Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Oct 01, 2015

Refiners prove winning energy bet

Refinery firms have been relatively insulated from the worst of the energy price collapse, which has cued the inevitable ETF to take advantage of the buoyant trading conditions.

- Constituents of the Market Vectors Oil Refiners ETF have outperformed the Russell 3000 energy constituents by over 40% YTD

- Short sellers have covered their positions in refinery shares while energy sees the opposite

- Dividends in refinery shares expected to climb by 38% in the coming fiscal year

Refineries have been one of the few bright spots in the energy sector over the last 12 months. While their peers have struggled to cope with falling oil prices, the price of refined products have fallen by a lesser extent than crude oil, making for buoyant trading conditions for the industry.

The fact that the "CRACK" spread, which measures the difference between a refinery's costs and its output, has actually increased in the last few months means that operating profits have been able to climb while the rest of the energy industry has had to contend with a halving of oil prices in the last 12 months.

Cue ETFs"

The attractive dynamics in the sector has prompted the inevitable ETF with Van Eck Securities recently launching the Market Vectors Oil Refiners ETF. The fund, which trades under the ticker CRAK, tracks an index of 26 firms that derive at least half their income from crude oil refineries. The constituents of the fund reflect the strong fundamentals underpinning the business case for refineries as their shares are up 11% on average over the last 12 months. This vastly outperforms the rest of the energy sector as the 175 energy constituents of the Russell 3000 are sitting on a 31% price retreat over the same period.

Since launching on August 19th, the ETF has managed to attract just under $1m in new assets, which represents roughly half of its seed capital.

The bullish market sentiment towards refinery funds have continued since CRAK's launch as the fund has outperformed the SPDR S&P Oil & Gas Exploration and Production ETF by 5%.

Short sellers cover

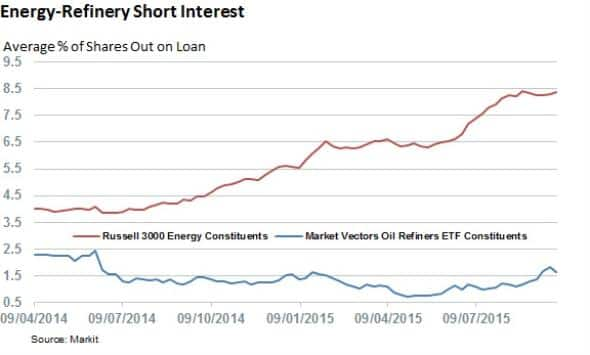

The tearaway returns delivered by refinery shares have not attracted short sellers as the constituents of the CRAK ETF have seen their average short interest fall by over a quarter in the last 18 months.

Energy names have seen the opposite trend as shorting activity in the Russell 3000 energy shares has doubled over the same period to 8.4% of shares outstanding. This divergent path means that refiners on average see a fifth of the shorting activity compared to the rest of the energy field.

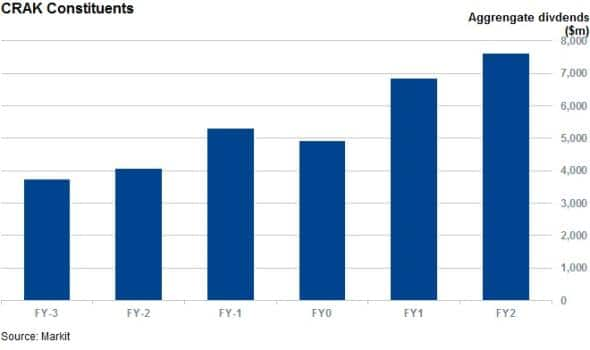

Dividends set to surge

Our dividend forecasting team is expecting these bumper trading conditions to translate into bumper dividends for shareholders. The aggregate dividends across the constituents of the CRAK ETF are expected to grow by 38% in the coming fiscal year when the industry is forecasted to pay $6.8bn in dividends.

Simon Colvin, Research Analyst at Markit

Posted 1 October 2015

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01102015-equities-refiners-prove-winning-energy-bet.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01102015-equities-refiners-prove-winning-energy-bet.html&text=Refiners+prove+winning+energy+bet","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01102015-equities-refiners-prove-winning-energy-bet.html","enabled":true},{"name":"email","url":"?subject=Refiners prove winning energy bet&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01102015-equities-refiners-prove-winning-energy-bet.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Refiners+prove+winning+energy+bet http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01102015-equities-refiners-prove-winning-energy-bet.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}