August 20, 2015 - Weekly Pricing Pulse

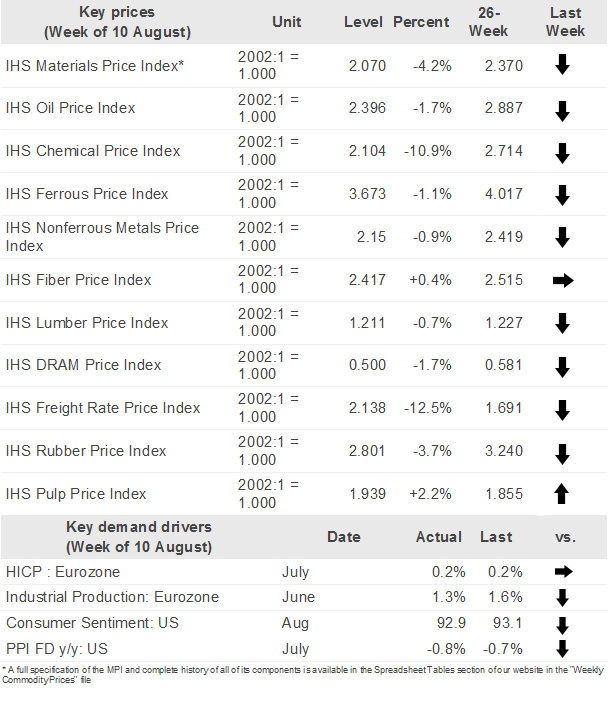

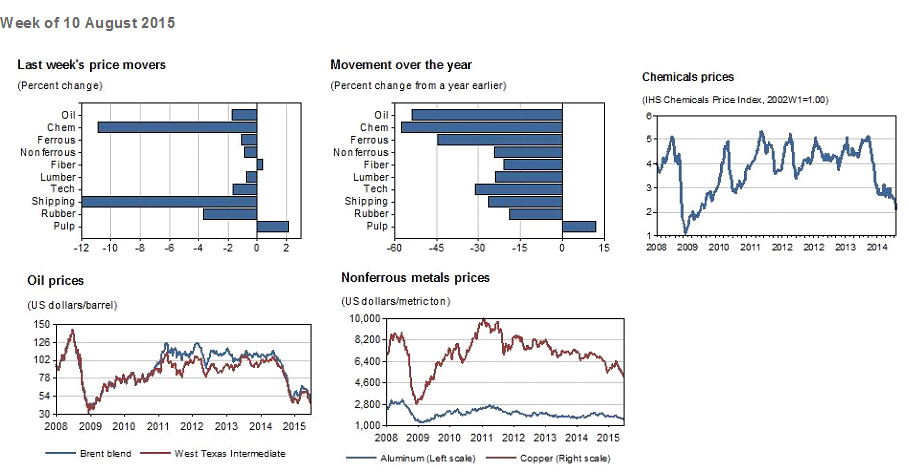

After dropping 3.5% during the first week in August, the IHS Material Price Index (MPI) was hit by another large 4.2% decline last week. While we were anticipating a decline, China's depreciation of the renminbi took markets by surprise and helped push commodity prices down much more strongly than the 1.6% decrease we were expecting. In terms of individual components, chemicals provided a major drag, dropping nearly 11%. Ocean going freight rates also experienced a sharp downward jolt, falling 12.5%. Other sizable decreases also came from rubber (down 3.7%), oil (down 1.7%), and DRAMS (down 1.7%).

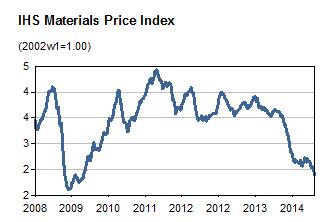

What is worrisome is that commodity prices, after showing some stability in the second quarter, are now falling at an accelerating rate once again—more than a year after the current correction began back in July 2014. Absent their complete collapse during the height of the Great Recession in 2008, prices are back to levels last seen in 2005.

Looking ahead, we expect the MPI to decline another 2.3% this week, with a downward trend indicated for the rest of the summer. The recent explosion in Tianjin could lead to temporary supply chain bottlenecks, however, providing some support to prices, especially chemicals.

Industrial Materials: Prices - Week of 20 August 2015

Key Prices & Demand Drivers