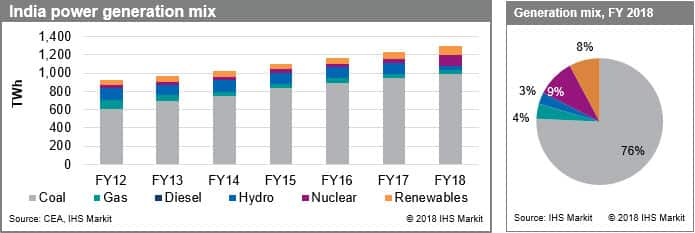

India's energy demand will most likely grow the fastest of all global economies by 2040.

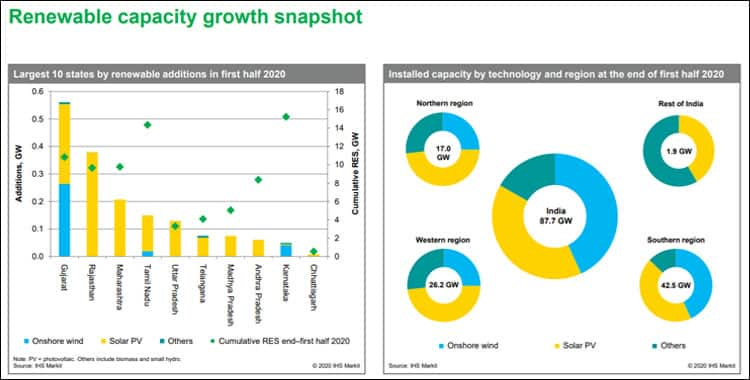

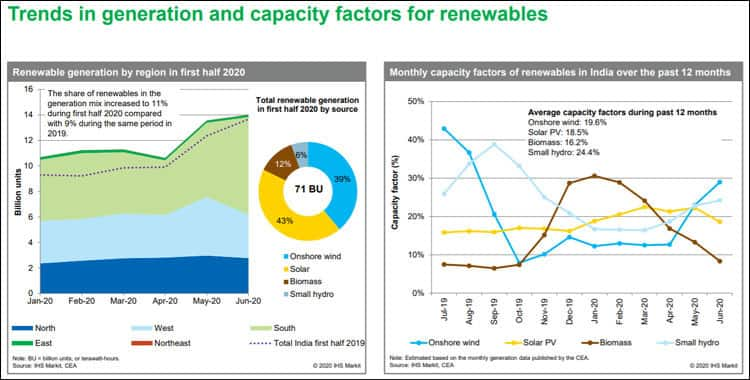

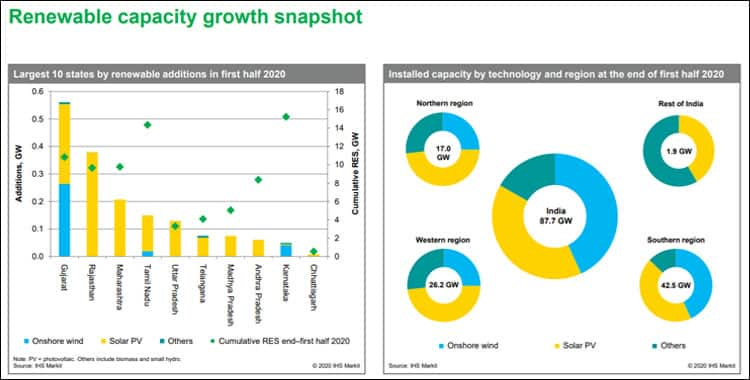

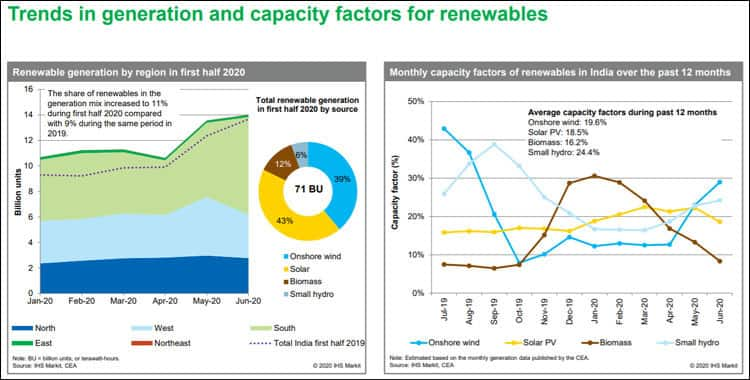

However, in the first half 2020, India’s renewable installed capacity reached 87.7 GW, with only 1.8 GW of new additions. The additions were down by 70% compared with the same period in 2019, as the COVID-19–induced lockdown severely impacted supply chains, construction