Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer LoginsDecember auto sales wrap up year on a familiar note

Little movement in pace of sales sets stage for an uncertain 2024 landscape

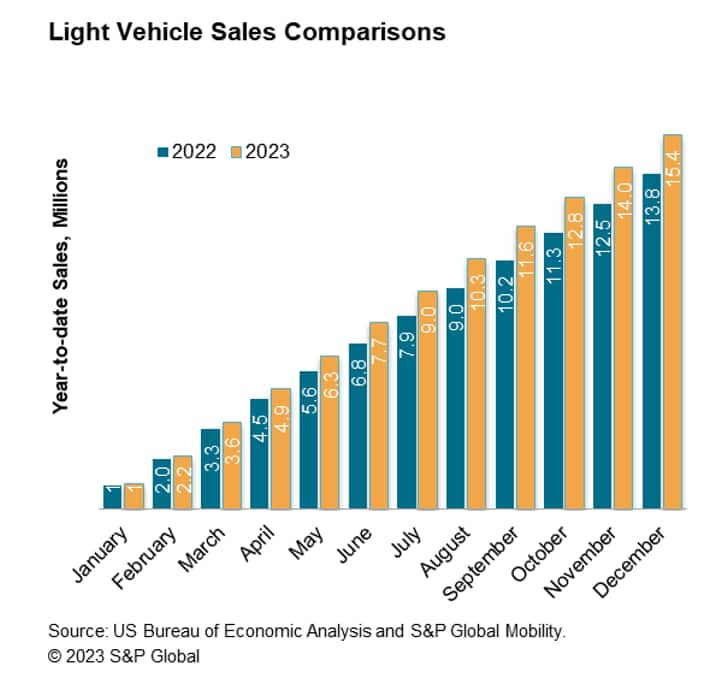

With volume for the month projected at 1.37 million units, December U.S. auto sales are estimated to translate to an estimated sales pace of 15.2 million units (seasonally adjusted annual rate: SAAR). This translates to a projected fourth quarter selling rate average of 15.3 million units, a level that continues to decelerate from the average pace of sales realized in the second quarter (15.8 million units), setting the stage for an unsettled auto demand outlook moving into 2024.

S&P Global Mobility projects US sales volumes are expected to reach 15.9 million units in 2024, an estimated increase of 2.0% from the projected 2023 level of over 15.4 million units. This aligns with S&P Global Mobility's global 2024 forecast of 88.3 million sales.

"The end of 2023 brings the industry a glimpse into what could be yet another uncertain environment for US auto sales levels in 2024," said Chris Hopson, manager of North American light vehicle sales forecasting for S&P Global Mobility.

"The good news is that incentives and inventory levels are progressing in the right direction. The not-so-good news is that this has not yet translated to momentum for sales levels," Hopson said. "This could be a stouter signal that US consumers are tapped out, which would be a heightened risk for auto demand as new vehicle consumers continue to face affordability issues by way of high interest rates, tight credit conditions and slow-to-recede vehicle prices."

"An uneasy consumer translates to an expectation of a mildly progressing auto sales environment next year," Hopson added." Stronger advances in new vehicle inventory could potentially result in increased incentives and dealmaking to help mitigate consumer headwinds."

Dealer advertised vehicle inventories continue to climb. Advertised new vehicle dealer inventory listings for the US market have increased to about 2.3 million units as of early December, said Matt Trommer, associate director of Market Reporting at S&P Global Mobility. This represents an increase of 4% from the end of October and a 60% year-over-year increase from 1.4 million units.

"The November surge was mostly driven by the Compact SUV segment, with the Toyota RAV4, Chevrolet Equinox, Mazda CX-5, and Nissan Rogue having shown large increases in inventory every month since August," Trommer said.

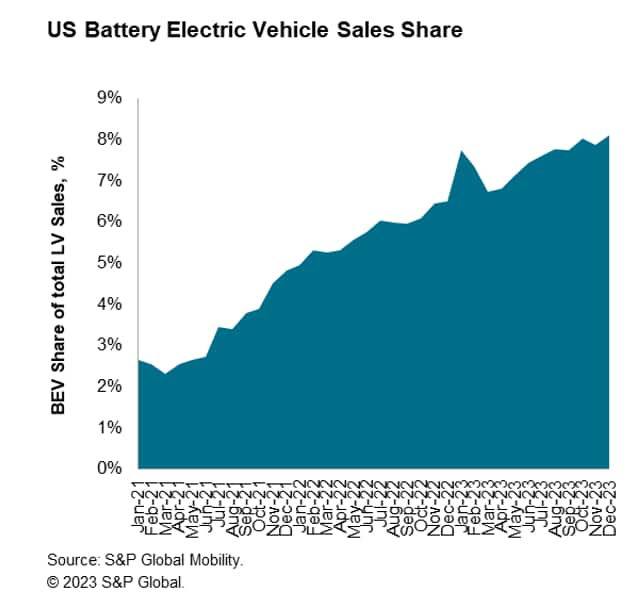

Continued development of battery-electric vehicle (BEV) sales remains an assumption in the longer term S&P Global Mobility light vehicle sales forecast. In the immediate term, some month-to-month volatility is anticipated. December 2023 BEV share is expected to reach 8.1%, similar to the month prior reading, and potentially elevated as availability of Federal tax credit levels becomes less certain starting in January 2024. BEV programs previously expected for stronger launches in Q4 2023 have been delayed to 2024, creating opportunity for BEV share advances beginning early next year.

With the rollout of several highly anticipated models, US BEV sales will continue to develop in the new year. By the end of 2024, there will be nearly 100 BEV models available, double the number there were in 2022, covering several more segments and providing consumers interested in an electric vehicle even more choice. As for vehicles already on sale, advertised dealer inventories of most non-Tesla EVs have plateaued.

Our Mobility News and Assets Community page features the latest automotive insights, visit the page to learn more.

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.