Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jul 03, 2017

New PMI surveys point to robust Australian economy in second quarter

June saw the first public release of new PMI data for Australia, compiled by IHS Markit on behalf of Commonwealth Bank. The data reveal an economy gaining growth momentum at the end of a solid second quarter.

Australia marks the 39th country covered by the global PMI series from IHS Markit and the 13th national or regional PMI in the Asia Pacific region.

Two monthly surveys are in fact produced, covering manufacturing and services, with data first collected in May 2016. A GDP weighted average of the two surveys' indices provides a series of indicators on the overall health of the Australian economy, including barometers of GDP, export, order book, inventory, employment and inflation trends.

As with all PMI surveys, readings above 50.0 signal an improvement in business activity on the previous month while readings below 50.0 show a deterioration.

Faster growth

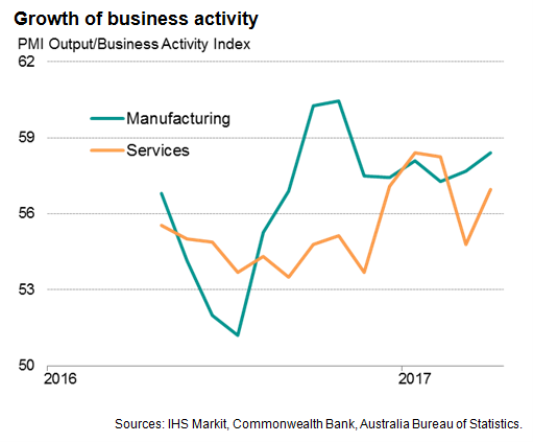

After adjusting for seasonality, the Commonwealth Bank Composite PMI improved to 57.2 in June, up from 55.2 in May. The manufacturing and service sectors both recorded stronger growth in activity during the month, in both instances driven higher by increased inflows of new work.

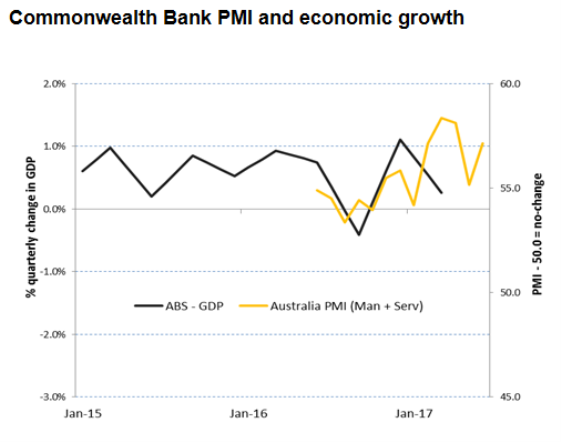

At 56.8, the second quarter average composite PMI reading is up slightly on 56.6 seen in the first quarter, and therefore points to slightly faster economic growth.

The economy grew 0.3% in the first quarter, according to the Australian Bureau of Statistics, much weaker than the 1.1% rise seen in the final three months of 2016.

Firms meanwhile continued to take on extra staff in healthy numbers, the overall rate of job creation holding close to the average seen over the past 12 months, albeit down slightly on earlier in the year. Backlogs of work nevertheless continued to rise, in both manufacturing and services, in a sign that operating capacity continued to be stretched despite the increased payroll numbers.

There was some respite on the inflation side, however, as input costs rose at the slowest rate seen in the history of the survey, down largely compared to earlier in the year in reflection of lower global commodity prices, especially oil.

Average prices charged for goods and services rose only modestly as a result of the reduced upward pressure on costs, the rate of increase having cooled markedly from April's recent peak.

Encouraging outlook

The robust PMI readings so far this year therefore suggest the economy has retained more growth momentum than indicated by the official data. The forward-looking indicators are also sending encouraging signals. Companies expectations about future output rose in June to the highest since survey data were first collected.

The latest service sector survey found that 70% of businesses are forecasting growth in the coming year. Organic company expansion, better economic conditions and increased marketing are all expected to bolster activity over the coming 12 months.

Similarly, around two-thirds of manufacturing survey respondents anticipate higher output over the coming year. Panellists widely expect to see organic growth, new product introductions and firmer demand in coming months.

The positive outlook tallies with recent upbeat rhetoric from the Reserve Bank of Australia, which held interest rates steady at its last meeting on signs of weaker growth at the start of the year, but noted that "economic growth is still expected to increase gradually over the next couple of years to a little above 3 per cent".

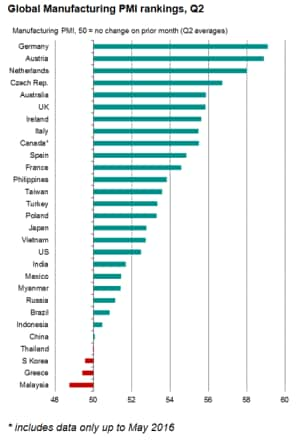

High ranking

One of the advantages of the IHS Markit data is that all PMI surveys around the world are compiled using the same methodology, making it easy to make international comparisons. For example, so far in the second quarter, the strong performance of the Commonwealth Bank PMI for manufacturing means Australia has notched-up the fifth strongest performance of all countries surveyed in the second quarter. The robust performance contrasts with weaker trends seen in many other countries in the Asia Pacific region, notably China, where manufacturing is struggling to expand.

In contrast, European economies are faring especially well so far this year, enjoying one of the best growth spells seen since the global financial crisis.

Please click here to access the new Australia PMI codes for your excel spreadsheet.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03072017-Economics-New-PMI-surveys-point-to-robust-Australian-economy-in-second-quarter.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03072017-Economics-New-PMI-surveys-point-to-robust-Australian-economy-in-second-quarter.html&text=New+PMI+surveys+point+to+robust+Australian+economy+in+second+quarter","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03072017-Economics-New-PMI-surveys-point-to-robust-Australian-economy-in-second-quarter.html","enabled":true},{"name":"email","url":"?subject=New PMI surveys point to robust Australian economy in second quarter&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03072017-Economics-New-PMI-surveys-point-to-robust-Australian-economy-in-second-quarter.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=New+PMI+surveys+point+to+robust+Australian+economy+in+second+quarter http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03072017-Economics-New-PMI-surveys-point-to-robust-Australian-economy-in-second-quarter.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}