Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 02, 2014

UK construction PMI still buoyant but signals weakest growth for over a year

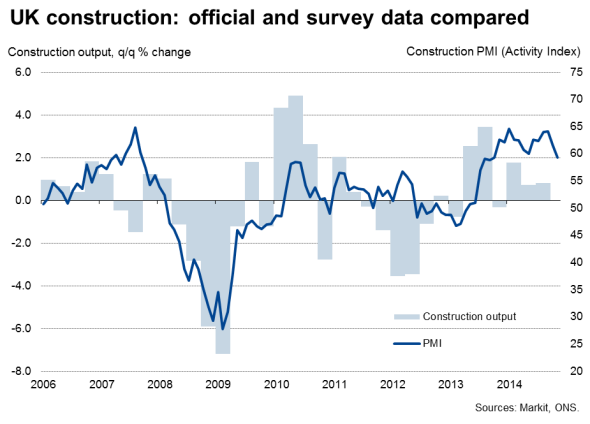

A further buoyant PMI survey in November suggest that the construction sector continues to thrive, but the rate of growth has slowed to weakest for over a year, and forward-looking indicators point to a further moderation in coming months.

Growth wanes

The headline index from the Markit/CIPS Construction PMI fell from 61.4 in October to a 13-month low of 59.4 in November, signalling an easing in the pace of construction sector growth.

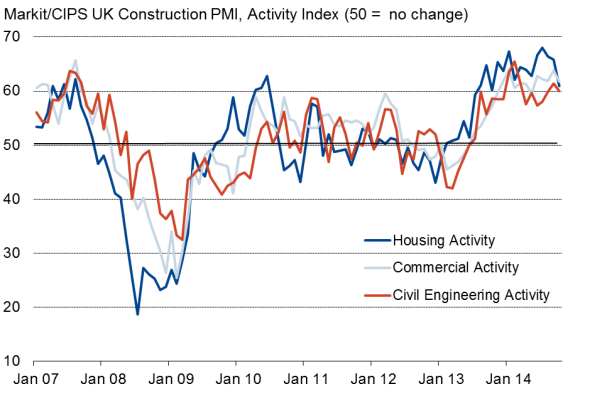

The slowdown was broad-based across the sector, though the key area of weakness was a sharp slide in growth of civil engineering activity, down to the weakest since July of last year. Commercial activity and housing also saw the smallest increases in activity since October of last year.

Broad-based upturn within construction

However, with the headline index remaining well above the 50.0 no change level, the decline in November merely points a cooling in growth from a remarkably strong pace over the summer months. After all, the average reading for the third quarter at 63.5 was the highest for 17 years.

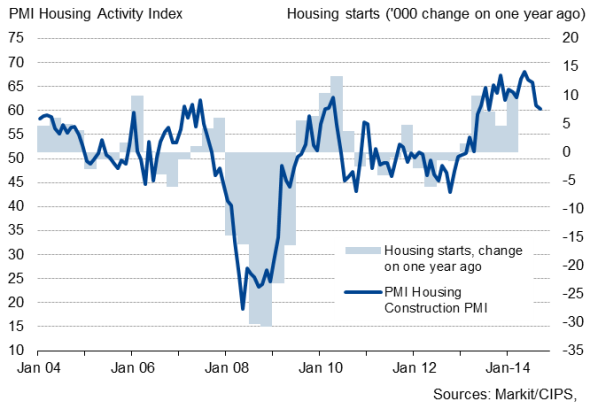

Commercial building activity and housing indicates remain particularly elevated, the latter running at a level indicative of house building rising by around 7,000 on a year ago when the survey is compared to official data on new housing starts.

House building

Further slowdown signalled

The survey does suggest, however, that growth could moderate further in coming months. In particular, inflows of new work in the construction sector slowed markedly again in November to the weakest for just over a year, though continuing to grow at a solid pace.

Similarly, business expectations about the year ahead remained elevated but slipped to the weakest since late last year, adding to signs that growth could continue to weaken in coming months.

Labour shortages drive up pay rates

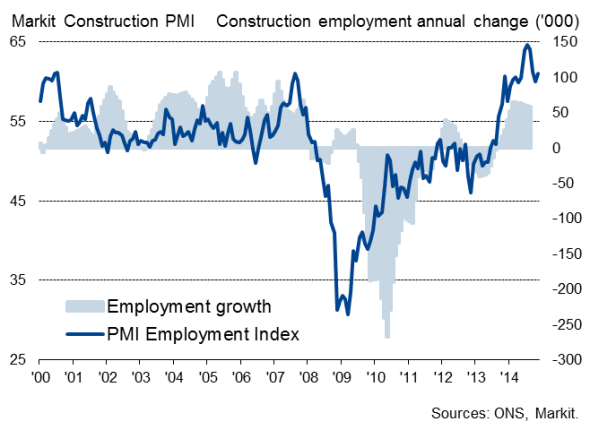

Any slowdown may be only modest, however. Despite signs of slower growth, employment rose sharply again as construction firms expanded capacity to meet higher workloads, suggesting firms are not expecting any sudden or significant downturn in business levels.

A downside of the recent surge in construction employment has been that shortages of skilled labour were again widely reported and a kay factor behind a survey record rise in average rates levied by sub-contractors in November.

Rising pay rates are clearly a key warning light for policymakers considering when the economy may be ready for higher interest rates. However, with construction only accounting for just 6% of the economy, policymakers will need to see evidence of wider measures of pay moving higher before alarm bells start ringing.

Construction sector employment

Subcontractor availability and prices

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02122014-Economics-UK-construction-PMI-still-buoyant-but-signals-weakest-growth-for-over-a-year.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02122014-Economics-UK-construction-PMI-still-buoyant-but-signals-weakest-growth-for-over-a-year.html&text=UK+construction+PMI+still+buoyant+but+signals+weakest+growth+for+over+a+year","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02122014-Economics-UK-construction-PMI-still-buoyant-but-signals-weakest-growth-for-over-a-year.html","enabled":true},{"name":"email","url":"?subject=UK construction PMI still buoyant but signals weakest growth for over a year&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02122014-Economics-UK-construction-PMI-still-buoyant-but-signals-weakest-growth-for-over-a-year.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+construction+PMI+still+buoyant+but+signals+weakest+growth+for+over+a+year http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02122014-Economics-UK-construction-PMI-still-buoyant-but-signals-weakest-growth-for-over-a-year.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}