Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 02, 2017

Eurozone manufacturers see rising price pressures as third quarter ends on strong note

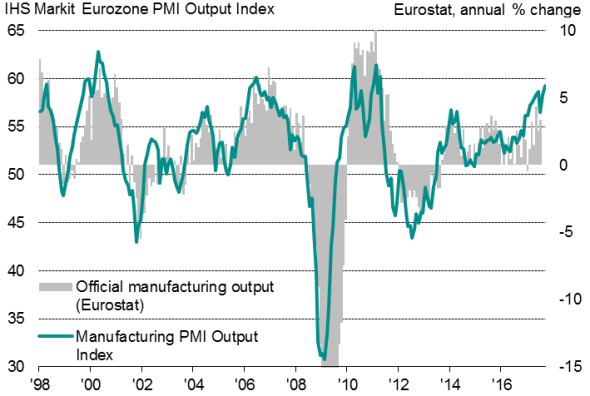

The booming eurozone manufacturing sector kicked into an even higher gear in September, with the PMI rising to a level only once beaten in the past 17 years. The headline PMI moved up from 57.4 in August to 58.1, closing in on the all-time high of 60.5 recorded in April 2000.

Surging order book growth encouraged manufacturers to take on extra staff at a rate never previously seen in the 20-year history of the PMI survey, with exports continuing to rise at a solid pace even in the face of the stronger euro.

Despite this expansion of capacity, backlogs of uncompleted work continued to build up at an increased rate, suggesting the hiring upturn has plenty more room to run. The increase in backlogs of work was the second-largest seen in the survey's history.

Optimism about the outlook has also improved, highlighting the increasingly positive mood among euro area producers. Although worries about the stronger euro have begun to appear, export growth showed only a modest easing and domestic demand conditions were generally seen to have improved.

The details of the survey also underscore how the recovery has become increasingly broad-based. September was the fourth successive month in which all surveyed countries recorded expansions as given by the headline PMI. Greece is the latest good news story, enjoying its strongest growth since June 2008.

Germany led the pack, closely followed by the Netherlands and Austria.

Eurozone manufacturing output

Capacity stretched despite record job gains

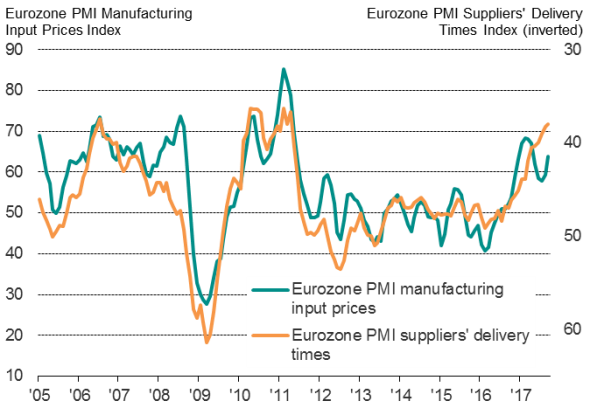

The upturn is being accompanied by rising inflationary pressures, linked to both rising global commodity prices and improved pricing power among suppliers. Increased input buying by manufacturers meant supplier delivery delays were the most widespread for over six years in September as demand often exceeded supply. Input price inflation consequently picked up, albeit remaining below the highs seen at the turn of the year. However, with oil prices continuing to rise, cost pressures are likely to intensify further in coming weeks.

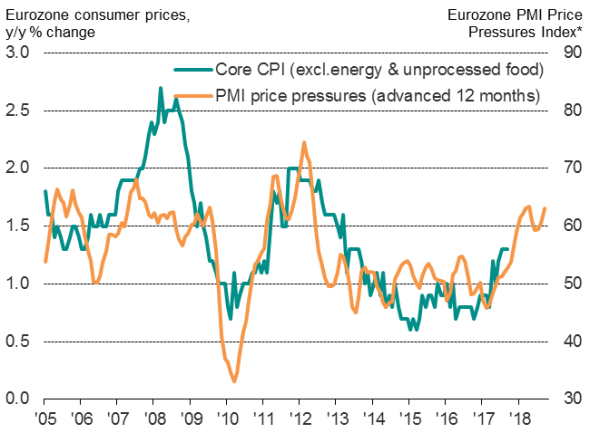

A composite index of supplier delays and input prices acts as a reliable forward indicator of core consumer price inflation, and suggests that inflationary pressures are on the rise.

Suppliers' delivery times and input prices

ECB to announce tapering

The upturn in price pressures and accelerating manufacturing growth will further fuel expectations of an imminent announcement from the ECB in relation to tapering of policy stimulus.

At its December 2016 meeting the ECB announced that it would extend its asset purchases to "December 2017 or beyond if necessary". However, the ECB also trimmed the monthly amount of asset purchases from "80 billion a month to "60 billion a month beginning in April 2017.

Prices pressures* and eurozone inflation

* The price pressures index is an average of the manufacturing input price and suppliers' delivery times index, the latter inverted in the calculation.

The central bank is widely expected to use either its October or November meeting to announce its intention to reduce its monthly asset purchases in 2018 from the current rate of "60bn per month.

IHS Markit then expects the ECB to start the process of gradually normalizing interest rates in the second half of 2018, starting with a lifting of the deposit rate from -0.40% in the third quarter. The first increase in its refinancing rate (currently 0.00%) could come just before the end of 2018.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02102017-Economics-Eurozone-manufacturers-see-rising-price-pressures-as-third-quarter-ends-on-strong-note.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02102017-Economics-Eurozone-manufacturers-see-rising-price-pressures-as-third-quarter-ends-on-strong-note.html&text=Eurozone+manufacturers+see+rising+price+pressures+as+third+quarter+ends+on+strong+note","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02102017-Economics-Eurozone-manufacturers-see-rising-price-pressures-as-third-quarter-ends-on-strong-note.html","enabled":true},{"name":"email","url":"?subject=Eurozone manufacturers see rising price pressures as third quarter ends on strong note&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02102017-Economics-Eurozone-manufacturers-see-rising-price-pressures-as-third-quarter-ends-on-strong-note.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Eurozone+manufacturers+see+rising+price+pressures+as+third+quarter+ends+on+strong+note http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02102017-Economics-Eurozone-manufacturers-see-rising-price-pressures-as-third-quarter-ends-on-strong-note.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}