Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

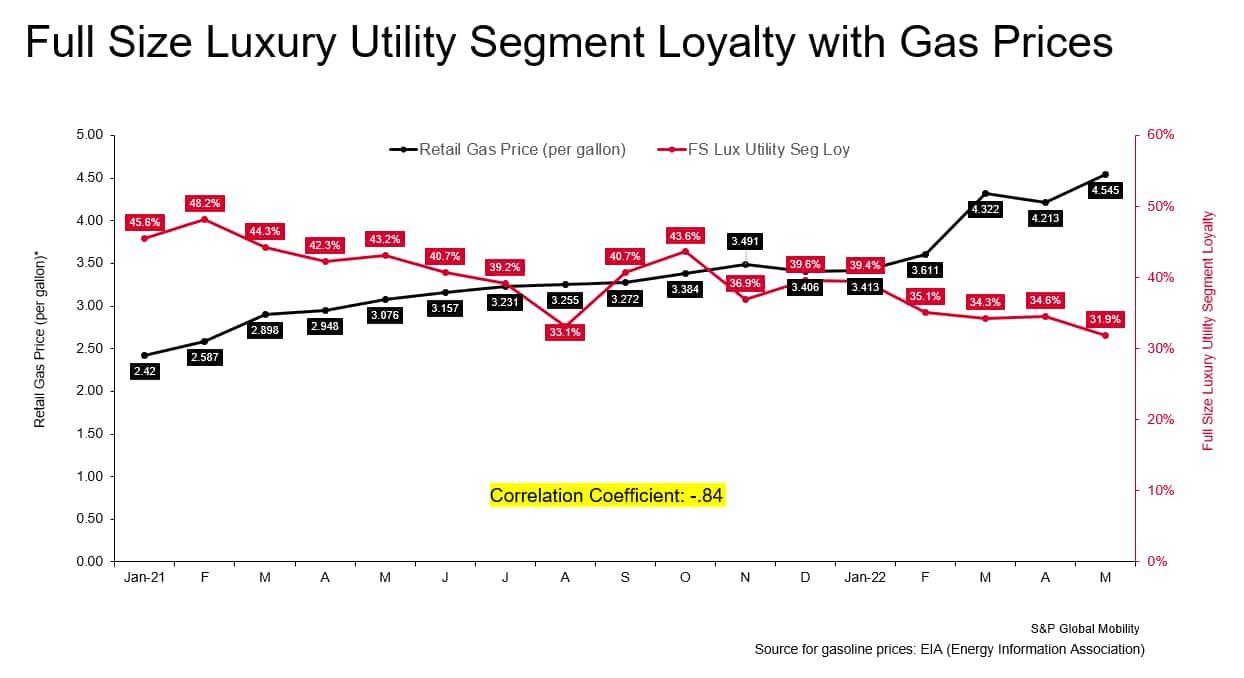

Customer LoginsFull size luxury utility segment loyalty plummets to 10-year low as gas prices spike

The national average for a gallon of regular unleaded gasoline jumped 88% from January 2021 to May 2022 ($2.42 - $4.55), driving a shift in consumer new vehicle purchasing patterns. Specifically, the propensity of return-to-market households with a full size luxury utility in the garage to acquire a similar vehicle dropped from 46% in January 2021 to 32% this past May. This inverse relationship between retail gas prices and loyalty to full size luxury utilities is most pronounced for the Range Rover, Range Rover Sport, Cadillac Escalade, Cadillac Escalade ESV and Mercedes-Benz G-Glass.

Surprisingly, the relationship between gas prices and the BMW X7 is actually a positive one, implying that over the past seventeen months, as gas prices have climbed, BMW X7 owners' loyalty to the segment rose modestly. Other BMW-related marketing actions may be influencing these findings.

Additional segments suffering a decline in loyalty concurrent with gas price increases include the midsize van and half ton pickup categories. The latter is particularly significant given that the domestic manufacturers' share of this segment was 92% during the relevant time period, based on total new light vehicle registrations, and it is commonly accepted that the domestic manufacturers derive an outsize portion of their bottom-line profits from this category. Household purchase and migration patterns in this segment are also noteworthy because this category accounted for 9.4% of all new light vehicle registrations in the January 2021 - May 2022 time period versus just 2% for midsize vans and 1% for full size luxury utilities.

Sources: S&P Global Mobility, EIA.gov (Energy Information Administration)

------------------------------------------

This automotive insight is part of our monthly Top 10 Trends Industry Report. The report findings are taken from new and used registration and loyalty data. To download the full report, please click below.

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.