Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jul 01, 2016

Vietnamese manufacturing ends second quarter on positive note

PMI data indicate that the Vietnamese economy remains one of the brighter lights in the region as we enter the second half of the year, with the manufacturing sector demonstrating an ability to secure new work and expand output despite a challenging global economic environment. That said, a worsening of global conditions is still the key headwind facing firms throughout the rest of the year. Low inflationary pressures will help Vietnamese firms to maintain competitiveness, key to continued expansion.

Nikkei PMI data for June, produced by Markit, pointed to solid growth momentum in the Vietnamese manufacturing sector midway through 2016. Output rose at the fastest pace in nearly a year on the back of higher new orders. Firms upped their staffing levels and purchasing activity accordingly. Meanwhile, the recent pick-up in inflationary pressures came to an end.

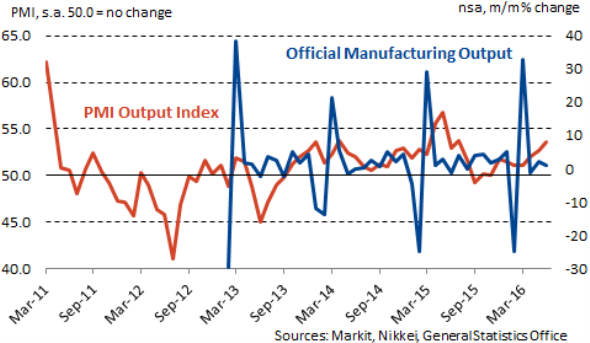

Output growth fastest since July last year

June saw solid expansions of both output and new orders, and the respective averages for the second quarter as a whole were the strongest for a year. There were also positive signs from export markets, as new orders from abroad rose at the joint-sharpest pace since the first month of data collection in March 2011.

Vietnam Manufacturing Output

Recently announced GDP data showed that the economy grew 5.5% on an annual basis over the first half of the year. Reports suggested that the agriculture sector suffered due to adverse weather, limiting the pace of growth for the economy as a whole. Official manufacturing data painted a more positive picture, with the first half of 2016 seeing a 10.2% increase in gross value added over the same period a year earlier.

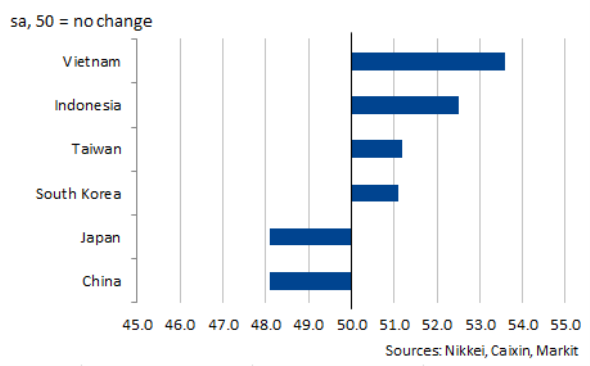

Vietnamese manufacturers outperform regional partners

As has been the case in recent months, the Vietnamese manufacturing sector was the best-performing of those in South East Asia for which PMI data are available in June. There have been signs of a return to growth in a number of countries, led by Vietnam, but the major manufacturing sectors of China and Japan continued to see production decline.

Manufacturing PMI Output Indices for June

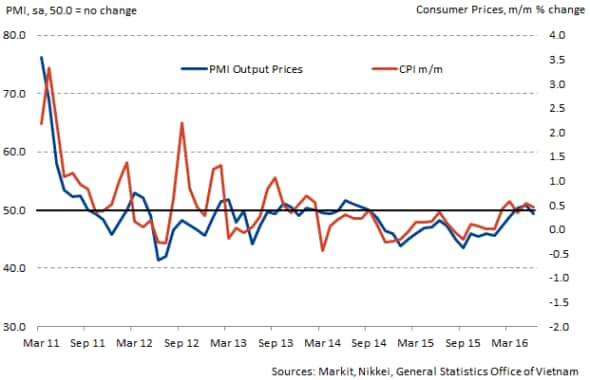

Cost inflation moderates

Vietnam’s producers benefitted from softer cost pressures in June. Earlier in the second quarter, accelerating rates of cost inflation had been recorded, with the rise in input prices in May the strongest since August 2014. However, this came to an end in June as inflation eased back to the weakest in the current four-month sequence of rising costs. While some businesses signalled higher oil prices, others mentioned signs of lower material costs in global markets.

Slower cost inflation enabled firms to lower their output prices in order to maintain competitiveness. Charges declined for the first time in three months, albeit marginally. Official data showed consumer price inflation remaining modest in June.

PMI Price Indices

PMI data for July will be published on the 1st August.

Andrew Harker | Economics Associate Director, IHS Markit

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01072016-Economics-Vietnamese-manufacturing-ends-second-quarter-on-positive-note.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01072016-Economics-Vietnamese-manufacturing-ends-second-quarter-on-positive-note.html&text=Vietnamese+manufacturing+ends+second+quarter+on+positive+note","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01072016-Economics-Vietnamese-manufacturing-ends-second-quarter-on-positive-note.html","enabled":true},{"name":"email","url":"?subject=Vietnamese manufacturing ends second quarter on positive note&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01072016-Economics-Vietnamese-manufacturing-ends-second-quarter-on-positive-note.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Vietnamese+manufacturing+ends+second+quarter+on+positive+note http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01072016-Economics-Vietnamese-manufacturing-ends-second-quarter-on-positive-note.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}