schedule, and labor availability. The disruption continued in 2020 and delayed more than 14 GW of pipeline.

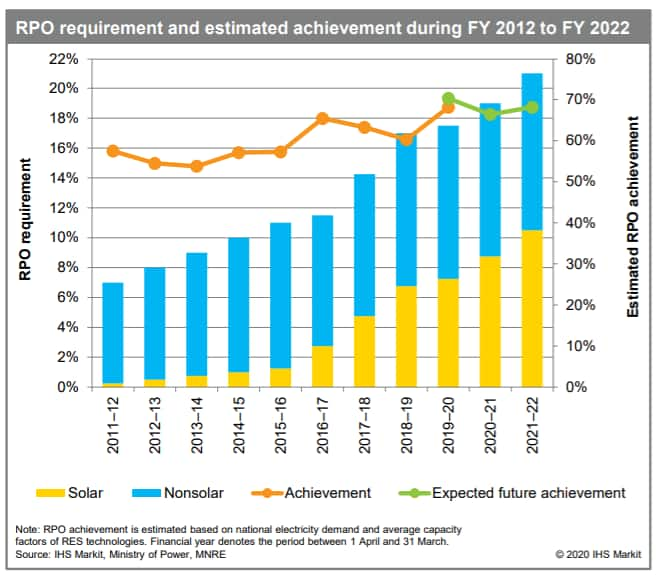

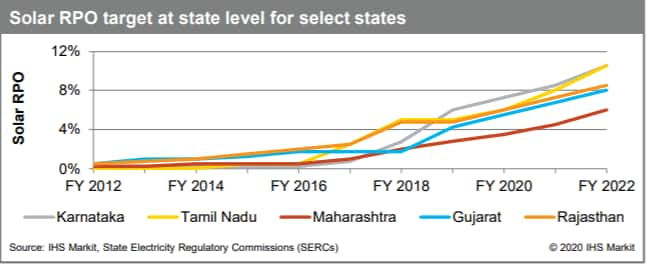

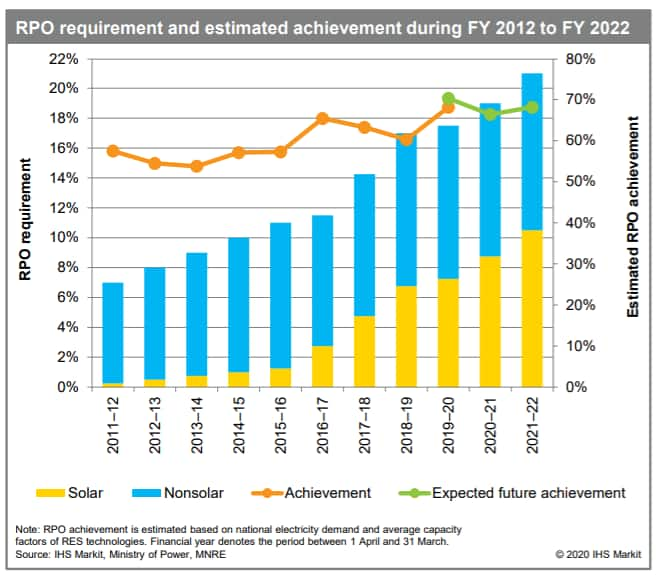

The RPO requirement increased to 19% of the total electricity consumption in the ongoing financial year (FY) 2020–21. Average compliance is expected to be 65% only. Due to the lack of any penalties, obligated organisations, mostly distribution companies and captive industrial customers, have purchased lower-than-required renewables.

