Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

INDICES COMMENTARY

Dec 16, 2021

iTraxx MSCI ESG Screened Europe Index - One year on

ESG initiatives have established themselves as one of the fastest growing areas in the investment industry today. Globally, ESG assets have exceeded $35 trillion, with over half of it focused on Europe. While the lion's share of these ESG assets is focused on equity products, fixed income products account for about $3 trillion of them. To supplement this fast-growing market, the iTraxx MSCI ESG Screened Europe index was launched in 2020 to offer market participants the ability to gain exposure to, or hedge, broad European ESG Corporate credit risk.

The iTraxx MSCI ESG Screened Europe index mitigates ESG risks by screening out names from the highly liquid iTraxx Europe index that are involved in adult entertainment, alcohol, gambling, weapons, firearms, tobacco, nuclear power, genetic engineering, and thermal coal. Firms with significant controversies related to their social and environmental impact are also excluded, as are firms with an MSCI ESG Rating of BBB or below. The names that are violators of the UN Global Compact are not explicitly excluded through a UNGC-based criterion, however, the current ESG screening criteria indirectly results in these names also being excluded.

So far, the iTraxx MSCI ESG Screened Europe index has five market markers actively quoting the index and providing liquidity. The interest in the index from global banks to provide liquidity within months of its launch has been a promising start for the product. Further, there have also been recent issuances of exchange traded and non-exchange traded structured products such as credit-linked notes on the back of this index. These products allow investors to gain physical exposure to European ESG corporate credit risk. Finally, there is ease of access for the iTraxx MSCI ESG Screened Europe index as market participants can trade the index via established Multilateral Trading Facilities (MTFs). The index is also clearable, making the market for this index more efficient by enabling market participants to trade it without counterparty risk.

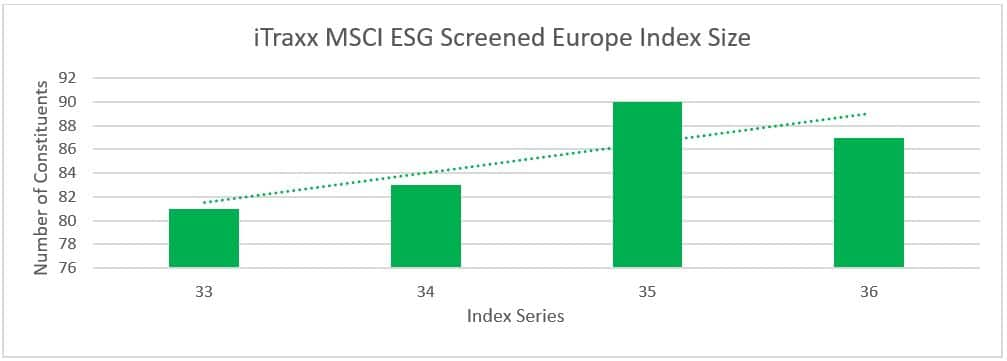

Index Size trend

Since the iTraxx MSCI ESG Screened Europe index was launched in June 2020, the general trend of the index size has been upward. This is due to the increasing number of iTraxx Europe constituents becoming eligible for the ESG-screened version. While some of these changes are driven by changes in the composition of the overall iTraxx Europe index, majority of the changes are due to improvements in the MSCI ESG ratings of the iTraxx Europe constituents. The trend is consistent with the increase in the number of issuers in iBoxx MSCI ESG bond indices as well.

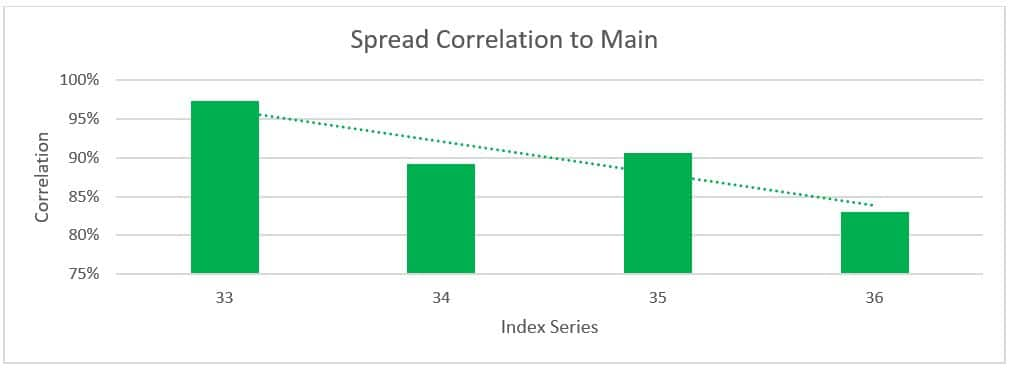

Spread correlation to Main

Despite the increase in index size of the iTraxx MSCI ESG Screened Europe index from Series 33 to Series 36 as shown in the previous chart, it is interesting to note that the correlation of the spreads of the index with those of the overall iTraxx Europe index has actually decreased. This shows that while the iTraxx MSCI ESG Screened Europe index may be similar to iTraxx Europe in terms of index composition, it is still a unique product that provides distinct diversified credit exposure.

