Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 03, 2015

Global economic growth slows for second successive month

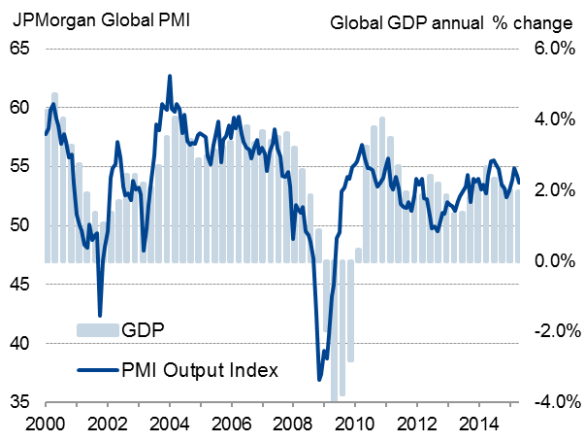

Global economic growth edged lower for a second successive month in May according to worldwide PMI survey data, hitting the lowest since January. The rate of expansion nevertheless remained reasonably robust, signalling global GDP growth of approximately 2-2.5% on an annual basis, and sufficiently strong to encourage firms to boost employment at the fastest rate seen since the financial crisis.

Growth continued to be underpinned by the US and UK, with support provided by a steady revival of the eurozone economy. Only weak growth continued to be seen across much of Asia, however, including China and Japan, and ongoing malaise was seen in many other emerging markets. A deepening downturn in Brazil remained a particular concern.

Global economic growth

Services outpaces manufacturing

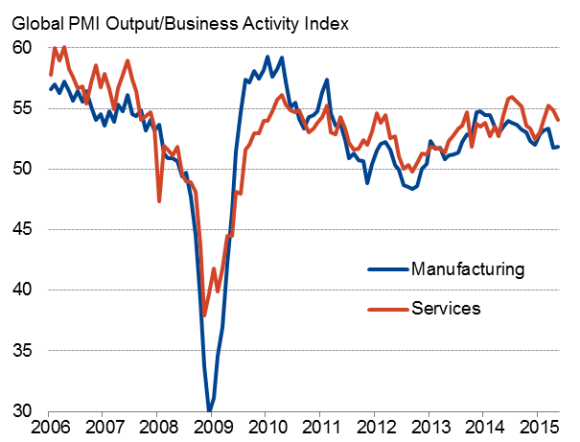

The JPMorgan Global PMI, compiled by Markit from its national survey data, fell for a second successive month in May, down from 54.2 in April to a four-month low of 53.6. Manufacturing remained especially subdued, recording the second-smallest expansion of output seen over the past 22 months. Service sector growth remained more impressive, albeit slowing slightly for a second successive month.

Service sector growth has consistently outpaced that of manufacturing for just over a year, the latter highlighting the weakness of global trade, especially in Asia. Worldwide goods exports fell, albeit only slightly, for the first time in almost two years in May.

Global manufacturing and services

Sources for all charts: Markit, JPMorgan, HSBC

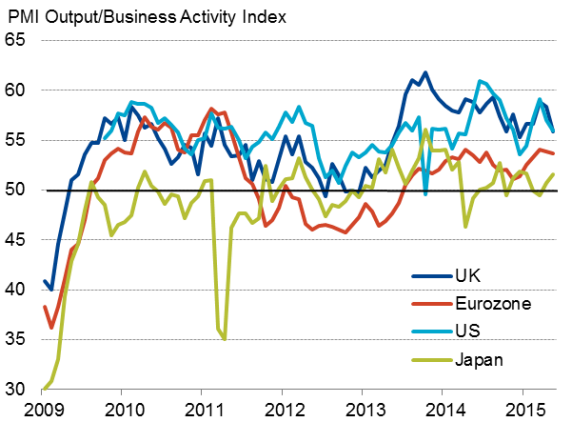

US and UK drive global growth

The US and UK continued to be the fastest growing major economies, albeit with rates of growth easing in both cases. While stronger PMI surveys in recent months have indicated rebounds in GDP growth rates in both countries after their disappointing first quarter performances, the survey data are broadly consistent with GDP rising in the second quarter by 0.6% (2.5% annualised) in the US and 0.5% in the UK. The softer May data add to suspicions, however, that growth could weaken further in both countries as they move into the summer months and deter the respective central banks from hiking rates until next year.