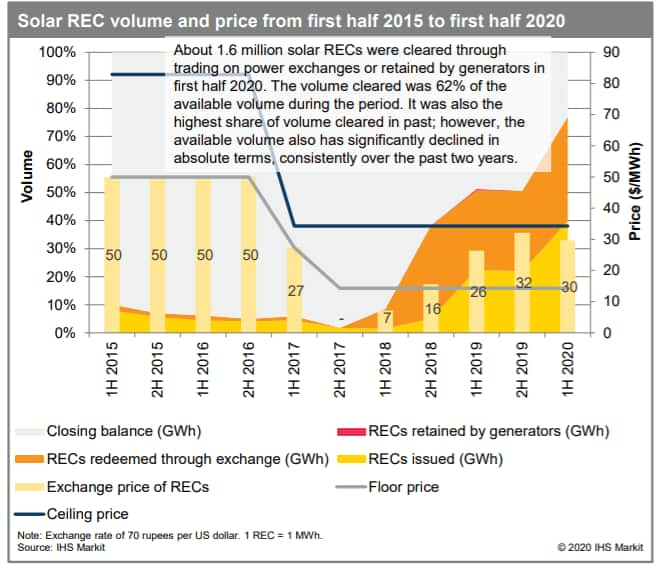

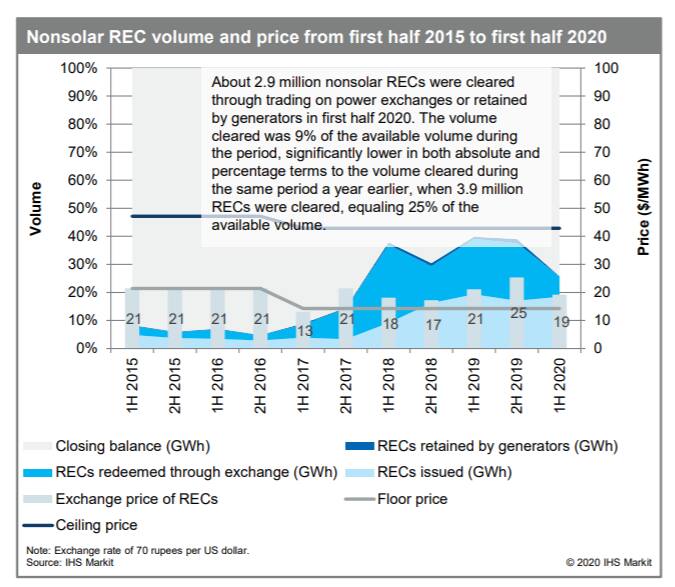

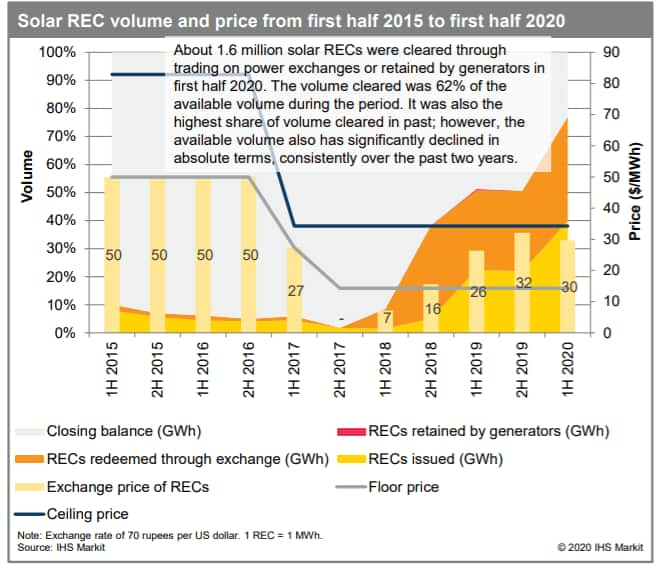

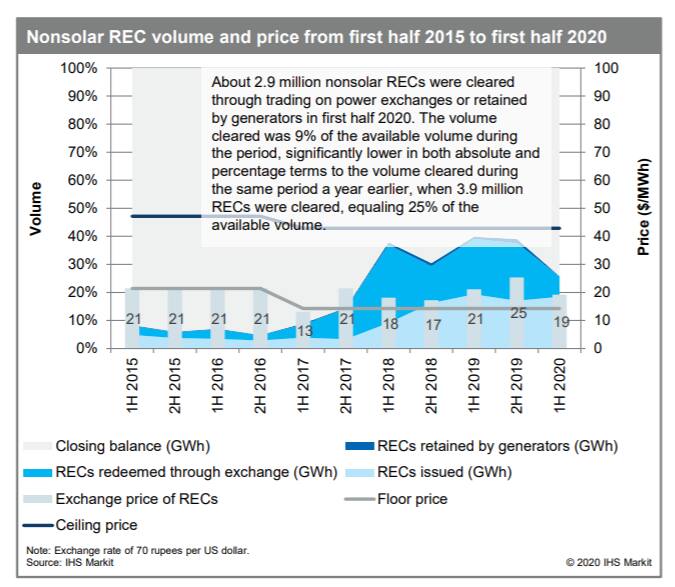

In the first half of 2020, approximately 9 million RECs were issued, compared to 4.7 million in the same timeframe of 2019, although cleared volume decreased from 5.2 million in the first half of 2019 to 4.5 million in the first half of 2020. REC prices dropped as supply grew, but they still traded 108 percent above the floor price for solar RECs and 34 percent above the floor price for non-solar RECs.

Renewable energy source (RES) grid integration needs forecasting and scheduling control. Six major states, which account for more than 60% of India's installed wind and solar power, have enacted a penalty mechanism. Due to delays in establishing the required online infrastructure, Maharashtra, Tamil Nadu, and Punjab have postponed the implementation of penalties.

Since construction activity has slowed due to COVID-19, only one Green Energy Corridor (GEC) project came online in the first half of 2020. A total of 19 GW of GEC projects are currently under construction, with another 74 GW projected to be completed by 2021. The dynamic programme is likely to be delayed, which would affect timelines of generation projects as well.

During the first half of 2020, India awarded 1.6 GW of renewables with storage capacity with a levelized tariff of about US$53. During that time, 2.2 GW of collocated renewable plus thermal tenders and 5 GW of round-the-clock (RTC) renewable plus thermal tenders were announced, with results expected by 2021. In most of these tenders, the storage portion is technology agnostic.

COVID-19 has had an impact on new tender announcements and the pace of ongoing tenders; however, during the first half of 2020, the impact on awarded capability was minimal as implementing agencies closed late-stage tenders. Around 38 GW of tenders are in various stages of the bidding process, with 19 GW of new tenders declared in the first half of 2020.

