Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer LoginsFrom Zhou Xizhou, S&P Global on Global Power and Renewables.

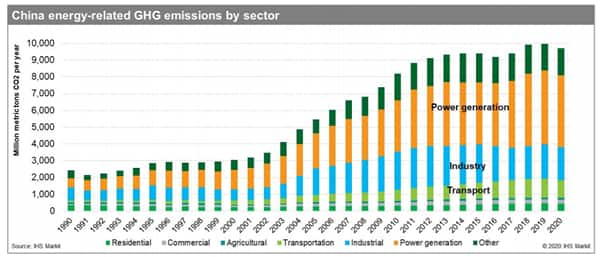

China became the world’s largest Greenhouse Gas (GHG) emitter in 2005 and by 2019, it was producing more than twice as much CO2 equivalent as the US (2nd largest). President Xi Jinping's historic statement in September that China will achieve carbon-neutral future by 2060 with global implications for climate change and energy markets.

China sets the stage for four decades of transformation

On 22 September 2020, in a speech at the General Debate of the 75th session of the UN General Assembly, Chinese President Xi Jinping announced that China will strive to achieve net carbon neutrality by 2060. In the same speech, President Xi also confirmed the goal for China to achieve peaking carbon emissions by 2030, as previously included in the Paris Agreement.

This marks the first time that China has pledged a carbon emissions target in absolute (as opposed to intensity) terms. The announcement is historic given that China is the largest carbon emitter globally with an estimated 10.0 billion metric tons of carbon emissions in 2019, twice as much as the second-largest emitter, the United States. The pledge relates to net, as opposed to gross, emissions. This means that the national energy-related and non-energy carbon emissions are expected to decline to very low levels but will not be eliminated completely.

A net carbon emissions position can rely on a variety of measures to bring China’s national carbon emissions into balance before 2060. Those measures include

The announcement only sets a high level and non-binding target but will undoubtedly bring enormous changes to China’s energy sector. Despite the long-term nature of the target, we expect key ministries, companies, and local governments to make carbon neutrality a key element of their plans and strategies, especially at a time when discussions are ongoing for the upcoming 14th Five-Year Plan [FYP] (2021–25).

For further information on how China’s carbon pledge sets up new paradigm for environment, economy, & energy, listen to Experts Xizhou Zhou, S&P Global Vice President of Power and Renewables.

Do you have questions on the power and renewables outlook? Ask Xizhou Zhou a question or get on-demand consultation services.

Sample questions:

To accelerate the delivery of alternative data to financial markets and help firms gain a competitive advantage, we provide an end-to-end alternative data value chain which includes a vast array of datasets, the tools and techniques for analyzing alternative data and access to experts to explain the data’s contents.

Interested in finding out about real life applications of alternative data?