Euroland's hesitant revival

Global growth was also supported by an ongoing, albeit somewhat hesitant, revival of the eurozone economy. The PMI data point to sustained euro area GDP growth of 0.3-0.4% in the second quarter, albeit with the momentum easing slightly in May.

As in the US and UK, euro area growth has been boosted by consumers benefitting from low prices, especially for fuel. The single-currency area has also received a boost from the commencement of QE by the ECB, something which the central bank's head, Mario Draghi, stressed would run its full course to €1.1 trillion and not be tapered in the light of the growth upturn and signs of returning inflation, citing in particular weaker-than-expected growth in other countries.

Only modest upturn in Japan

Of the other major developed economies, Japan remained the straggler, though its PMI signalled a welcome upturn in the pace of growth to a four-month high in May. However, although trends improved in both manufacturing and services, rates of expansion remain stubbornly weak despite the central bank's huge stimulus and the weaker yen, raising the prospect of the Bank of Japan needing to do more to lift inflation in coming months.

Developed world

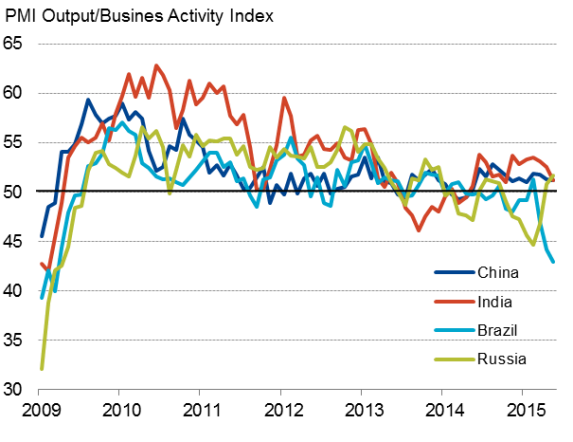

Emerging markets in the doldrums

The latest PMI surveys also highlighted the deepening malaise facing many emerging economies. Brazil in particular is heading for a deep recession, with high inflation and rising interest rates killing demand to the extent that the economy is contracting at its fastest rate for six years.

Growth has slowed to a crawl in both China and India compared to pre-crisis rates of expansion, acting as major brakes on the global economy. In China, the dominant manufacturing economy is leading the slowdown, registering its first drop in production since late last year.

Manufacturing across Asia ex-Japan contracted for a second successive month as a result of China's weakness spreading across the region. Hong Kong in particular saw a steepening downturn in May as exports to China fell at the fastest rate since 2008.

In India, business activity in the dominant service sector was reported to have been in decline for the first time for over a year in May.

The sole bright spot in the emerging world appears to be Eastern Europe, which shows signs of benefitting from the revived growth in the eurozone. However, weakness in Russia, linked to low oil prices and sanctions imposed by the West, remains a drag on wider European growth. Although Russia saw growth pick up to the highest since the end of 2013, its industrial sector remains in decline with manufacturing output contracting in May.

Emerging markets

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03062015-Economics-Global-economic-growth-slows-for-second-successive-month.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03062015-Economics-Global-economic-growth-slows-for-second-successive-month.html&text=Global+economic+growth+slows+for+second+successive+month","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03062015-Economics-Global-economic-growth-slows-for-second-successive-month.html","enabled":true},{"name":"email","url":"?subject=Global economic growth slows for second successive month&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03062015-Economics-Global-economic-growth-slows-for-second-successive-month.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+economic+growth+slows+for+second+successive+month http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03062015-Economics-Global-economic-growth-slows-for-second-successive-month.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}