Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Nov 01, 2016

Chinese manufacturing sector begins fourth quarter on solid footing

After showing signs of stabilisation for the last three months, China's manufacturing sector pulled out of the slow lane in October, driven by domestic demand. Growth of production and orders accelerated during the month, with output expanding at the fastest rate in over five years. Inflationary pressures also picked up.

The Caixin China Manufacturing PMI, a key barometer of the health of the goods-producing sector compiled by Markit, rose for the second successive month, up from 50.1 in September to a 27-month high of 51.2 in October. Though moderate, the considerably stronger upturn in October pointed towards the manufacturing economy gaining momentum at the start of the fourth quarter.

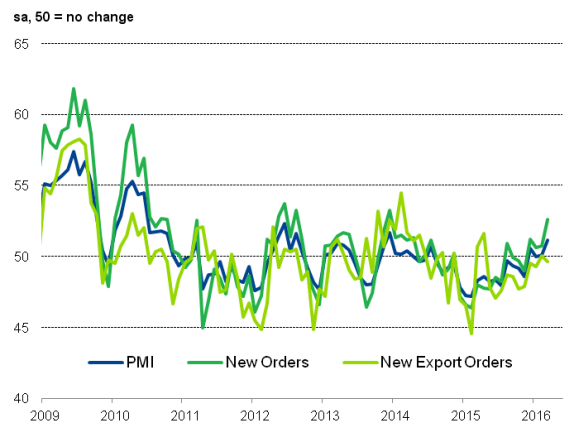

Domestic-led upturn

Production expanded especially sharply, growing at the fastest rate since March 2011, helped by a further rise in new orders. A renewed decline in export sales, albeit marginal, suggested that much of the uplift was driven by a welcome strengthening of domestic demand.

Part of this further improvement in manufacturing conditions therefore appears to have been due to the government's efforts to stimulate the economy through fiscal measures. Other encouraging leading signals were busier supply chains and increased purchasing activity.

Domestic demand drives manufacturing growth

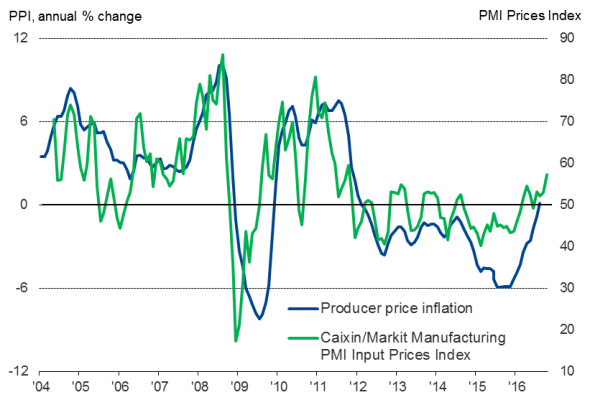

Prices rise at fastest rate since early-2011

A further key feature of the October survey was a revival of inflationary pressures. Average prices charged by producers showed the largest monthly rise since February 2011.

However, in many cases, price hikes were driven by the need to pass higher costs on to customers: input prices jumped to the greatest extent since September 2011.

Rising cost burdens were linked to higher prices for raw materials such as oil, steel, copper and coal, according to survey respondents, which in many cases simply appeared to reflect higher global prices. The Suppliers' Delivery Times Index, a useful barometer of the extent to which a demand and supply imbalance is driving prices higher, pointed to few signs of prices being raised due to demand outstripping supply in China.

Inflation and supply chain constraints

Producer input prices

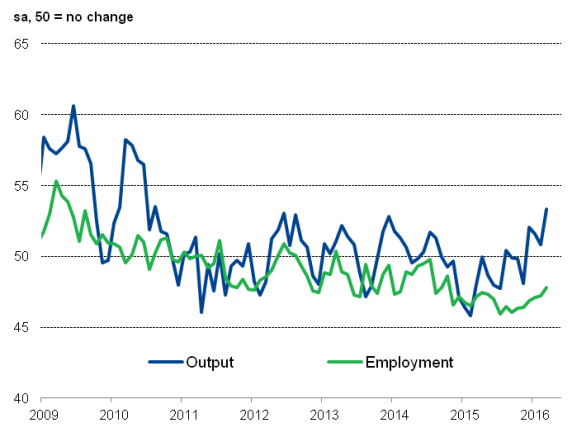

Job cuts continue

Job cuts in the manufacturing sector consequently continued to be widely reported despite strong improvements in output and new orders, as companies downsized and sought cost savings. On a brighter note, there were nascent signs of stabilisation in the manufacturing workforce as the rate of decrease in employment slowed to the weakest since May 2015.

Job cuts persist despite expanding output volumes

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

Bernard.Aw@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01112016-Economics-Chinese-manufacturing-sector-begins-fourth-quarter-on-solid-footing.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01112016-Economics-Chinese-manufacturing-sector-begins-fourth-quarter-on-solid-footing.html&text=Chinese+manufacturing+sector+begins+fourth+quarter+on+solid+footing","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01112016-Economics-Chinese-manufacturing-sector-begins-fourth-quarter-on-solid-footing.html","enabled":true},{"name":"email","url":"?subject=Chinese manufacturing sector begins fourth quarter on solid footing&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01112016-Economics-Chinese-manufacturing-sector-begins-fourth-quarter-on-solid-footing.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Chinese+manufacturing+sector+begins+fourth+quarter+on+solid+footing http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01112016-Economics-Chinese-manufacturing-sector-begins-fourth-quarter-on-solid-footing.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}