Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Feb 02, 2016

Nigerian bonds rebound from lows

The news that Nigeria was in talks with the World Bank and African Development Bank has been treated well by the market as its bonds are now trading above their mid-January lows.

- Spreads in Nigerian sovereign bonds stand at 686bps, down from last week's high of 777bps

- The Markit iBoxx USD Corporates Nigeria has yielded over 10% since the start of January

- Nigeria's 5-yr CDS contracts remain illiquid despite recent volatility

The oil rout has seen Nigeria's government reach out to the World Bank and African Development Bank as it seeks to plug a projected $15bn budget deficit gap opened up by falling oil revenues. The country has already burned through one-quarter of its foreign exchange reserves despite an import restriction aimed at staunching capital outflows. The $3.5bn of reported funding from these institutions is aimed at lowering Nigeria's need to raise foreign capital; a fortuitous development given the declining demand for Nigerian bonds in the wake of the oil slump.

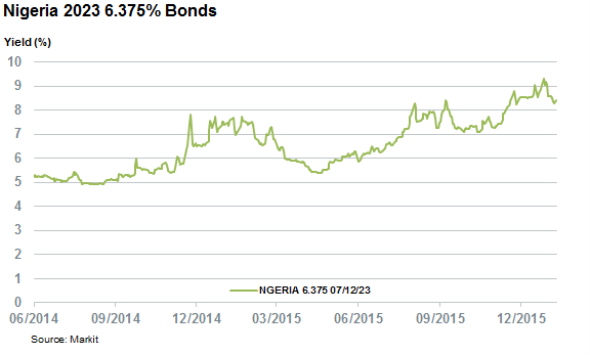

Nigeria's most recently issued bond, the 6.375% note maturing in 2028, saw its yield surge to an all-time high of 9.2% on January 20th. While the yield has since settled somewhat following the recent oil price rebound to settle at 8.4% as of latest count, this still represents a 50% increase on the level seen 18 months ago.

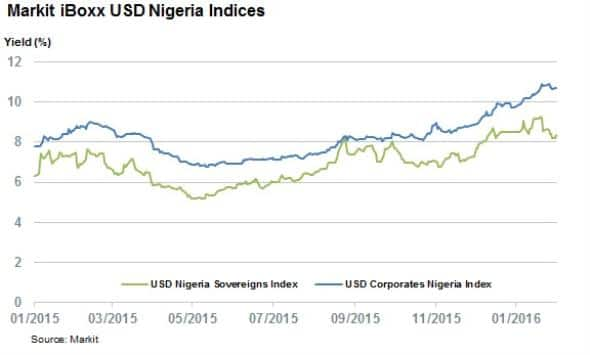

These woes are reflected across the rest of Nigeria's overseas listed bonds as the Markit iBoxx USD Nigeria Sovereigns Index which tracks the asset class has seen its yield jump to 8.3% after trading as low as 5.15% last spring. This surging yield means that investors are now requiring 685bps of extra yield over US treasuries to hold the country's sovereign bonds.

However the market appears to be taking the news of the country's advances to external lenders in stride, given that both the 2028 note and the Nigeria Sovereigns Index traded roughly flat on Monday despite a 5% drop in the price of oil.

Corporate bonds also impacted

Dollar denominated Nigerian corporate bonds also highlight the country's economic struggles, as the Markit iBoxx USD Corporates Nigeria Index has traded over the 10% mark since the first week of the year. Interestingly, these bonds have not enjoyed the same rebound seen by the sovereign bonds as the current yield, 10.7%, is only 17bps tighter than the recent wide seen two weeks ago.

CDS remain illiquid

Despite the recent volatility seen in Nigerian bonds, the CDS contract which references the country has continued to prove illiquid as the 5-yr Nigerian CDS spread continues to earn the worst liquidity score of 5, according to Markit CDS pricing. The cash bond market is relatively more liquid as the previously mentioned 2028 note has a liquidity score of 3, the midpoint of Markit EVB's bond liquidity score.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02022016-credit-nigerian-bonds-rebound-from-lows.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02022016-credit-nigerian-bonds-rebound-from-lows.html&text=Nigerian+bonds+rebound+from+lows","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02022016-credit-nigerian-bonds-rebound-from-lows.html","enabled":true},{"name":"email","url":"?subject=Nigerian bonds rebound from lows&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02022016-credit-nigerian-bonds-rebound-from-lows.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Nigerian+bonds+rebound+from+lows http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02022016-credit-nigerian-bonds-rebound-from-lows.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}