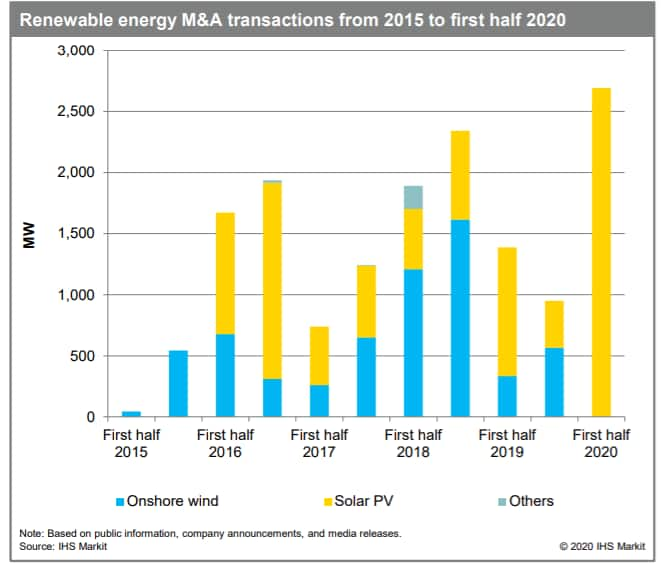

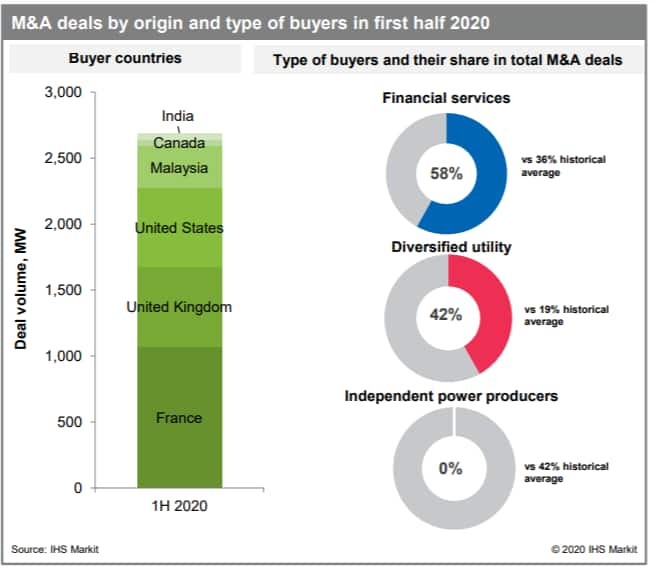

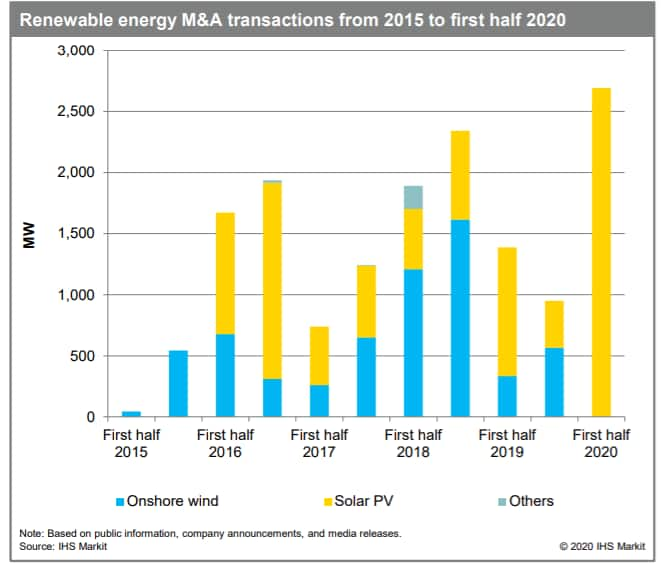

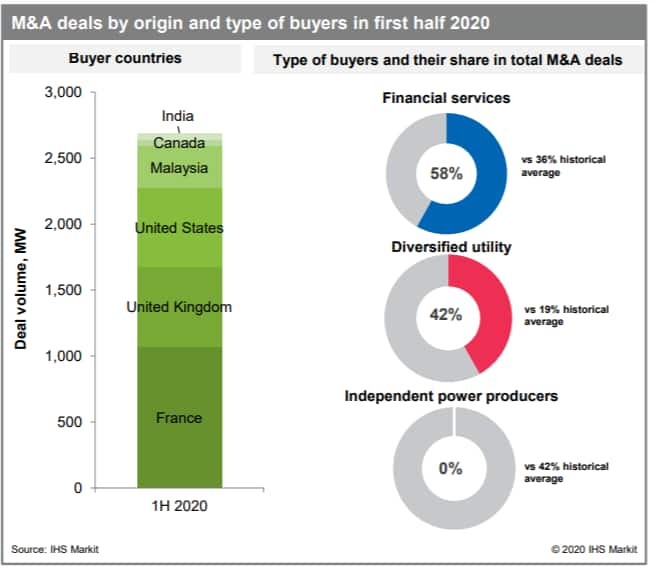

In the first half of 2020, 2.7 GW of renewable M&A transactions were recorded, up by 94% from the same time in 2019. Acquisitions are driven by large portfolio owners mainly in the financial services sector, while IPPs sell off assets to raise funds to develop pipeline projects. As developers seek to reduce portfolio and policy risk, further deals are planned.

Historical and target renewable capacity

Historical renewable installed capacity and targets by technology and key policy drivers

Accelerated depreciation (AD) of 80%, an RPO goal of 15% by 2022, and feed-in tariffs with long-term contracts are among the first policies and support mechanisms implemented.

