December 15, 2017 - Weekly Pricing Pulse

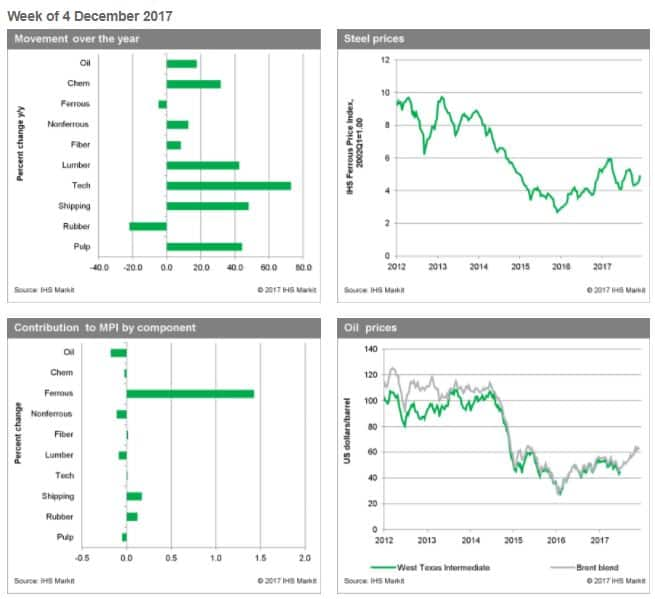

The gains last week were driven by a small subset of commodities, with the broader market posting a sequence of small declines.

The IHS Markit Materials Price Index (MPI) rose 1.3% last week, hitting its highest level since late 2014. Gains were concentrated in three areas: ferrous metals, rubber, and freight, all of which posted large jumps.

Steel markets have been in a strong uptrend over the last two weeks, with unseasonably warm weather in China helping to prolong the building season. Steady demand has pressured already-tight markets caused by government-mandated cuts in production to meet pollution targets. Rubber prices have also been moving higher recently in reaction to a set of factors—a pledge by rubber producers to cut exports, a warehouse fire in Shanghai that damaged a significant block of inventory, and the Thai government’s plan to increase buffer stock purchases in 2018.

Recent macroeconomic data has added to the buoyant mood in commodity markets. US employment growth for November came in above expectations, highlighting yet again solid labor market conditions leading into 2018. In the Eurozone, November’s manufacturing PMI reading moved up 1.5 points, to 60.0, with Germany hitting 62.5, the highest level since 2011. In Japan, the second reading third-quarter GDP showed 0.6% growth, a doubling from the prior period, driven by stronger private nonresidential investment. Despite these positive demand-side drivers, we expect the New Year to bring slower growth in China, a tightening in financial markets, and slightly lower oil prices, a combination that will cap commodity prices and stem the buildup of pressure in supply chains.

IHS Markit Materials Price Index

Industrial Materials: Prices

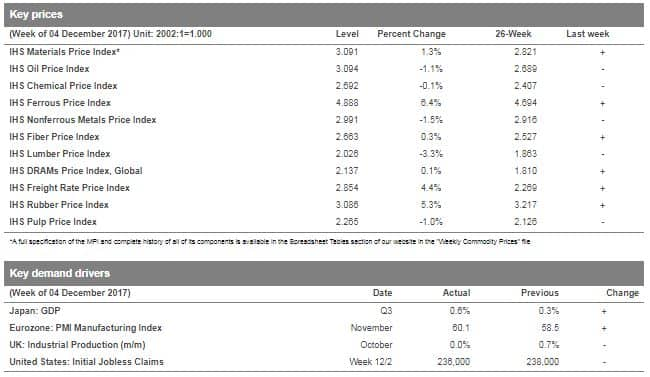

Key Prices & Demand Drivers