Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer LoginsAutomotive Insights – Canadian EV Information and Analysis Q2 2022

Highlights

- Zero-emission vehicle (ZEV = BEV and PHEV) trends in Canada levelled off in the first half of 2022 after a strong first quarter.

- In Canada, one ZEV is registered for every twelve brand-new vehicles.

- Between 2021 H1 and 2022 H2, ZEV's market share climbed from 5.2% to 7.9%.

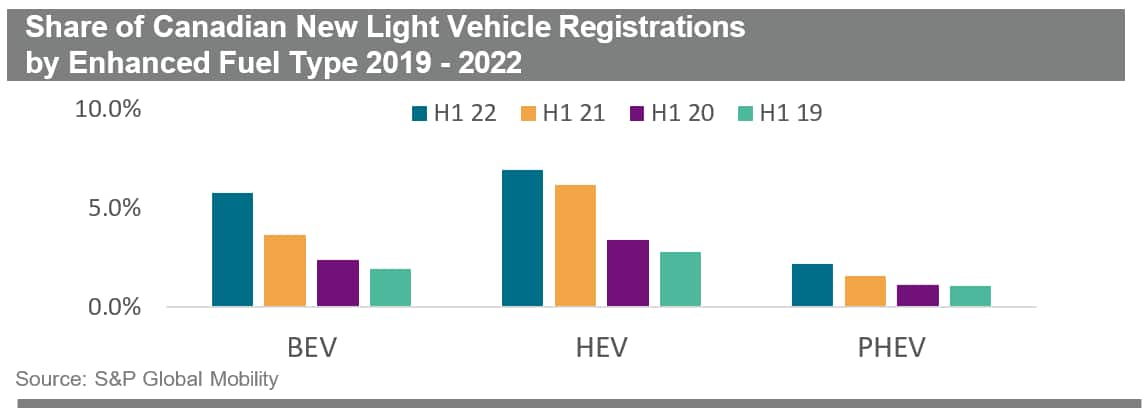

National Enhanced Fuel Type Trend

When compared to H1 2021, new vehicle registrations fell by 11.8% overall and the combined volume of xEV light vehicles (EV/PHEV/HEV/FCEV) did increase by 15.5% in H1 2022, xEVs now account for 14.8% of all new registrations, while traditional ICE vehicles account for 85.2%.

Further comparisons of H1 2022, BEVs and PHEVs saw volume gains (11,960 and 2,844), while HEV and FCEV each saw volume declines.

Continued inventory constraints, new BEV and PHEV entrants, and increased fuel prices have accelerated the uptake of BEV and PHEV vehicles in the Canadian market.

Download the full Canadian EV Insights report and sign up to receive future installments

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.