Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 01, 2015

UK consumers support manufacturing growth as strong pound hits order books

UK manufacturers remained in the slow lane in May, receiving important support from rising consumer spending as the strong pound continued to hit overseas trade.

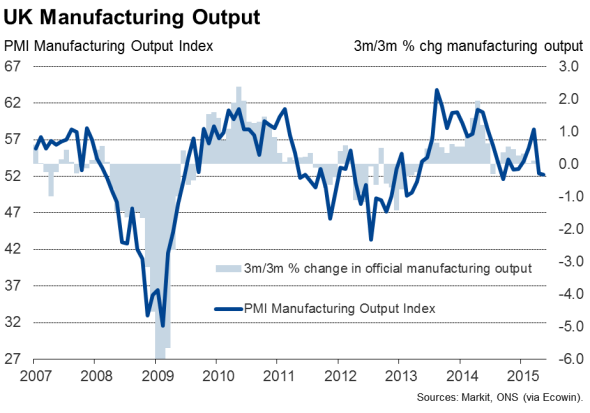

The Markit/CIPS Manufacturing PMI rose from 51.8 in April to 52.0, but still signalled one of the weakest expansions seen over the past two years. The average PMI reading in the second quarter so far is the lowest since the second quarter of 2013.

Manufacturing drag

The survey's output index is running at a level consistent with the official measure of factory output falling 0.3% in the second quarter, meaning the goods- producing sector is acting as an increasing drag on the economy. Manufacturing output rose just 0.1% in the first quarter, according to the latest official data, contributing to a sharp slowdown in overall economic growth.

Factory employment, which surged throughout most of last year and in the early months of 2015, barely rose for a second successive month as companies grew reticent to hire in the face of disappointing order books.

Strong pound hurting exports

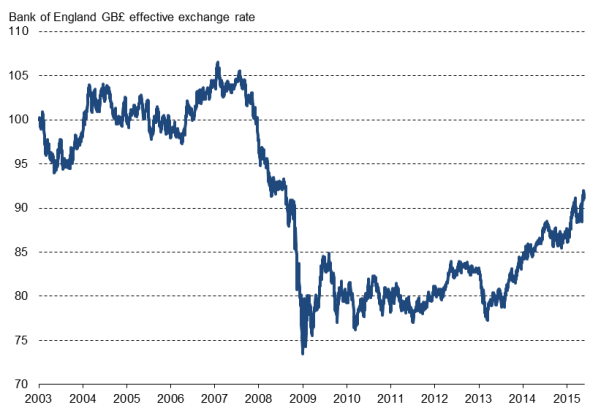

Export orders fell marginally, dropping for the third time in the past four months, in part due to the stronger exchange rate hitting competitiveness in overseas markets. The stronger pound also appears to be hurting orders from domestic customers, who look to prefer cheaper imports (GDP data showed a surge in imports in the first quarter).

The pound has risen to its highest since early-2008 on a trade-weighted basis, reflecting a growing conviction that - despite the manufacturing sector's malaise - robust consumer-led growth means UK interest rates are likely to start rising later this year, contrasting in particular with ongoing stimulus in the eurozone.

Exchange rate

Consumer boom

Import substitution and export losses were most pronounced in the intermediate goods sector, which supplies inputs to other manufacturers and saw total new orders fall for a second successive month. Orders for investment goods such as plant and machinery also remained disappointingly weak, albeit picking up from the decline seen in April. That left consumer goods producers providing the main engine of manufacturing growth again in May, for which new orders continued the surge that has been evident since February.

Charges rise for first time in five months

An upturn in price pressures is adding to the likelihood of UK interest rates rising later this year. Although inflation has fallen to -0.1%, underlying price pressures are building. Manufacturers' average selling prices increased for the first time in five months, rising at the fastest rate since last August as the rate of decline of input prices slowed markedly, in part due to higher oil prices.

May's disappointing manufacturing PMI calls into question the need for higher interest rates, which may in turn put downward pressure on sterling to the benefit of exporters. However, much will depend on the performance of the larger services economy, for which the next PMI data are published on 3rd June.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01062015-Economics-UK-consumers-support-manufacturing-growth-as-strong-pound-hits-order-books.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01062015-Economics-UK-consumers-support-manufacturing-growth-as-strong-pound-hits-order-books.html&text=UK+consumers+support+manufacturing+growth+as+strong+pound+hits+order+books","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01062015-Economics-UK-consumers-support-manufacturing-growth-as-strong-pound-hits-order-books.html","enabled":true},{"name":"email","url":"?subject=UK consumers support manufacturing growth as strong pound hits order books&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01062015-Economics-UK-consumers-support-manufacturing-growth-as-strong-pound-hits-order-books.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+consumers+support+manufacturing+growth+as+strong+pound+hits+order+books http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01062015-Economics-UK-consumers-support-manufacturing-growth-as-strong-pound-hits-order-books.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}