Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 01, 2016

PMI signals sluggish worldwide manufacturing upturn in August

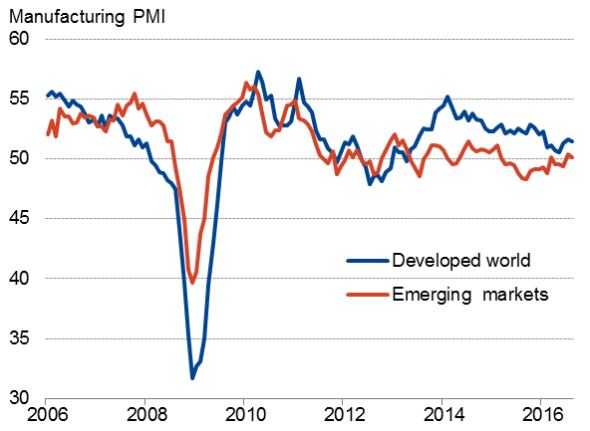

Global manufacturing saw further steady but unspectacular growth in August, reflecting signs of an improvement in emerging markets and sluggish but ongoing expansion in the developed world, the latter helped by a marked upturn in UK manufacturing activity after an initial slump that followed the EU referendum.

Global manufacturing output

PMI falls from eight-month high

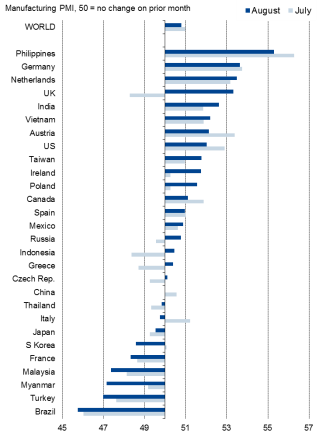

The JPMorgan Global PMI, compiled by Markit from its worldwide business surveys, fell from an eight-month high of 51.0 in July to 50.8 in August. The latest reading is nevertheless one of the strongest seen in recent months and indicates that factories are enjoying their best quarter so far this year, albeit by a slim margin.

Of the 28 countries covered by the PMI surveys, only nine reported a deterioration in manufacturing conditions, while 18 reported improvements. China's producers reported no change.

Worldwide manufacturing PMI rankings

Sources for charts: JPMorgan, Nikkei, Caixin, IHS Markit.

In terms of changes in the PMI, 14 of the countries saw their manufacturing PMI rise compared to the July reading while 13 saw a decline, with only Spain seeing an unchanged reading.

Production and exports rise

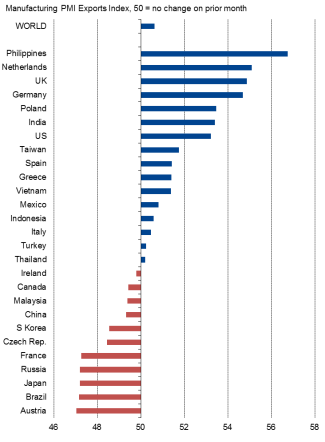

Across all counties, output rose at the fastest rate since last November, roughly consistent with a 2.5% annual rise in worldwide factory production, despite order book growth slowing slightly. More encouraging was a further marginal gain in exports which, although modest, was the largest since last November, suggesting global trade is starting to revive.

The amount of inputs purchased by factories also rose, up for a second successive month to register the first back-to-back increases in input buying since January, adding to signs that the recent upturn has some momentum.

Export rankings

Hiring subdued by cost cutting

Producers remained cost conscious, however, with employment falling again after having briefly returned to growth in July.

Cost consciousness was in part related to a further increase in average input costs, which rose for a fifth successive month. Although modest, and slower than July, the increase in costs was one of the largest seen over the past two years. Selling prices fell marginally on average, however, down for the first time in five months, as firms offered discounts to win new sales.

