September 22, 2017 - Weekly Pricing Pulse

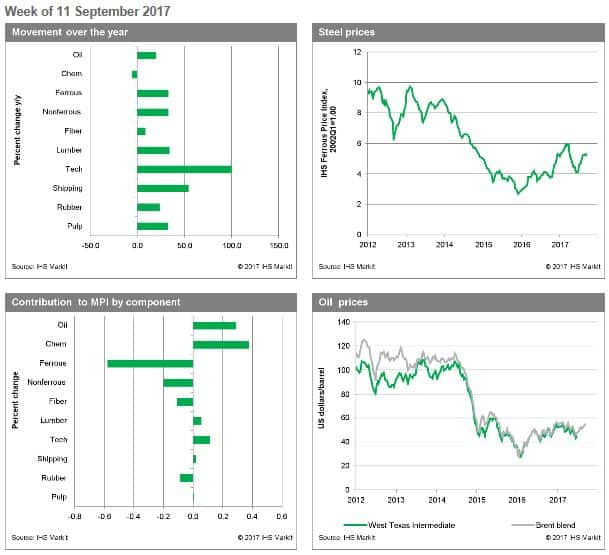

Metals markets have been on a strong upward curve over the summer months, but this now appears to be in reverse as Chinese buying fails to support prices at such elevated levels.

The Materials Price Index (MPI) slipped 0.1% last week, the first decline in four weeks, as metal markets finally began to slide. The strength of the last few weeks has been largely down to a surge in metal prices and the aftermath of Hurricane Harvey and its impact on chemicals and energy markets. Indeed, the latter two are still seeing price growth as the longer-run impacts of the hurricane continue to oscillate around markets.

For metals markets, a decline in interest from China has soured the mood, pushing down prices after many weeks of price growth. Ferrous markets have enjoyed strong gains in recent weeks, with iron ore prices nearly reaching $80/dry metric ton unit (dmtu) and copper prices pushing through $6,900/metric ton over the same period. For both these metals it appears the mood has changed, with prices slipping over the last week as Chinese financial interest wanes and physical buyers wait on the sidelines for more favorable pricing.

Last week there were some downbeat macroeconomic announcements, with Chinese industrial production reportedly growing 6% in August (annual basis), down 0.4 percentage point on July. In the United States, the Bloomberg consumer comfort index eased from 52.6 to 51.9 last week, following the turmoil from Hurricane Harvey. Furthermore, in the Eurozone, industrial production was up just 0.1% month on month (m/m) in July, a tepid rebound following the 0.6% m/m drop in June. It seems that some of the exuberance that has built over the last few months has begun to slip, although a decline over one week does not mean a trend reversal. Therefore, the next few weeks are key to ascertain if the current slip in metals pricing is indicative of a broader drop or this remains a false dawn.

IHS Materials Price Index

Industrial Materials: Prices

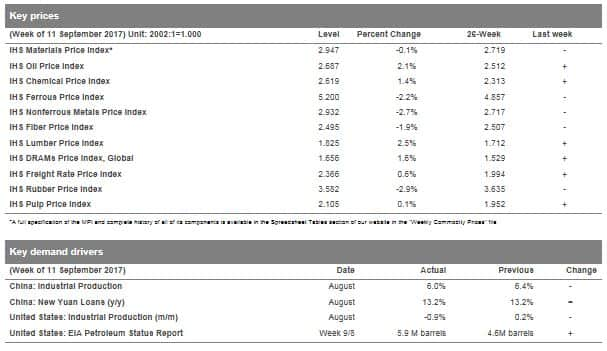

Key Prices & Demand Drivers