has now accelerated for two successive months, pushing the average index reading for the third quarter so far to the highest since the fourth quarter of last year, albeit by only a small margin.

The sustained elevated PMI readings therefore suggest the UK is on course to see another spell of strong economic growth in the third quarter, similar to the 0.8% expansions seen in each of the first two quarters of the year.

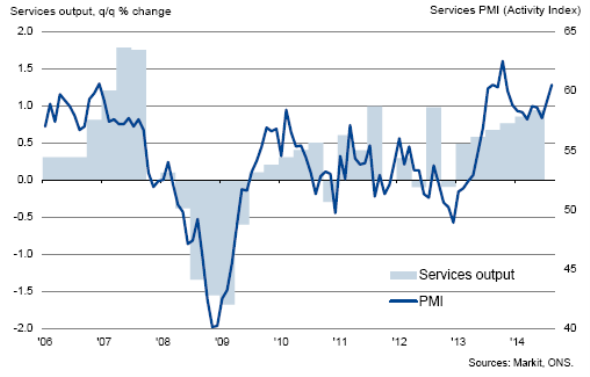

Worryingly, the August data show that the economy has become increasingly dependent on the vast service sector as a driver of the continuing recovery. The output (business activity) index for services rose for a second successive month from 59.1 in July to 60.5, its highest since last October.

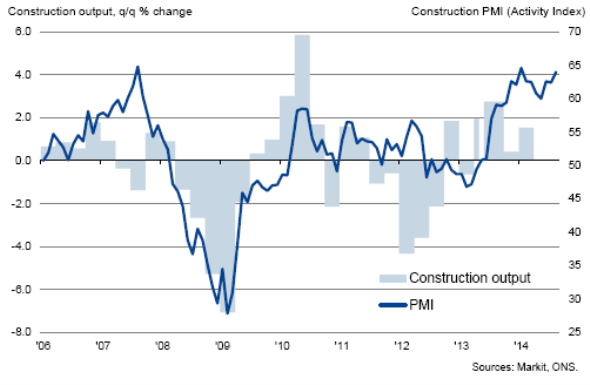

Growth also accelerated in the smaller construction sector, rising to the fastest since January and registering the fourth-largest monthly improvement seen since 1998. The headline index jumped from 62.9 to 64.0. While house building activity provided the mainstay of the sector's upturn, commercial building and civil engineering also continued to grow at historically high rates.

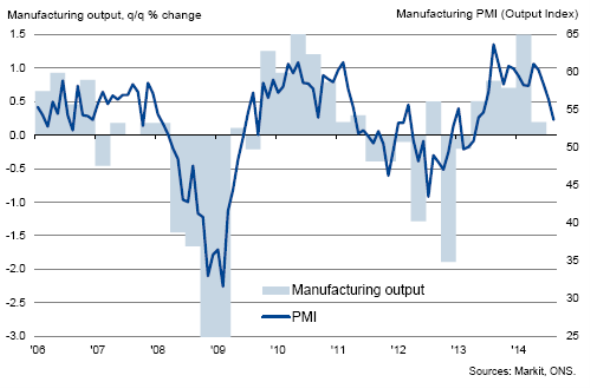

While the survey data suggest the services and construction sectors are set to grow by at least 1% each in the third quarter, manufacturing looks to be faring less well. The sector's output index fell sharply from 56.4 in July to 53.7 in August, representing an easing in the pace of growth for the fourth month running and the smallest monthly gain in production since April of last year. If the sector continues to see growth decelerate to the extent seen in recent months, output would be stagnating by the start of the fourth quarter.

Putin effect

The slowdown in the manufacturing sector was in part linked to a softening of export demand, with overseas orders growing at the slowest rate since March. This was partly driven by the appreciation of the exchange rate, with sterling approximately 3% higher than at the start of the year in August, as well as the impact of Russian sanctions and uncertainty arising from the Ukraine crisis.

Weaker orders and employment growth

Policy makers will certainly be concerned by the extent of the slowdown in manufacturing and will be eager to see whether the global economic uncertainty caused by the Ukraine crisis will also filter through to a significant slowdown in services and construction. Some impact is already evident, with growth of new orders moderating in all three sectors in August.

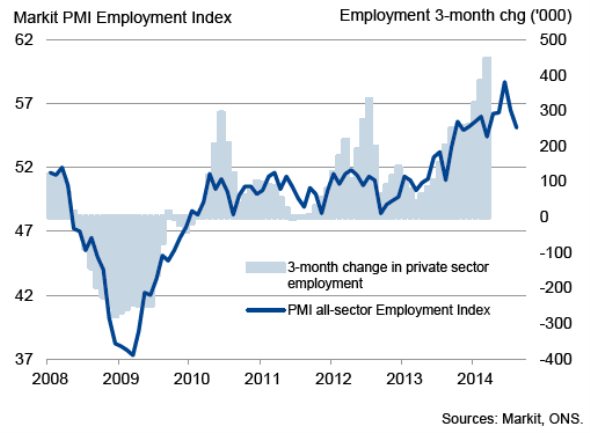

Employment growth also slowed further from June's record high, down to the lowest since March as rates of job creation eased in all three sectors.

Policy split

The weak manufacturing data plus the slowing of order book and employment growth in services and construction therefore reduce the risk of other members of the Bank of England's Monetary Policy Committee joining Ian McAffferty and Martin Weale in voting for a hike in interest rates.

Dovish policy makers will also be reassured by the PMI surveys showing average prices charged for goods and services barely rising in August, showing the smallest monthly increase since May of last year. Input cost inflation also moderated, helped in part by the falling cost of imports arising from the strong exchange rate.

However, hawkish policy makers will prefer to focus on the overall PMI picture, which shows the economy as a whole gaining further momentum instead of slowing, as the Bank's projections had expected, with a growth surge in the domestic economy driving the expansion and eating away spare capacity.

UK services output

UK manufacturing output

UK construction output

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03092014UK-economy-picks-up-speed-in-August-despite-slowdown-in-manufacturing.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03092014UK-economy-picks-up-speed-in-August-despite-slowdown-in-manufacturing.html&text=UK+economy+picks+up+speed+in+August+despite+slowdown+in+manufacturing","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03092014UK-economy-picks-up-speed-in-August-despite-slowdown-in-manufacturing.html","enabled":true},{"name":"email","url":"?subject=UK economy picks up speed in August despite slowdown in manufacturing&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03092014UK-economy-picks-up-speed-in-August-despite-slowdown-in-manufacturing.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+economy+picks+up+speed+in+August+despite+slowdown+in+manufacturing http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03092014UK-economy-picks-up-speed-in-August-despite-slowdown-in-manufacturing.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}