August 13, 2015 - Weekly Pricing Pulse

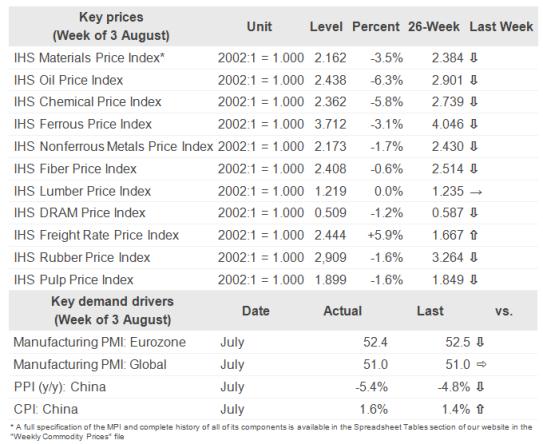

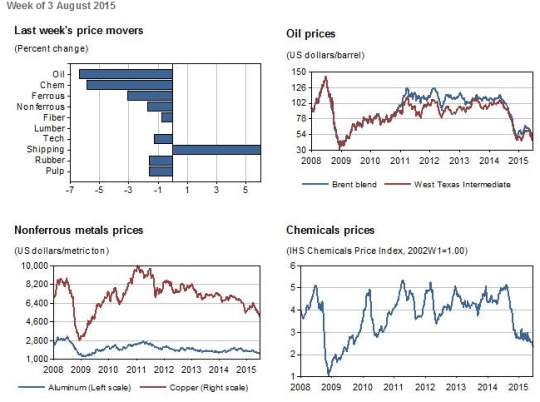

Oil market pressures drove the MPI down 3.5% last week to yet another post-2009 low. Oil itself was down by a hefty 6.3%, with chemicals also decreasing 5.8%. Other declines included a 3.1% drop in steel-making materials and a 1.7% drop in nonferrous metals.

Despite the very strong downward trend seen this summer, we are still some 30% off the financial crisis low hit in December 2008. The key test going forward, though, is whether downward momentum continues after September's anticipated US interest rate hike.

This week's commodity headlines will be dominated by China's unexpected devaluation of the renminbi, which was lowered by 1.9%. While a step towards economic easing is not a surprise, the specific instrument choice was. The initial reaction seems to be driving the dollar up, which will end up putting more pressure on commodity prices--we expect another 1.6% decline in the MPI this week. However, the positive export impact of a weaker renminbi could also spur increased industrial commodity demand, although this effect may take some time to materialize.

Global Pricing Summary - Week of 13 August 2015

Key Prices & Demand Drivers