Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 03, 2017

UK Manufacturing PMI signals slowdown amid rising prices

UK manufacturers reported a further slowing of production growth in March, with forward-looking indicators suggesting the pace of expansion could weaken further in the second quarter. Price pressures meanwhile remained elevated.

Slower growth

The headline PMI - a composite index based on a variety of survey sub-indices - fell for a third successive month in March, down from 54.5 in February to a four-month low of 54.2.

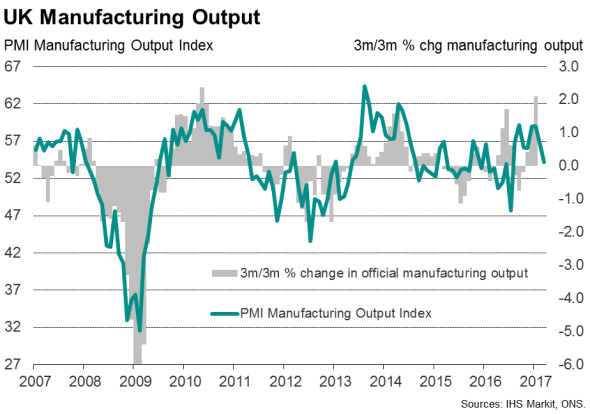

An even steeper fall has been seen in the survey's output index, which bodes ill for official manufacturing data. Although the output index registered well above the neutral 50.0 mark in March, it was considerably lower than its recent peaks in December and January.

The sector is therefore on course to contribute less to economic growth in the first quarter compared to the strong 1.3% increase in production seen in the final quarter of last year. However, thanks to a strong January, the first quarter could still see reasonable growth of approximately 0.6-7%.

The worry is that the further easing in the rate of growth of manufacturing output signalled in March compared to the near seven-year high 2.1% rate achieved in the three months to January bodes ill for momentum heading into the second quarter.

Weaker forward-looking indicators

In a further sign that production may slow in April, the amount of inputs bought by manufacturers showed the smallest rise for eight months. Similarly, new order growth slowed to a four-month low, backlogs of work fell slightly for a second successive month and inventories continued to be wound down in March.

The slower expansion of output is linked to a deterioration in export order growth. The March survey recorded the second-weakest increase in new export orders since July.

Slower overseas sales growth suggests that some of the stimulus from the depreciation of sterling seen after the EU referendum has begun to wane.

Inflationary pressures

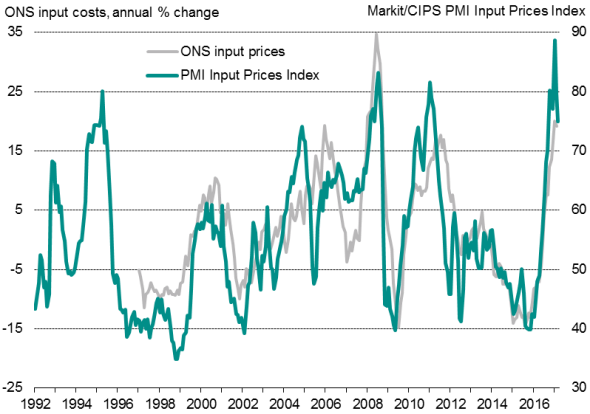

Manufacturers continued to report rising costs and prices. Prices charged for goods leaving the factory gate rose at a slightly increased rate, registering the second-largest monthly increase for almost six years. Higher prices were generally linked to the need to pass higher costs on to customers.

Input costs continued to rise sharply. Much of the inflationary pressure was again linked to more expensive imports resulting from the weak currency. The rate of increase in the cost of materials bought by factories nevertheless eased for a second month running.

Morsels of brighter news

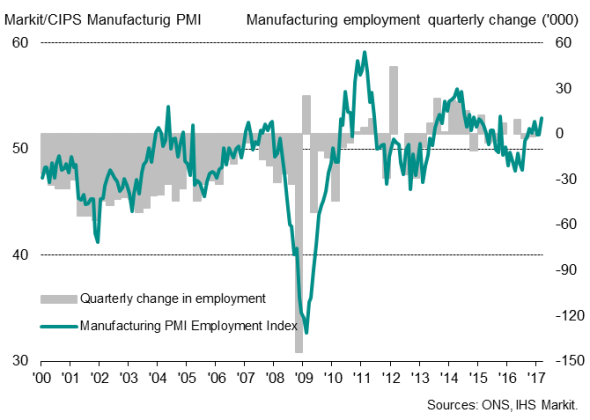

An upturn in employment growth brought a rare piece of brighter news from the survey. Factory job creation hit a 17-month high in March. However, with the pace of expansion in production slowing, the extra jobs point to weakened productivity growth.

Similarly, firms' expectations of their own production levels in the year ahead were more optimistic than any time in the past ten months, though merely in line with the average seen over the past five years.

UK goods exports

Producer input costs

Factory employment

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03042017-Economics-UK-Manufacturing-PMI-signals-slowdown-amid-rising-prices.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03042017-Economics-UK-Manufacturing-PMI-signals-slowdown-amid-rising-prices.html&text=UK+Manufacturing+PMI+signals+slowdown+amid+rising+prices","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03042017-Economics-UK-Manufacturing-PMI-signals-slowdown-amid-rising-prices.html","enabled":true},{"name":"email","url":"?subject=UK Manufacturing PMI signals slowdown amid rising prices&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03042017-Economics-UK-Manufacturing-PMI-signals-slowdown-amid-rising-prices.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+Manufacturing+PMI+signals+slowdown+amid+rising+prices http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03042017-Economics-UK-Manufacturing-PMI-signals-slowdown-amid-rising-prices.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}