The Solar Mission launched in 2010, with a target of 22 GW by 2022. As additions slowed, mixed policy signals emerged from the implementation of the REC mechanism and the suspension of AD benefits, which was later reinstated.

Another wave of policy impetus with an RE target of 175 GW was announced in 2015, with 100 GW of solar and 60 GW of wind set for 2022. An additional 50 GW target was announced to include floating solar, hybrid renewables, and storage projects

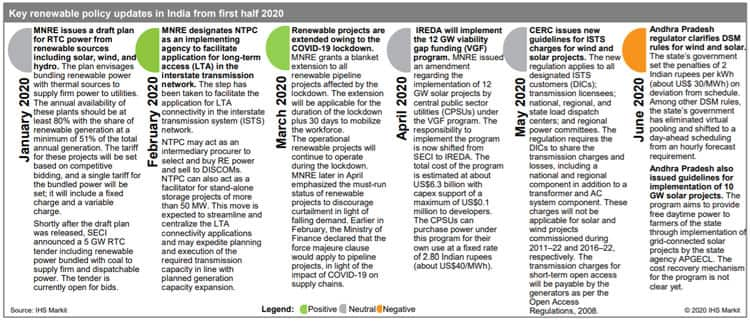

In 2019, the corporate tax rate on generation companies was halved to 15%. COVID-19 influenced project execution in the first half of 2020, with blanket timeline extensions being provided to pipeline renewable projects.

The Central Electricity Authority (CEA) in its optimal generation capacity mix for 2029‒30 envisages more than 450 GW of RE installed capacity including 280 GW of solar PV and 140 GW of wind (both onshore and offshore).

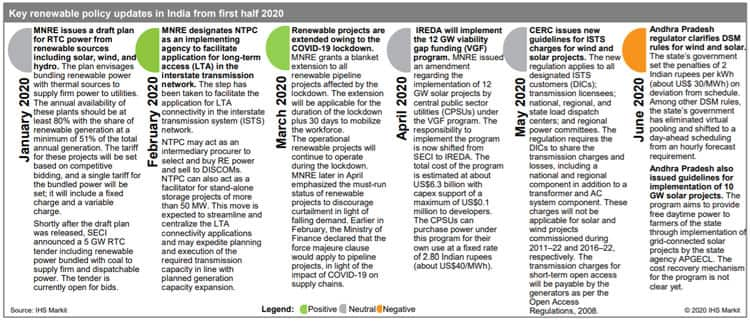

Policy and market updates

Key renewable policy announcements

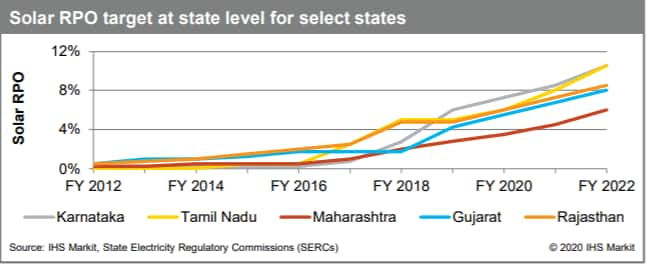

National RPO targets are more ambitious and remain underachieved, while state regulators have set lower RPO targets

Effective from July 2020, CERC has declared the removal of the floor price for both solar and nonsolar RECs, pushing the ceiling tariff down to US$14/MWh to reflect falling renewable costs.

Only one GEC project came online in first half 2020 as construction activity has stalled owing to COVID-19. About 4 GW of under-construction projects are delayed beyond their scheduled commissioning dates.

Record M&A transactions of 2.7 GW were conducted in first half 2020, up by 94% from the same period in 2019. Acquisitions were driven by large portfolio owners mainly in the financial services sector, while IPPs sell off assets to raise funds to develop pipeline projects.

Learn more about renewable energy in A new visualization of power market evolution: Examining the impact of renewables and battery penetration on North American power markets with data-driven analytics (APAC) webinar.

https://ihsmarkit.com/events/A-new-visualization-of-power-market-evolution/overview.html