December 8, 2017 - Weekly Pricing Pulse

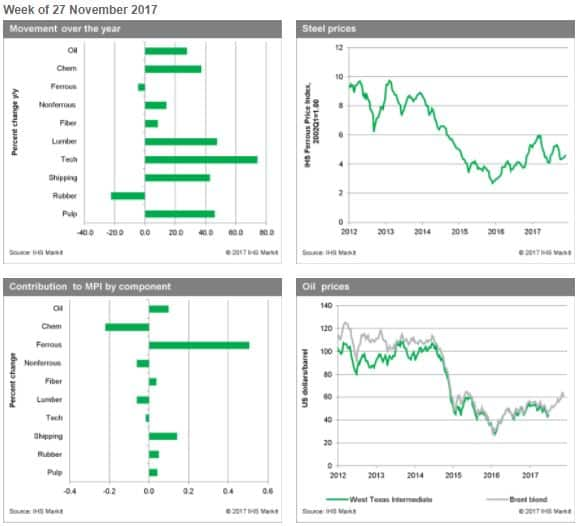

The IHS Markit Materials Price Index (MPI) increased by 0.5% last week, its fourth consecutive gain. The increase was more broadly based than in recent weeks, with six of the ten subcomponents rising. Freight and ferrous metals were the biggest movers, increasing by 3.8% and 2.3%, respectively.

Steel markets appear to have been the driver behind last week's increase in the MPI. Chinese cuts in both steel production and iron ore mining have boosted industry margins worldwide. The hope is that this spring will see a rebound in steel making that will boost seaborne iron ore shipments because of continuing restrictions on Chinese mines.

Macroeconomic data last week contributed to the positive mood in markets. Global manufacturing continued to expand at a healthy clip with November's headline IHS Markit Manufacturing Purchasing Manager's Index (PMI) recording its best reading since March 2011. The only disappointment in the data was from China, where the Caixin Manufacturing PMI fell to 50.8 in November. Slower growth in China is one of three reasons we see commodity prices remaining relatively range bound next year. Markets also received a boost at week's end because of the growing likelihood of a US tax cut by year-end and therefore the prospect of fiscal stimulus in 2018. Next up for markets will be the US Federal Reserve meeting on 12–13 December. It is widely expected that interest rates will be lifted another 25 basis points. It will be interesting to see how markets and the US dollar react—tighter financial conditions are the second reason we see a change ahead in commodity markets. The third reason we see commodity prices relatively flat in 2018 is the price of oil, which we believe will retreat slightly in early 2018 despite continued discipline on the part of OPEC.

IHS Markit Materials Price Index

Industrial Materials: Prices

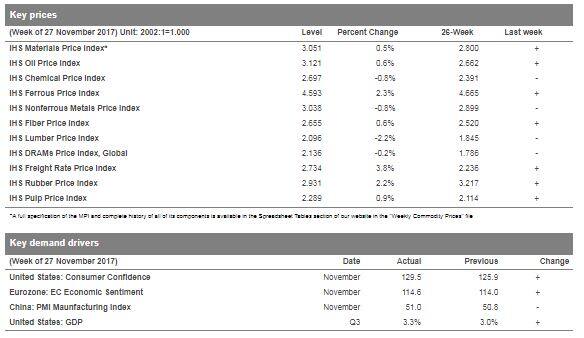

Key Prices & Demand Drivers