Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Sep 21, 2022

Toward a reliable low-carbon power system: Navigating the evolving flexibility policy landscape

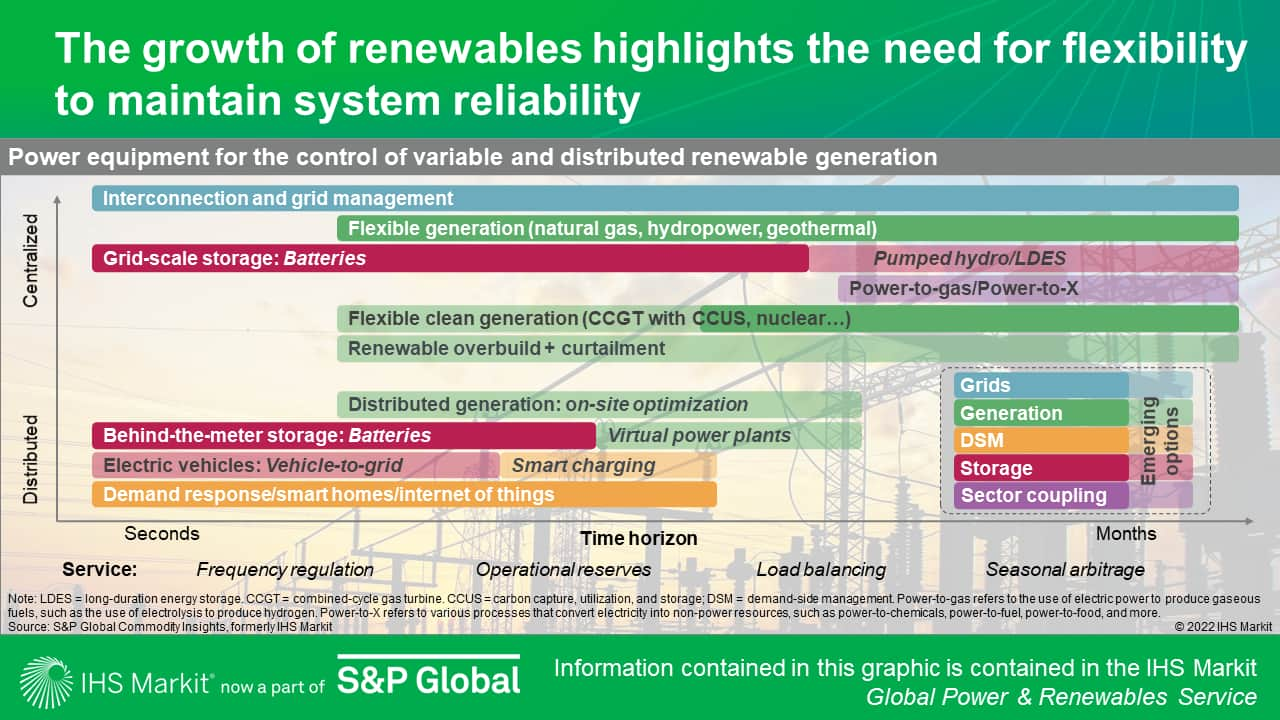

As wind and solar generation becomes increasingly widespread in power markets globally, the associated variability and impact on system reliability are catching the attention of system operators and policymakers. In particular, the role of flexible resources—such as gas turbines, energy storage, reservoir hydro, or demand-side management (DSM)—is becoming more important as they help meet the grid's frequency regulation, operational reserves, and load balancing requirements.

S&P Global recently published a report examining how policymakers worldwide are putting in place mechanisms to incent and reward flexibility, creating commercial opportunities for market participants.

Policies addressing flexibility vary substantially across markets, depending on renewable penetration rates, the level of market liberalization, demand growth rates, and more

