Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jul 13, 2021

Climate change and power market fundamentals: The value of modelling scenarios

Climate change affects both the demand and supply side of electricity markets, thus potentially altering seasonal wholesale power price profiles, system planning, and carbon dioxide (CO2) emission reduction strategies. Recent drought and heat waves across the Western U.S. highlight the urgency of incorporating climate change analysis into power system modelling. Researchers at IHS Markit conducted an analysis of the California Independent System Operator (CAISO) power market under various future climate change scenarios. For simplicity, we did not simulate supply side responses. In essence, we evaluated "what if" various climate change scenarios occurred overnight before system planners could respond.

Climate change can alter hydropower production and electricity demand

Hydroelectric generation in CAISO is affected by the amount and type of precipitation that falls in California and the greater western United States, and when precipitation falls.

Climate change projections show a decrease in summer hydropower availability and an increase in winter and spring availability, largely coinciding with the "wet season"—October-May, although lagged. The shift in hydropower timing results from a greater proportion of winter precipitation falling as rain, which cannot be stored in the mountains as snow, and earlier snowmelt, which accelerates runoff relative to historical patterns.

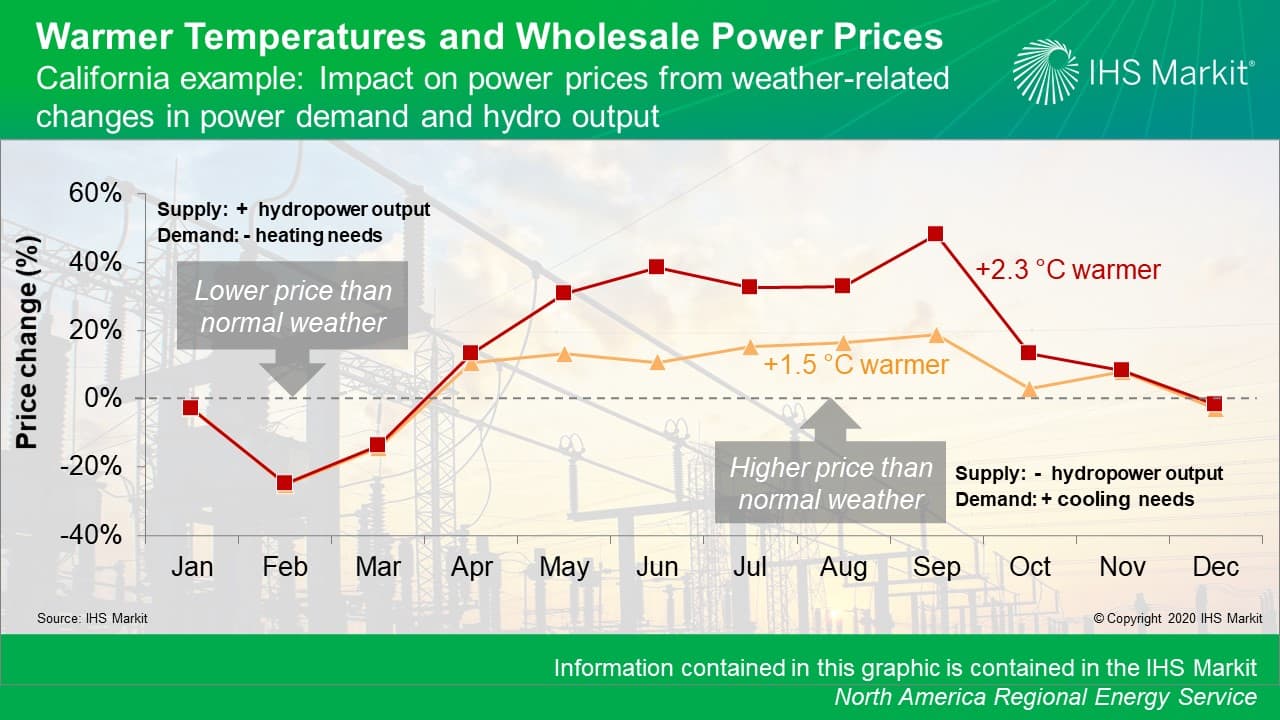

The relationship between electricity demand and warming temperatures is more straightforward. Warmer year-round temperatures mean heating demand during the winter and spring is lower and cooling demand during the summer is greater.

Combining two climate change channels—electricity demand and hydroelectric generation patterns

The interactions between hydropower and electricity demand amplify the effect on wholesale power prices. For example, during September, lower hydropower availability overlaps with periods of elevated electricity demand, raising wholesale power prices. Absent any supply response, simulated prices increase by close to 50% under a 2.3 °C warmer case, a larger impact than the sum of the individual effects from hydropower and demand due to nonlinearities in the power system.

Needless to say, adjustments to supply resources, as well as a host of other fundamental market elements not reflected in the current system, would alter these simulated prices. For example, significantly more battery storage or pumped hydroelectric resources could temper simulated market prices.

The shifts in hydropower production and changes in demand are two of many factors that system planners and market participants are considering with respect to climate change. These two factors can combine to produce impacts that are larger than their independent effects. Similar amplifying impacts may also exist if more climate-affected variables are considered.

Participants in the CAISO market and policymakers would be wise to be mindful of the compounding effects of climate change that could result in more extreme outcomes than the sum of the individual, independent effects indicates when managing wholesale power price risk, planning the power system, assessing reliability criteria, and designing policies to reduce power sector CO2 emissions.

Learn more about our research on the North American power markets.

Access the full report and 250+ other deliverables on the Climate and Sustainability Hub. Sign up for your access today.

Barclay Gibbs, Executive Director Climate & Sustainability, leads North American power analytics for IHS Markit

Wade Shafer is Director for the Climate and Sustainability, North America Power and Renewables practice at IHS Markit.

Yufei Su is a Consulting Principal for the Climate & Sustainability Group practice at IHS Markit.

Posted on 13 July 2021

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fesg%2fs1%2fresearch-analysis%2fclimate-change-and-power-market-fundamentals-the-value-of-mode.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fesg%2fs1%2fresearch-analysis%2fclimate-change-and-power-market-fundamentals-the-value-of-mode.html&text=Climate+change+and+power+market+fundamentals%3a+The+value+of+modelling+scenarios+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fesg%2fs1%2fresearch-analysis%2fclimate-change-and-power-market-fundamentals-the-value-of-mode.html","enabled":true},{"name":"email","url":"?subject=Climate change and power market fundamentals: The value of modelling scenarios | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fesg%2fs1%2fresearch-analysis%2fclimate-change-and-power-market-fundamentals-the-value-of-mode.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Climate+change+and+power+market+fundamentals%3a+The+value+of+modelling+scenarios+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fesg%2fs1%2fresearch-analysis%2fclimate-change-and-power-market-fundamentals-the-value-of-mode.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}