Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 01, 2016

Developed world leads global manufacturing PMI to 27-month high

Global manufacturing expanded in November at the fastest rate since August 2014, according to PMI survey data. Growth was led by the developed world, with rising domestic demand benefitting the US and eurozone exporters helped by the weak euro. However, emerging markets also continued to show renewed signs of life. The surveys also found producers' costs to be rising at the fastest rate for over five years.

Global manufacturing output

The JPMorgan Global Manufacturing PMI, compiled by Markit and based on results of surveys in over 30 countries, inched up from 52.0 in October to 52.1 in November, the marginal improvement taking the index to its highest since August 2014. The upturn means the survey data are roughly consistent with global manufacturing output rising at a 4% annual pace.

Output growth slowed slightly, but inflows of new orders showed the largest rise for 27 months, buoyed by the joint-highest growth of exports for just over two years (albeit still running at a subdued pace of expansion compared to rates seen prior to the global financial crisis).

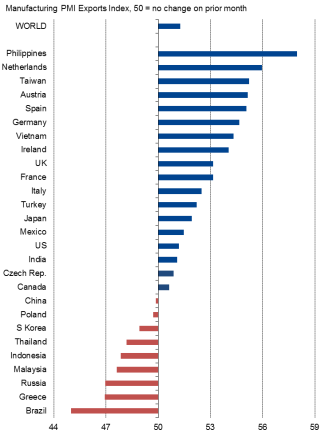

Worldwide manufacturing PMI rankings

Sources for charts: JPMorgan, Nikkei, Caixin, IHS Markit.

The recent drag from inventory reduction also continued to ease, with stocks of both finished goods and inputs showing only marginal declines.

Developed world leads upturn

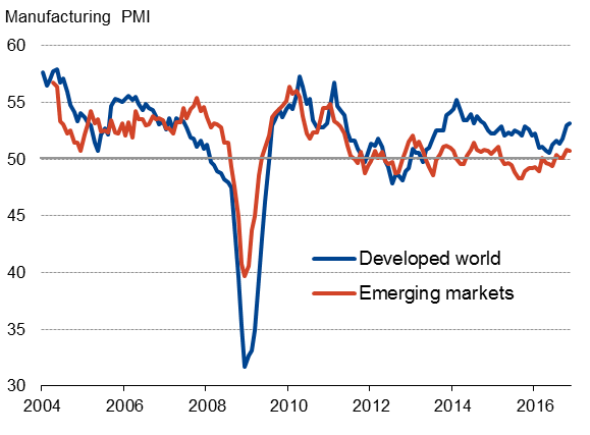

The expansion continued to be led by the developed world, where the manufacturing PMI edged up to 53.2, its highest for just over two years. The emerging market PMI nudged lower to 50.7, but that was still the second-best reading in the past 21 months.

Developed v emerging markets

Four of the top six countries in terms of improvements in manufacturing conditions were found in the eurozone, with the Netherlands leading the global pack. The data also highlight how the weakened euro is benefitting exporters. The eurozone PMI consequently rose to its highest since January 2014.

Growth also accelerated in the US, where the PMI of 54.1 was the highest for 13 months and positioned the US at seventh place in the rankings.

The US manufacturing sector was buoyed by rising domestic demand, with export performance still struggling in the wake of the strong dollar.

The UK sank to eleventh place in the rankings, having sat as high as second place as recently as September. At 53.4, the UK PMI signalled the weakest expansion since August. However, most notable has been a slide in UK export performance: having topped the PMI export rankings in September as producers benefitted from the weakened pound, the UK fell to ninth place in the global rankings in November, with export growth having slowed sharply over the past two months.

Japan meanwhile saw some alleviation of the pressures of a strong yen as the exchange rate depreciated in November, though the country continued to lag behind all other major developed economies. At 51.3, the Nikkei PMI for Japan was down marginally on October but still the second-strongest reading since January.

Emerging markets fill lower rankings

Only seven of the 28 countries covered by the Markit-compiled PMI surveys reported a deterioration of manufacturing conditions in November (down from eight in October). Once again, all except Greece were emerging markets, with Brazil continuing to suffer the steepest downturn.

Export rankings

However, performance across the emerging markets was very mixed, with the Philippines sitting at second place in rankings as its manufacturing growth spurt continued.

Growth slowed in the manufacturing sectors of both China and India, but the former continued to enjoy its strongest growth spell for over two years. Russia meanwhile saw the fastest rate of expansion since March 2011, as rising domestic demand offset a further steep drop in exports.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01122016-Economics-Developed-world-leads-global-manufacturing-PMI-to-27-month-high.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01122016-Economics-Developed-world-leads-global-manufacturing-PMI-to-27-month-high.html&text=Developed+world+leads+global+manufacturing+PMI+to+27-month+high","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01122016-Economics-Developed-world-leads-global-manufacturing-PMI-to-27-month-high.html","enabled":true},{"name":"email","url":"?subject=Developed world leads global manufacturing PMI to 27-month high&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01122016-Economics-Developed-world-leads-global-manufacturing-PMI-to-27-month-high.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Developed+world+leads+global+manufacturing+PMI+to+27-month+high http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01122016-Economics-Developed-world-leads-global-manufacturing-PMI-to-27-month-high.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}