Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer LoginsAutomotive Insights – Canadian EV Information and Analysis Q3 2022

Highlights

- In Canada, trends in zero-emission vehicles (ZEV = BEV and PHEV) picked up dramatically for all light vehicle registrations as of quarter 3 2022.

- ZEVs account for one out of every 12 new vehicles registered in Canada. ZEVs market share increased to 8.4% for 2022, up from 5.3% in the previous period.

- The market share of battery electric vehicles (BEV) increased to 6.5%, with volume increasing by 56.0% year over year. Year over year, total ZEV volume increased by 38.8%.

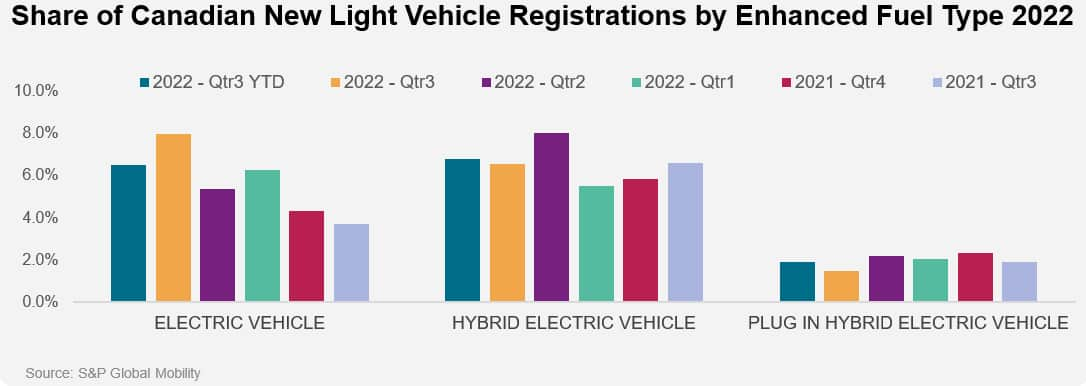

National Enhanced Fuel Type Trend

When compared to Q3 2021 year to date, new vehicle registrations have fallen by 12.5% overall and the combined volume of xEV light vehicles (EV/PHEV/HEV/ FCEV) increased by 14.7% as of Q3 2022. xEVs now account for 15.2% of all new registrations; while traditional ICE vehicles account for 84.8%.

Further comparisons of Q3 2022 against the previous year show BEVs and PHEVs saw volume gains (25,368 and 287), while HEV and FCEV each saw volume declines.

Inventory constraints continue to play a role on new vehicle registrations. Despite the constraints, BEV adoption rates continue to increase and have doubled from Q3 2021 (3.7%).

Download the full Canadian EV Insights report and sign up to receive future installments

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.