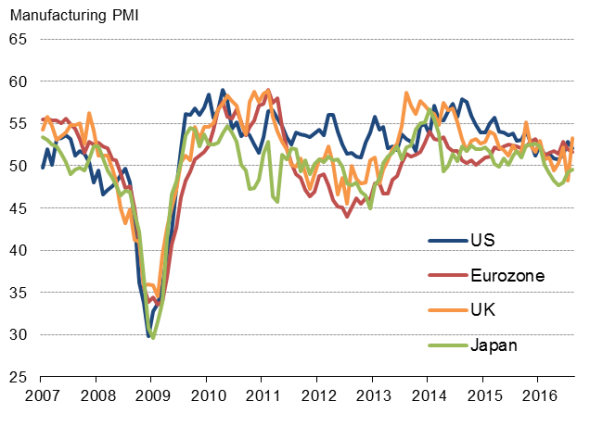

Steady developed world expansion

At 51.5, the developed world manufacturing PMI fell from 51.7 but was nevertheless the second-highest reading since January. US business conditions continued to strengthen at a steady pace, improving on the near-stagnation seen in the second quarter but weaker than seen in July.

Growth remained sluggish in the eurozone, likewise slipping compared to July. Germany and the Netherlands held second and third spots in the rankings, however, highlighting a core of manufacturing strength in the euro area's northern regions.

In Japan, manufacturing continued to contract, though the rate of decline eased to signal only a marginal decline.

UK shows best improvement

The biggest change of all countries was seen in the UK, where manufacturing activity rebounded after a 'Brexit' vote-related slump in July, pushing the UK into fourth place in the overall growth rankings.

The UK benefitted not just from confidence improving after the initial shock and renewed central bank stimulus, but also a steep drop in the exchange rate, which buoyed exports. UK manufacturers enjoyed the third-strongest export growth of all countries surveyed in August.

Philippines leads growth rankings

Emerging markets continued to lag behind the developed world, with the PMI down from 50.4 to 50.1. However, the latest marginal improvement in emerging market manufacturing marked the first back-to-back gains in almost a year-and-a-half.

The fastest growth of all countries was recorded in the Philippines, for which PMI data were released for the first time in August alongside sister surveys for Thailand and Myanmar (enabling the creation a new Nikkei ASEAN PMI).

Developed v emerging markets

Brazil and Turkey see steepest declines

Brazil remained firmly at the foot of the rankings, followed by Turkey, with both countries beset by political uncertainty.

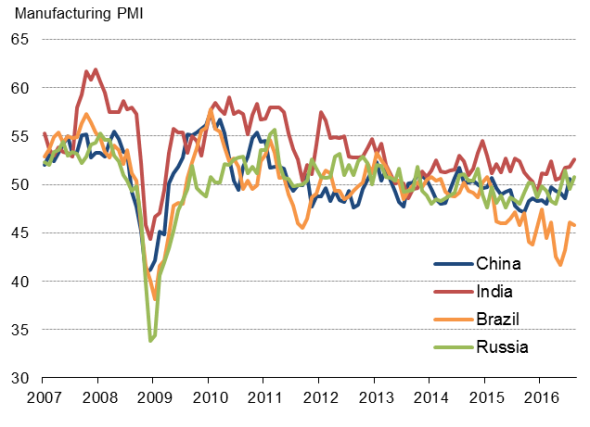

Although China's manufacturers reported no overall change in business conditions, the survey brings welcome news that the sector is stabilising in the third quarter after being in a state of continual decline since early-2015.

Russia's manufacturing sector is similarly showing signs of steadying after almost two years of decline, with the PMI above 50 for the second time in three months in August.

India saw the strongest performance of the BRICs, however, with the PMI reaching its highest for just over a year.

Developed world manufacturing

Emerging market manufacturing

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01092016-Economics-PMI-signals-sluggish-worldwide-manufacturing-upturn-in-August.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01092016-Economics-PMI-signals-sluggish-worldwide-manufacturing-upturn-in-August.html&text=PMI+signals+sluggish+worldwide+manufacturing+upturn+in+August","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01092016-Economics-PMI-signals-sluggish-worldwide-manufacturing-upturn-in-August.html","enabled":true},{"name":"email","url":"?subject=PMI signals sluggish worldwide manufacturing upturn in August&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01092016-Economics-PMI-signals-sluggish-worldwide-manufacturing-upturn-in-August.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=PMI+signals+sluggish+worldwide+manufacturing+upturn+in+August http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01092016-Economics-PMI-signals-sluggish-worldwide-manufacturing-upturn-in-August.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}