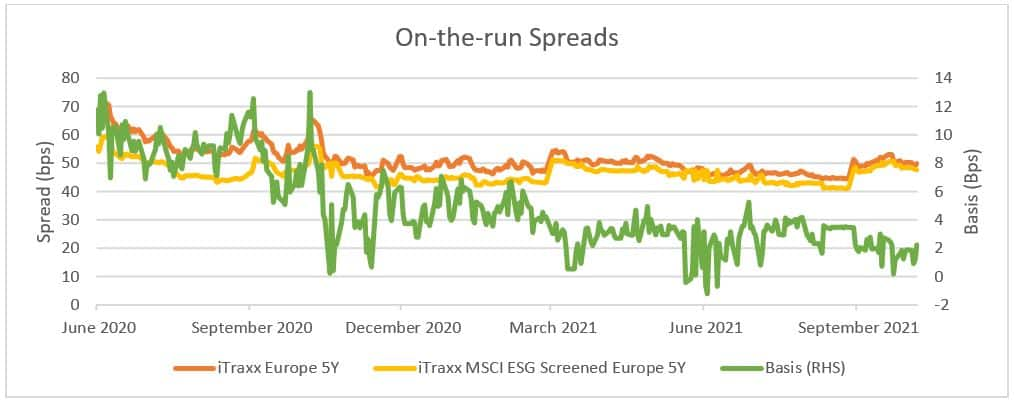

Basis to Main

Relative value trading is a key aspect of the iTraxx MSCI ESG Screened Europe index. Being an ESG-screened version of the iTraxx Europe index, trading two indices in tandem with each other presents a number of arbitrage opportunities. An interesting observation is that at the time of its launch, the iTraxx MSCI ESG Screened Europe index was being quoted at about 10 to 12 basis points tighter than the overall iTraxx Europe index. This basis to the Main has consistently reduced to about 2 basis points in November 2021. This decrease in the basis between the two indices can be partly attributed to the increase in the number of constituents in the ESG-screened version, causing the index to trade at similar levels as the overall iTraxx Europe index.

Returns

One of the use cases of the iTraxx MSCI ESG Screened Europe index that has seen some traction in recent months is the issuance of ESG credit-linked notes. The index can be used to create structured products that offer "ESG yields" to investors. While the returns of the iTraxx MSCI ESG Screened Europe index are lower relative to that of the iTraxx Europe index, it is interesting to note that in periods of market downturn, the ESG-screened version has outperformed the overall iTraxx Europe index. This was observed during the volatile period last year from September to December 2020 arising from the Brexit negotiations and vaccine developments. Prior to the index starting trading in June 2020, on a theoretical basis, the iTraxx MSCI ESG Screened Europe index also outperformed the overall iTraxx Europe index during the market downturn in March 2020 induced by the Covid-19 pandemic.

Volumes

Despite the regular quoting activity and global market makers providing liquidity, actual traded volumes of the index have been modest relative to those of iTraxx Europe. However, the index is still in its nascent stage and we believe volumes will pick up over time. The index is still the only standardized credit derivative that can be used to provide exposure to (or hedge) European ESG corporate credit risk. Building liquidity in CDS indices is often a dilemma of causality - new market participants want to see strong liquidity in the index before they want to begin trading, which only develops when new market participants start trading the index.

That being said, the index is a structurally sound product consisting of liquid index constituents and benefits from standardized trading conventions and infrastructure. Though growing at a fast pace, the ESG assets in fixed income are still in their early stages. As the market matures in the coming years, we believe the iTraxx MSCI ESG Screened Europe index will be key instrument that supports this market.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fesg%2fs1%2fresearch-analysis%2fitraxx-msci-esg-screened-europe-index-one-year-on.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fesg%2fs1%2fresearch-analysis%2fitraxx-msci-esg-screened-europe-index-one-year-on.html&text=iTraxx+MSCI+ESG+Screened+Europe+Index+-+One+year+on+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fesg%2fs1%2fresearch-analysis%2fitraxx-msci-esg-screened-europe-index-one-year-on.html","enabled":true},{"name":"email","url":"?subject=iTraxx MSCI ESG Screened Europe Index - One year on | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fesg%2fs1%2fresearch-analysis%2fitraxx-msci-esg-screened-europe-index-one-year-on.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=iTraxx+MSCI+ESG+Screened+Europe+Index+-+One+year+on+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fesg%2fs1%2fresearch-analysis%2fitraxx-msci-esg-screened-europe-index-one-year-on.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}