Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Feb 03, 2015

Norway leads Nordic short covering

Short sellers have started to show the first signs of sustained short covering in Norwegian equities in the last few weeks.

- Demand to borrow constituents of the OBX index doubled in 2014, but has fallen by 10% in January

- Energy firms have led the decline in shorting activity as short sellers profit from some of their best performing positions of last year

- Norway was the only Nordic country to attract new ETF investment in January

Short selling oil services firms was arguably among the best performing trades of 2014. Companies which had benefitted from energy sector expansion came under pressure as the price of oil headed to multi year lows. This development saw Norwegian equities, which are disproportionately tied to both primary energy producers and services firms, come under increasing scrutiny from short sellers.

While 2015 so far has provided little in the way of bullish news for the energy sector, the price of oil looks to have settled slightly in the last couple of weeks, which has encouraged Norwegian shares to bounce back from the lows experienced in December. As a result, short sellers have moved to cover some of their positions in the country’s headline OBX index.

Short sellers start to cover

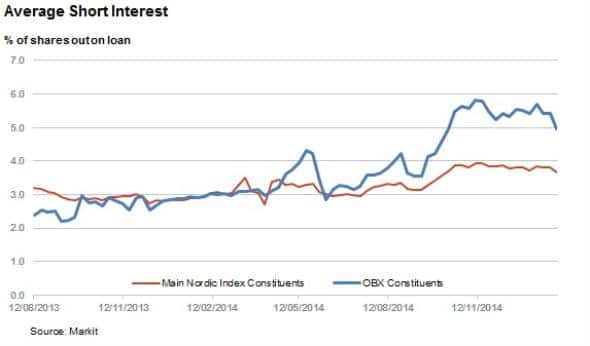

2014 saw average demand to borrow constituents of the OBX index nearly double from 2.8% of shares outstanding to over 5.5% in the closing week of December. The majority of the increase was registered in in the second half of the year when the energy sectors troubles started in earnest.

Short sellers appear to have lost some of their appetite for Norwegian shares in recent weeks however, as demand to borrow shares in the OBX now sits 10% lower than the levels seen at the start of the year, with 5% of shares out on loan.

This decreasing enthusiasm to bet against Norwegian shares has driven covering across constituents of the headline Nordic indexes, as average demand to borrow constituents of the previously mentioned OBX, OMV, KFX and HEX25 now stands 4% lower than at the end of last year.

Energy stocks regain favour

Unsurprisingly, most of the covering across the OBX index has come from energy shares, whose average demand to borrow has fallen from 7.8% of shares outstanding to 7%.

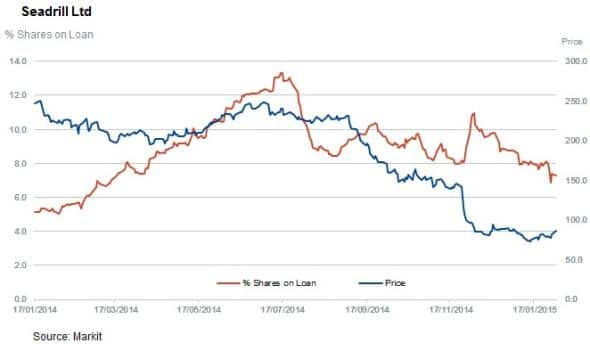

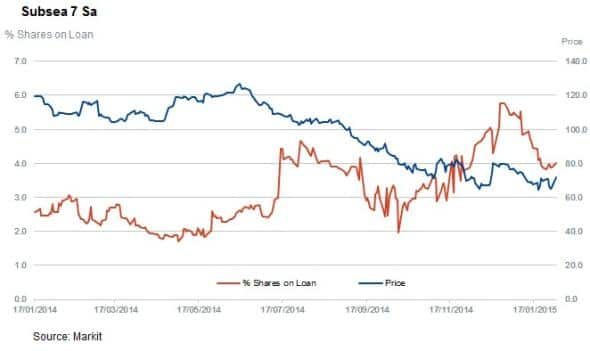

This covering has been led by some of last year’s best performing short sales, with Seadrill and Subsea 7 both registering sustained short covering after experiencing bearish sentiment in the closing weeks of last year.

These new developments seem to have been well timed as the shares have rebounded sharply in the opening days of February as oil regained some of its lost ground. But questions no doubt still linger over the sector, as energy shares still remain the most shorted sector by far both in Norway and the overall Nordic universe.

ETF investors also favour Norway

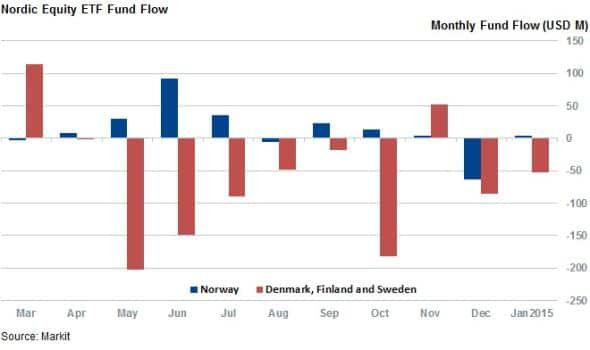

Investors’ changing attitude towards Norway can also be gauged by the fact that the county is the only Nordic country to have experienced net inflows in January. $2.8m of asset flowed to the eight Norwegian equity products over the course of the month, contrasting with net outflows in products that track, Finnish, Danish and Swedish assets.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03022015-Equities-Norway-leads-Nordic-short-covering.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03022015-Equities-Norway-leads-Nordic-short-covering.html&text=Norway+leads+Nordic+short+covering","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03022015-Equities-Norway-leads-Nordic-short-covering.html","enabled":true},{"name":"email","url":"?subject=Norway leads Nordic short covering&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03022015-Equities-Norway-leads-Nordic-short-covering.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Norway+leads+Nordic+short+covering http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03022015-Equities-Norway-leads-Nordic-short-covering.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}