Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Mar 02, 2016

Asian credit risk recedes but single names exposed

Credit risk in the region has fallen rapidly since mid-February's highs, but some single names continue to exhibit heightened levels.

- Markit iTraxx Asia Ex Japan IG index has tightened 26bps over the past three weeks

- IG Asian names such as Bank of China and Wharf Hldgs's credit risk at 'junk' levels

- Junk name Sony's 5-yr CDS spread of 70bps implies investment grade status

A bounce from mid-February's lows has seen credit risk recede in global fixed income markets, and the Asian region has been no exception.

The Markit iTraxx Asia Ex Japan IG index, which tracks 40 investment grade single names' credit spreads, has tightened 26bps over the past three weeks. The move has been reminiscent of what was seen last October, when spreads peaked at 165bps amid emerging market turmoil, before tightening rapidly to 123bps by November. The current spread of 151bps is however still 28bps wider and 13bps wider than at the beginning of the year, suggesting current investor sentiment remain cautious.

Single 'A's exposed

Despite the more optimistic mood in the region, some single name credits continue to exhibit heightened levels of credit risk, despite their strong credit ratings.

Noble Group and Toshiba have been just two of the high profile casualties that have seen credit rating agencies downgrade their status from investment grade to 'junk' (BBB or below).

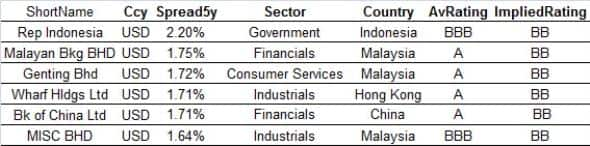

Using Markit's CDS pricing service, implied ratings can be derived based on single name 5-yr CDS spreads and associated CDS sector curve spreads.

Several investment grade rated credits currently trade with CDS spreads that imply a much lower credit rating, with three coming from Malaysia. This includes the sovereign entity itself, hampered in recent months by a weak currency and falling commodity prices.

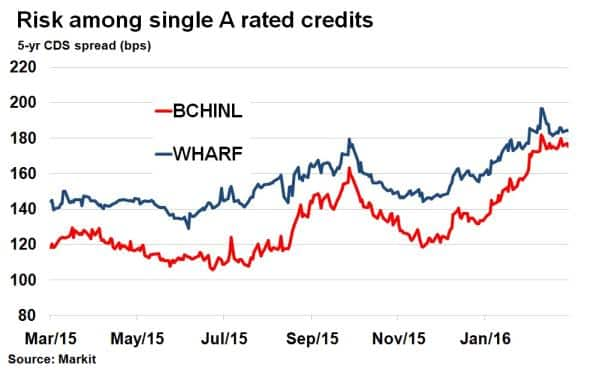

But those facing the biggest potential fall are the higher rated 'A' credits. In particular Bank of China and Hong Kong based conglomerate Wharf Holdingsldgs, which have seen their 5-yr CDS spreads widen 31% and 16% this year, respectively. In Bank of China's case, the disparity between rating agencies was made all the clear when Fitch affirmed its 'A' rating yesterday, citing "expectations of an extremely high probability of support from the Chinese government in the event of stresses". But the market is not taking any chances.

Sony's recovery

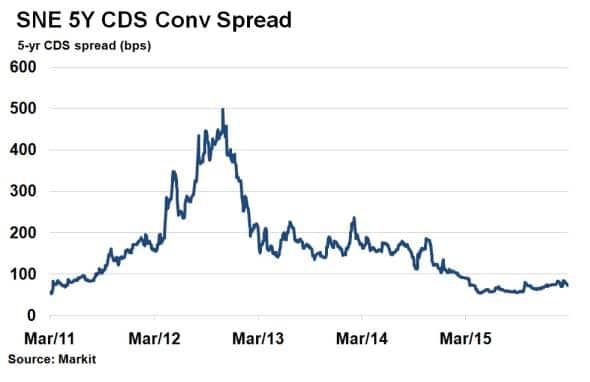

On the contrary, Japanese firm Sony's current 5-yr CDS spread implies an investment grade rating, despite its current junk status.

After being downgraded by Moody's in January 2014, its 5-yr CDS spread has more than halved. CDS sector curves currently imply an 85bps investment grade threshold for BBB status in the consumer goods category, and Sony's 5-yr CDS spread has been trading below this since March 2015. Even amid the heightened volatility seen in global credit markets mid last year and the beginning of this year, Sony's business has remained resilient, showcased by its recent jump in profits.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02032016-credit-asian-credit-risk-recedes-but-single-names-exposed.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02032016-credit-asian-credit-risk-recedes-but-single-names-exposed.html&text=Asian+credit+risk+recedes+but+single+names+exposed","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02032016-credit-asian-credit-risk-recedes-but-single-names-exposed.html","enabled":true},{"name":"email","url":"?subject=Asian credit risk recedes but single names exposed&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02032016-credit-asian-credit-risk-recedes-but-single-names-exposed.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Asian+credit+risk+recedes+but+single+names+exposed http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02032016-credit-asian-credit-risk-recedes-but-single-names-exposed.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}