Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 03, 2014

Eurozone recovery slows

Eurozone output expanded for the fourteenth successive month in August, according to the latest PMI surveys from Markit. At 52.5 in August, the final Markit Eurozone PMI Composite Output Index eased from July's three-month high of 53.8 to signal the weakest rate of increase during the year-so-far.

Output growth slowed in both the manufacturing and service sectors. Manufacturing production increased at the slowest pace during the current 14-month sequence of expansion, while the rate of growth at service providers was the weakest since June. The stronger expansion was again recorded in services.

Ireland remained at the top of the eurozone PMI output growth league table in August. Business activity in Ireland rose at the quickest pace since August 2000, underpinned by a similarly strong increase in new orders (the fastest since July 2000).

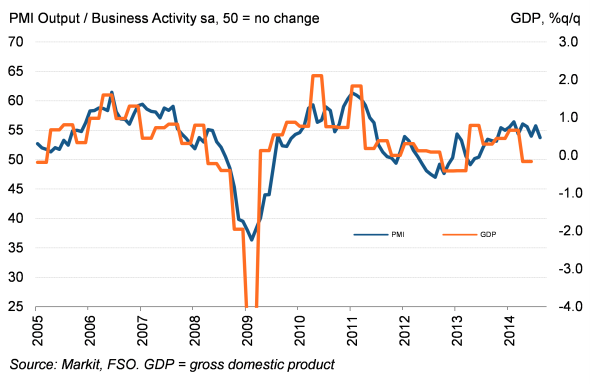

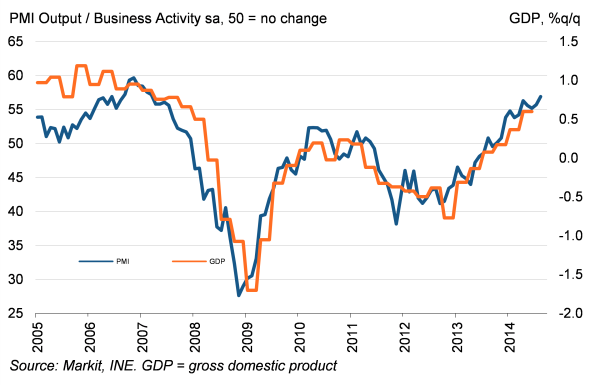

Spain also registered accelerated output growth - an 89-month high - with the performance of the service sector especially positive. Although Germany saw economic activity expand for the sixteenth month running, growth slowed at both manufacturers and service providers.

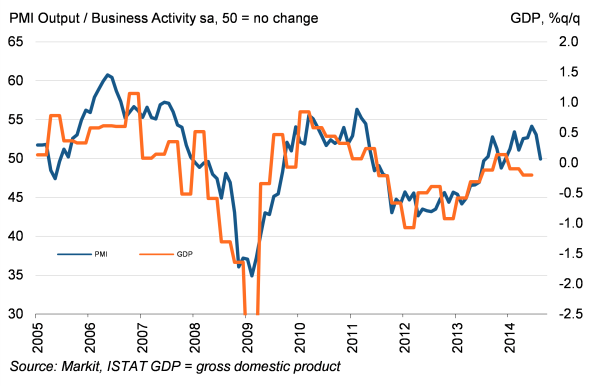

Italy dipped back into contraction territory in August, halting a seven-month sequence of expansion. The weakness in Italy was mainly centred on services, where business activity and new orders both fell, while manufacturing saw a sharp growth slowdown.

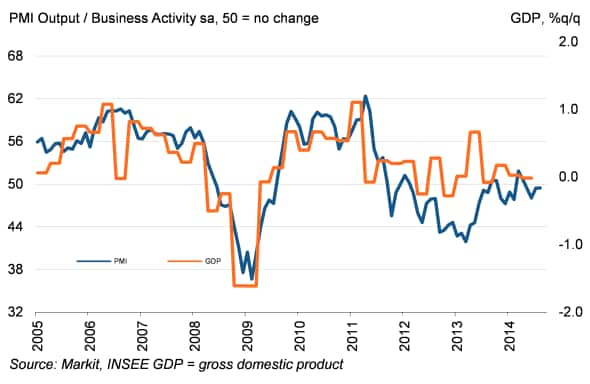

French output contracted for the fourth month running. However, the pace of decline was only mild and, in a positive sign, inflows of new business rose following a moderate increase in the service sector. French manufacturing output and new business remained in deep downturns, however.

Job creation slowed to near-stagnation in August. However, the latest survey nonetheless marked the ninth successive month without a decrease in headcounts. Ireland was a bright spot on the labour market horizon, with jobs growth at a 14-year high. Germany and Spain reported increases to payroll numbers, but cuts were seen in France and Italy.

Input cost inflation slowed to a three-month low in August, with rates of increase easing in Germany, Italy, Spain and Ireland. Meanwhile, average selling prices continued to fall, with only Germany and Ireland reporting increases in output charges.

Comment

Chris Williamson, Chief Economist at Markit said:

"The eurozone economy is defying expectations of gaining momentum, which will no doubt add to calls for the ECB to embark on full-scale quantitative easing. The PMI suggests the eurozone's economy is likely to have seen renewed growth in the third quarter but, instead of accelerating in line with ECB expectations after the June stimulus announcements, the pace of growth is down to the weakest seen so far this year.

"Tensions in Ukraine are clearly having an impact on confidence, subduing business spending and investment.

"However, it is likely to be too early to see anything other than firmer rhetoric from the ECB as far as QE is concerned, as policymakers give more time for the previously announced measures to take effect, notably the TLTROs.

"The impressive performances of Ireland and Spain will also encourage ECB President Mario Draghi to stress that recoveries in other countries are being held back by the lack of successful structural reforms rather than a lack of central bank stimulus. The PMI data add to the view that, in the absence of governments taking tough measures to boost competitiveness and productivity, economic performance will remain disappointing even with further ECB action."

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03092014Eurozone-recovery-slows.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03092014Eurozone-recovery-slows.html&text=Eurozone+recovery+slows","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03092014Eurozone-recovery-slows.html","enabled":true},{"name":"email","url":"?subject=Eurozone recovery slows&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03092014Eurozone-recovery-slows.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Eurozone+recovery+slows http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03092014Eurozone-recovery-slows.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}