Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 03, 2017

Week Ahead Economic Overview

US labour market figures will play a key role in determining whether the Fed hikes rates at its March meeting, and ECB policymakers will make their latest monetary policy announcement for the euro area. Prior to this, Eurostat issues revised GDP numbers for Q4 2016. Construction and industrial output data are meanwhile published in the UK, with data watchers looking for signs of any economic slowdown.

A strong set of US labour market data could well be enough to encourage Fed policymakers to raise interest rates as soon as March. PMI data for February pointed to another solid 175,000 increase in non-farm payrolls. Weak wage growth could suggest there's a case for any tightening of policy to not be rushed (average hourly earnings growth dipped from 2.8% to 2.5% in January), but there's a growing consensus that the Fed will want to move sooner rather than later.

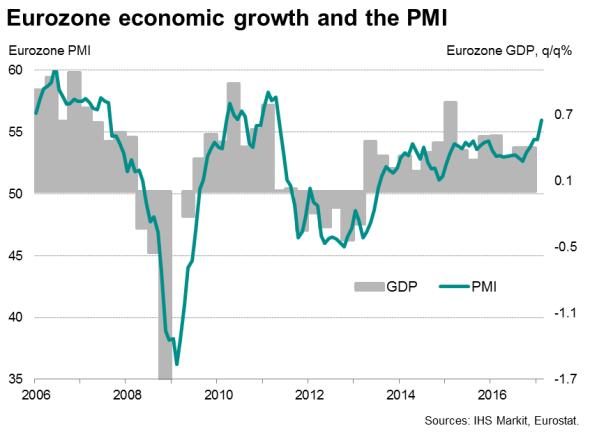

Central bankers at the ECB meanwhile meet to determine latest monetary policy for the eurozone. Although the majority of analysts believe policy will be left unchanged until at least the end of the year, recent data releases have shown economic growth strengthening. PMI numbers for February painted a bright picture of the euro area economy firing on all cylinders, as output growth hit a 70-month high and job creation also quickened. Moreover, faster expansions were recorded in all 'big-four' nations, most notably Germany and France, with both looking likely to record 0.6% growth for the first quarter.

With the eurozone inflation rate reaching 2% in February, its highest level since January 2013 and above the ECB benchmark, forecasters will be tuning in to ECB rhetoric to see if they should be bringing forward their predictions on when the ECB will begin tapering its stimulus.

Eurostat also releases its final growth figures for the fourth quarter, which are expected to show that GDP growth will remain unchanged from the 0.4% recorded during the second estimate. Meanwhile, industrial output data for Spain, France and Germany are released, offering data watchers clues to the direction of economic growth in the euro area for the first quarter.

In the UK, the Office for National Statistics updates industrial and construction output data, while also announcing latest trade balance figures. Analysts will assess the releases for potential evidence that the economy is losing steam following its strong second-half performance during 2016, especially after February survey data pointed to a slowdown in GDP growth to 0.4% for the first quarter.

Other key economic data releases include a second estimate on Japanese fourth quarter GDP, with data watchers looking for any revisions from the 0.2% increase initially recorded, while China's inflation rate and latest trade balance figures will provide a steer on the health of Asia's largest economy.

Monday 06 March

Australian retail sales are made available in the early hours of the week.

The Eurozone Senitx Index is released.

In Greece, the second estimate on fourth quarter GDP is issued.

The Brazilian Services PMI is released by IHS Markit.

Tuesday 07 March

In Australia, the latest AIG Construction Index is released, while the Reserve Bank of Australia sets latest monetary policy.

Russia's consumer price index is updated for February.

Eurostat provides its update for Q4 GDP, while the fourth quarter GDP data for South Africa is also announced.

Italy's producer prices index is issued.

In the UK, the latest Halifax House Price index is released, while the British Retail Consortium publishes updated retail sales numbers.

Brazilian Q4 2016 GDP data are released along with the latest producer prices index.

Wednesday 08 March

Revised GDP numbers for Japan are published.

In China, latest trade balance figures are updated.

German industrial production data are released.

French non-farm payrolls and trade balance figures are out, alongside an update on its current account.

Latest Spanish and Brazilian industrial output numbers are made available.

Thursday 09 March

Chinese inflation rates are issued.

ECB policymakers meet to determine the latest interest rate for the euro area.

In Greece, the latest unemployment rate is provided.

Friday 10 March

In India, the latest trade balance numbers are published, along with updated industrial output data.

An update on German trade balance data are made available.

Industrial output numbers are updated in France.

Spanish retail sales figures are issued.

Latest Greek inflation data are made available.

The Office for National Statistics releases latest construction and industrial output data, along with trade balance figures.

Canadian employment data are released.

The US Bureau of Labor Statistics provides an update on latest non-farm payrolls, unemployment rates and average hourly earnings figures.

Samuel Agass | Economist, Markit

Tel: +441491461006

samuel.agass@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03032017-economics-week-ahead-economic-overview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03032017-economics-week-ahead-economic-overview.html&text=Week+Ahead+Economic+Overview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03032017-economics-week-ahead-economic-overview.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Overview&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03032017-economics-week-ahead-economic-overview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Overview http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03032017-economics-week-ahead-economic-overview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}