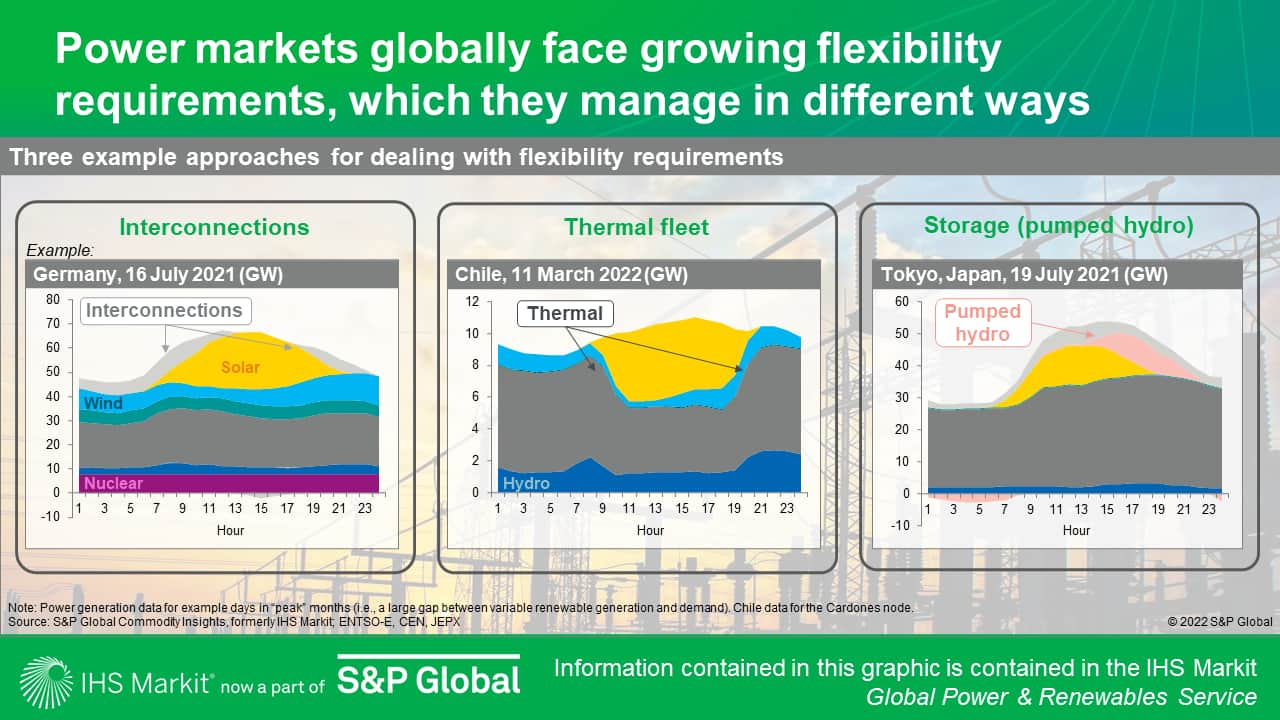

Today, in different markets and during different times of the year, different resources are fulfilling flexibility requirements (Figure 1).

In Europe for example, where demand growth is minimal and accelerating the renewable build-out is imperative to wean off Russian gas, the REPowerEU policy is leading to a rethink of energy storage. In contrast, in Asia, lower renewables penetration, rapid demand growth, and a priority for cheap electricity make the Chinese and Indian governments call upon conventional coal for flexibility; and Vietnam will rely on thermal peaking units. In Brazil, where climate change hampers the vast hydro fleet's ability to supply power effectively, the government is discussing comprehensive power reforms.

In broad terms, these types of policies can be categorized based on the key aspects they rely on, among which are:

- Market-based mechanisms versus government mandates. In liberalized markets, governments try to elicit flexibility investments from market participants by adjusting their remuneration. This can be through creating ancillary services markets, offering specific remuneration for DSM, or opening energy or capacity markets to storage like in California. In contrast, governments can also prescriptively mandate additions of flexible capacity, like in China's latest Five-Year Plan for the energy sector.

- Emerging technologies versus conventional fleets. Steep decarbonization requirements and hedging opportunities in real-time markets can lead liberalized markets to espouse battery solutions. In contrast, other markets may rely more heavily on traditional pumped or reservoir hydro, or look to thermal options, like mentioned previously for China and India. The role of flexible gas and coal as these countries decarbonize, however, is left largely unclear.

- Generation versus transmission versus demand-side solutions. All the markets studied rely on generation technologies for flexibility, but some look beyond too. As one example, Europe's extensive transmission grid offers flexibility that contrasts with the many local or isolated power markets that exist globally, including in the United States. Collaborative approaches are often cheaper than individually investing in flexible resources.

As countries strive to decarbonize, flexibility will increasingly need to come from zero-carbon supply or demand-side resources

Variable renewable technologies will dominate the newbuild mix for decades to come: S&P Global's reference outlook has wind and solar representing 66% of gross capacity additions worldwide over 2022-50. As a result, power market designs and the power system's technology mix will need to evolve with the energy transition (Figure 2).

For example, high gas prices and increased volatility in wholesale power prices can lead to greater calls for batteries. On the other hand, electricity retail tariffs are often regulated or subsidized, which reduces the incentives for energy efficiency and DSM—the surge in global energy prices has exacerbated this situation, especially in Europe. Policies may emerge that encourage hydrogen electrolyzers to operate flexibly, although it is early to gauge their merits. What is more certain is that power markets, which are by nature local, will likely continue to see an assortment of flexibility policies that are suitable to local market structures and regulatory environments.

This evolving landscape of policies promoting flexibility presents market participants with emerging risks and fresh opportunities to monetize flexibility resources.

Learn more about our global power and renewables research.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fesg%2fs1%2fresearch-analysis%2ftoward-a-reliable-low-carbon-power-system-navigating.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fesg%2fs1%2fresearch-analysis%2ftoward-a-reliable-low-carbon-power-system-navigating.html&text=Toward+a+reliable+low-carbon+power+system%3a+Navigating+the+evolving+flexibility+policy+landscape+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fesg%2fs1%2fresearch-analysis%2ftoward-a-reliable-low-carbon-power-system-navigating.html","enabled":true},{"name":"email","url":"?subject=Toward a reliable low-carbon power system: Navigating the evolving flexibility policy landscape | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fesg%2fs1%2fresearch-analysis%2ftoward-a-reliable-low-carbon-power-system-navigating.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Toward+a+reliable+low-carbon+power+system%3a+Navigating+the+evolving+flexibility+policy+landscape+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fesg%2fs1%2fresearch-analysis%2ftoward-a-reliable-low-carbon-power-system-navigating.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}