Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Mar 25, 2021

IMF’s upcoming Debt Sustainability Analysis likely to accelerate Ethiopia’s economic reform momentum

- Debt treatment under the G20 Common Framework will depend on the outcome of the International Monetary Fund (IMF)'s upcoming Debt Sustainability Analysis (DSA) for Ethiopia.

- Ethiopia is likely to strengthened commitment to adhering to the IMF Extended Credit Facility (ECF) program requirements.

- A short-term devaluation of the birr has so far faced strong political opposition. However, we see that in the interest of obtaining a supportive DSA and thus adhering to IMF requirements, policy revisions could now be speeded up.

- The Ethiopian government has already shown gradual steps in addressing foreign-exchange regulations since the IMF expects foreign exchange regulations to lay the groundwork for achieving single-digit and sustainable inflation.

The Ethiopian finance ministry stated on 1 February that the inclusion of private creditors in any debt restructuring deal was "very unlikely" and that any potential adjustment would be "minor". Nevertheless, IHS Markit believes that the extent of debt treatment will be based on the outcome of the IMF's upcoming DSA for Ethiopia. A supportive IMF DSA would be imperative for Ethiopia to preserve long-term access to international financial markets and limit private creditor inclusion in debt restructuring. Therefore, liability management exercises to preserve market access remain crucial as an outcome of Ethiopia's engagement with the G20 Common Framework. Furthermore, for the IMF DSA to be favorable, IHS Markit believes Ethiopia must provide a strengthened commitment to adhering to the IMF ECF program requirements, such as adopting a more-flexible exchange rate regime.

On 23 February, the IMF reached a staff-level agreement on policy measures for the completion of the first and second reviews under the ECF-Extended Fund Facility (EFF) arrangements. At that time, the IMF highlighted that it welcomed Ethiopia's plan to tap into the G20 Common Framework to rework its debt situation, as it would strengthen the country's debt sustainability, such as through the restructuring of debt service obligations, thus potentially lowering debt distress. Ethiopia's call to participate in the G20 Common Framework comes as no surprise. IHS Markit reported on 26 March 2020 that the Office of the Prime Minister of Ethiopia, Abiy Ahmed, released on 24 March 2020 an official appeal in which Ahmed highlighted the urgent need for a debt resolution and restructuring package. The proposal was that all interest payments on government loans should be written off under such a package. Additionally, low-income countries' part of the debt was to be written off, with the remaining debt to be converted into long-term low-interest loans with a 10-year grace period. Thereby, debt repayments would be limited to 10% of the value of exports.

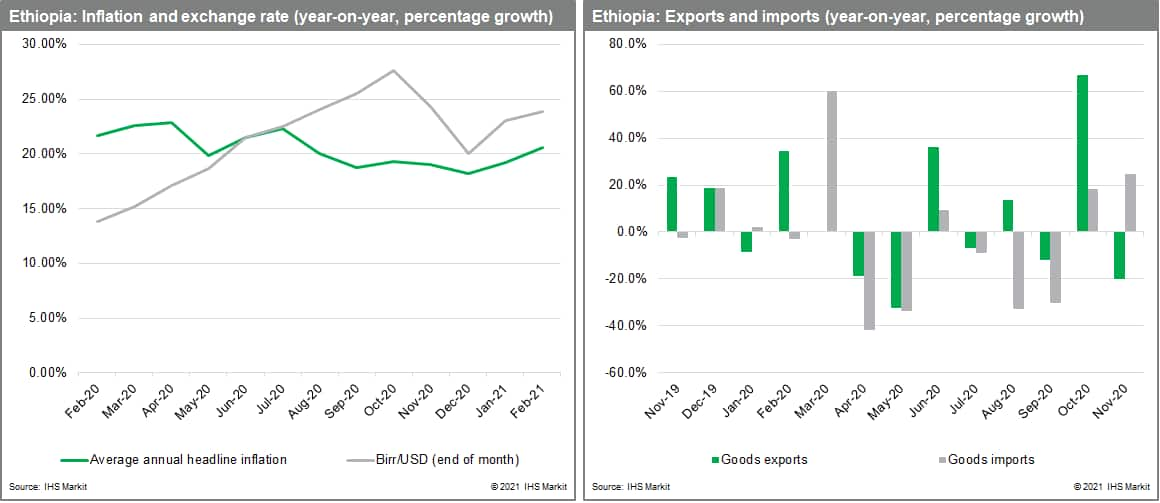

Ethiopia's economy was hit hard by various factors in 2020, starting with the severe locust infestation outbreak early in the year affecting the agriculture's sector growth performance. The coronavirus disease 2019 (COVID-19)-pandemic-induced weak global demand drove down investment and exports growth overall. While Ethiopia's real GDP is expected to recover this year, downside risks are on the upscale with no signs of tourism picking up swiftly amid the global pandemic and conflict in the northern region of Tigray. Reaching government revenue targets will remain very challenging for Ethiopia without further debt accumulation and support from the global community. To adhere fully to IMF program, Ethiopia needs to move, in the long run, towards a market-clearing exchange rate. However, such a move, including a short-term devaluation of the birr, has so far faced strong political opposition to the resulting inflationary pressures, among other challenges. While such a policy change remains less likely to be considered before the summer legislative elections, we see that in the interest of obtaining a supportive DSA and thus adhering to IMF requirements, policy revisions could now be speeded up.

Additionally, we expect to see alignment by the government with the IMF to show greater prudence in borrowing by state-owned enterprises (SOEs), combined with reforms to improve governance and oversight of SOEs that will provide better transparency on SOE debt to support the sustainability of public finances. Besides reforming its monetary policy framework, the Ethiopian government has already shown gradual steps in addressing foreign-exchange regulations since the IMF expects foreign exchange regulations to lay the groundwork for achieving single-digit and sustainable inflation. On 9 March, the National Bank of Ethiopia announced its revision of directive FXD/70/2021 for the retention and utilization of export earnings and inward remittances, which includes a greater percentage of foreign-exchange holdings to be retrained ultimately, boding well for exporters.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fesg%2fs1%2fresearch-analysis%2fimf-debt-sustainability-analysis-ethiopia-reform.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fesg%2fs1%2fresearch-analysis%2fimf-debt-sustainability-analysis-ethiopia-reform.html&text=IMF%e2%80%99s+upcoming+Debt+Sustainability+Analysis+likely+to+accelerate+Ethiopia%e2%80%99s+economic+reform+momentum+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fesg%2fs1%2fresearch-analysis%2fimf-debt-sustainability-analysis-ethiopia-reform.html","enabled":true},{"name":"email","url":"?subject=IMF’s upcoming Debt Sustainability Analysis likely to accelerate Ethiopia’s economic reform momentum | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fesg%2fs1%2fresearch-analysis%2fimf-debt-sustainability-analysis-ethiopia-reform.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=IMF%e2%80%99s+upcoming+Debt+Sustainability+Analysis+likely+to+accelerate+Ethiopia%e2%80%99s+economic+reform+momentum+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fesg%2fs1%2fresearch-analysis%2fimf-debt-sustainability-analysis-ethiopia-reform.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}