Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 03, 2016

Japan PMI surveys point to second quarter economic decline

The Nikkei PMI data for Japan, compiled by Markit, cast doubt on Japan's ability to continue growing after a surprisingly buoyant start to the year.

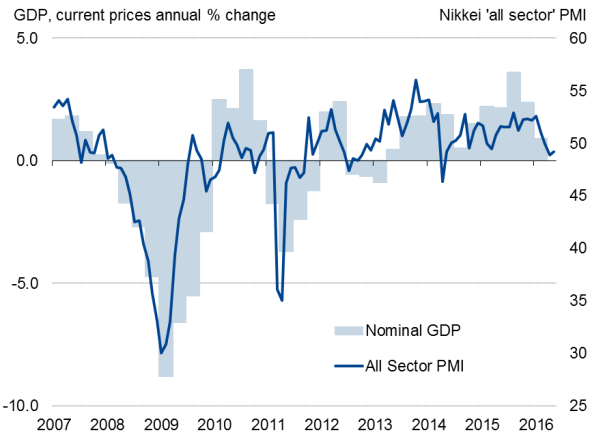

The economy grew 0.4% (1.7% annualised) in real terms during the first quarter, according to official estimates. The increase caused sighs of relief, as the economy had contracted in the fourth quarter. A further fall in the first quarter would have indicated a technical recession. However, the PMI surveys, which also signalled growth in the first three months of the year, have since lost ground, suggesting GDP could return to contraction in the second quarter.

Economic growth indicators

The economy grew 0.4% (1.7% annualised) in real terms during the first quarter, according to official estimates. The increase caused sighs of relief, as the economy had contracted in the fourth quarter. A further fall in the first quarter would have indicated a technical recession. However, the PMI surveys, which also signalled growth in the first three months of the year, have since lost ground, suggesting GDP could return to contraction in the second quarter.

Looking across both manufacturing and services, an average PMI reading of 49.2 in May was up only marginally on the two-year low of 48.9 seen in April.

At 49.0, the average PMI reading for the second quarter so far is down from 51.2 in the first quarter and is the weakest since the second quarter of 2014, a time when Japan was reeling from a hiking of the sales tax from 5 to 8%.

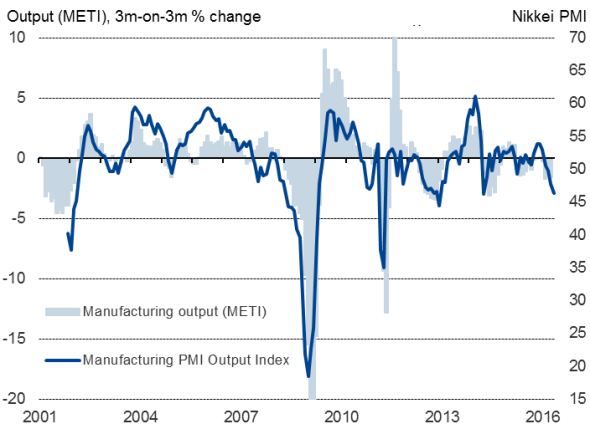

The surveys showed factory output falling for a third month running in May, declining at the fastest rate since the tax hike of April 2014. Excluding the time around the Fukushima disaster, the aforementioned period two years ago and a slowdown in December 2012, we have to go back to the global financial crisis to see a steeper rate of decline than seen in May.

Manufacturing output

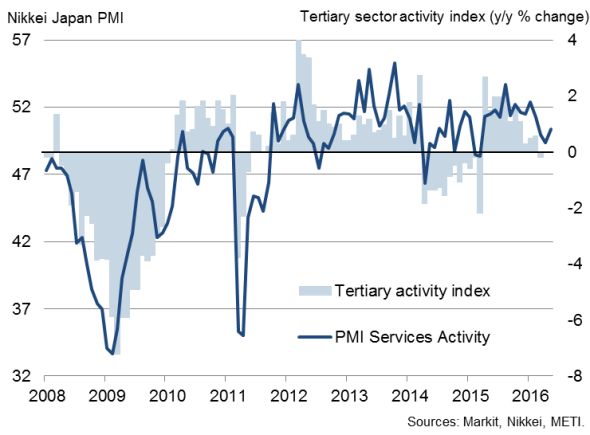

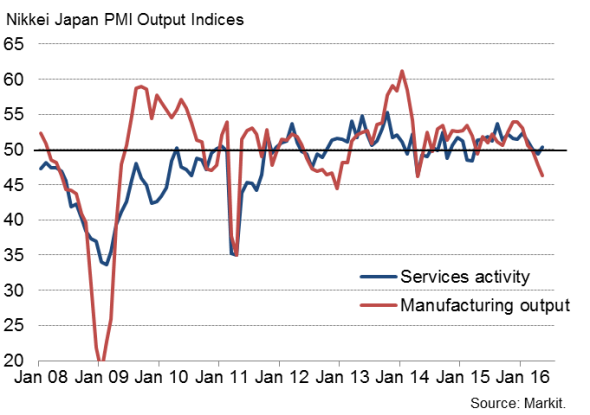

The situation is slightly better in services, where the PMI data indicated a return to growth for the first time in three months in May. But the expansion was only marginal, failing to offset the manufacturing downturn.

Services activity

Manufacturing v services output

Earthquakes are to blame for some of the weakness, especially in manufacturing, but there are additional factors at play, not least the yen. A steep appreciation of the yen, up approximately 10% against the US dollar so far this year, has hurt exporters who are already struggling with weak overseas demand. The PMI showed goods exports falling at the sharpest rate since January 2013.

In the service sector, firms also reported subdued spending by domestic businesses and households, often linked in turn to a lack of confidence that the economic upturn has legs. Business optimism in the service sector also remained firmly in the doldrums, slipping further in May to the joint-lowest seen over the past year.

The malaise certainly looks set to persist into June. Inflows of new business deteriorated for a third successive month in May, dropping at the fastest rate since 2012 in manufacturing and virtually stagnating in services.

It is not surprising, therefore, that Japan's next sales tax hike, from 8 to 10%, scheduled for April next year, has been delayed until 2019. The postponement, blamed on external factors (notably weak demand in China), gives the economy more breathing space to grow by alleviating the fiscal squeeze. Further stimulus, including looser fiscal policy, is also being put together, to be deployed in the autumn.

Email economics@markit.com for access to the data.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03062016-Economics-Japan-PMI-surveys-point-to-second-quarter-economic-decline.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03062016-Economics-Japan-PMI-surveys-point-to-second-quarter-economic-decline.html&text=Japan+PMI+surveys+point+to+second+quarter+economic+decline","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03062016-Economics-Japan-PMI-surveys-point-to-second-quarter-economic-decline.html","enabled":true},{"name":"email","url":"?subject=Japan PMI surveys point to second quarter economic decline&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03062016-Economics-Japan-PMI-surveys-point-to-second-quarter-economic-decline.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Japan+PMI+surveys+point+to+second+quarter+economic+decline http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03062016-Economics-Japan-PMI-surveys-point-to-second-quarter-economic-decline.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}