Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Sep 11, 2023

By Charles Ross and Evgeniya Maiburova

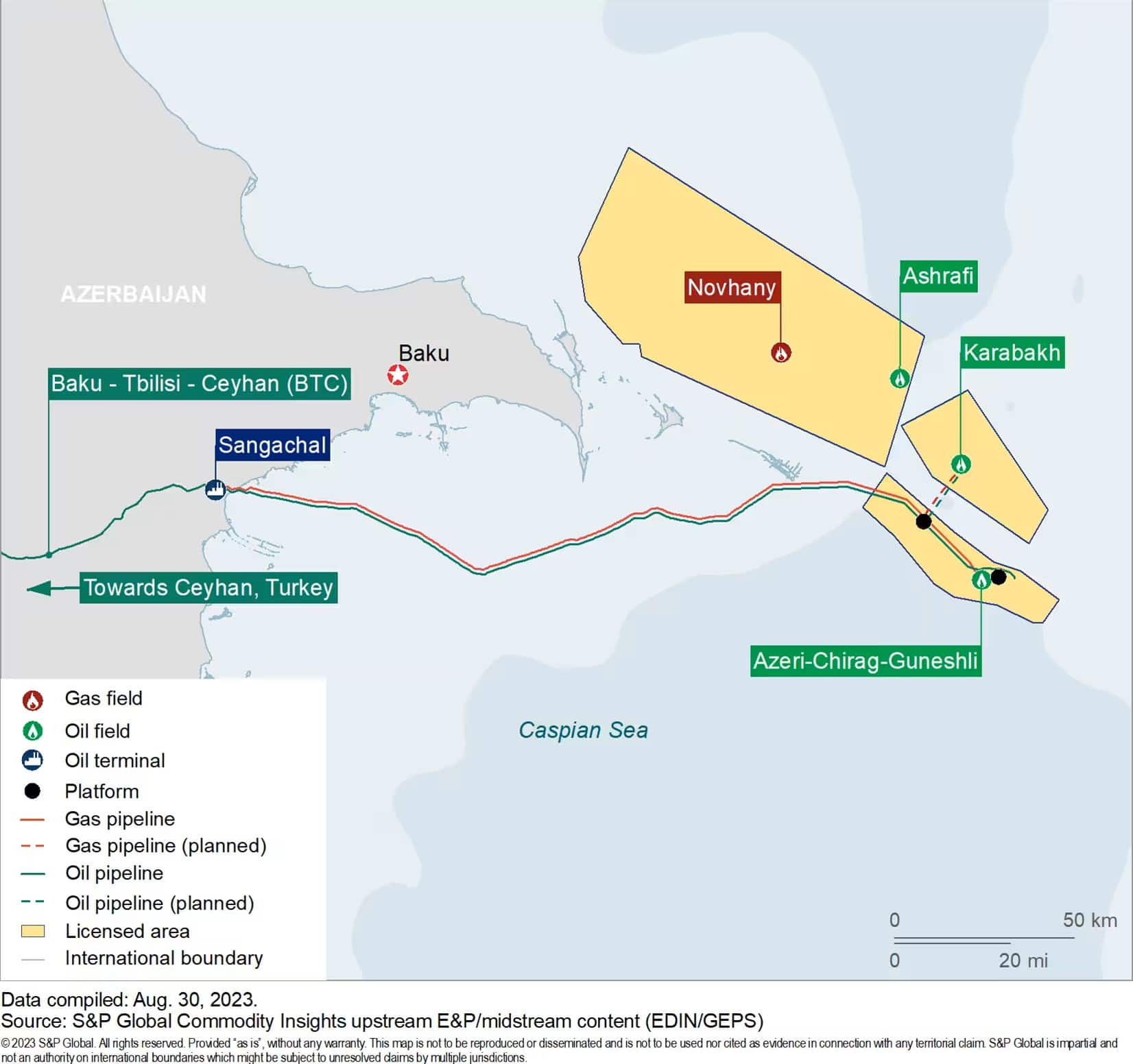

Sources state that Equinor is looking at a potential sale of its business in Azerbaijan which includes 7.27% working interest in the giant Azeri-Chirag-Guneshli (ACG) field, 50% in the Karabakh Operating Company which is looking to develop the offshore Karabakh oil and gas field, and 8.71% in the Baku-Tbilisi-Ceyhan (BTC) oil pipeline. It also includes 50% in the Ashrafi-Dan-Ulduzu-Aypara exploratory area which is under a production sharing agreement (PSA) with The State Oil Company of the Republic of Azerbaijan (SOCAR). It is unclear why Equinor is looking to divest in the region, but it's likely due to it not being part of its core focus areas. It is believed that the sale of the portfolio could fetch around $1 billion.

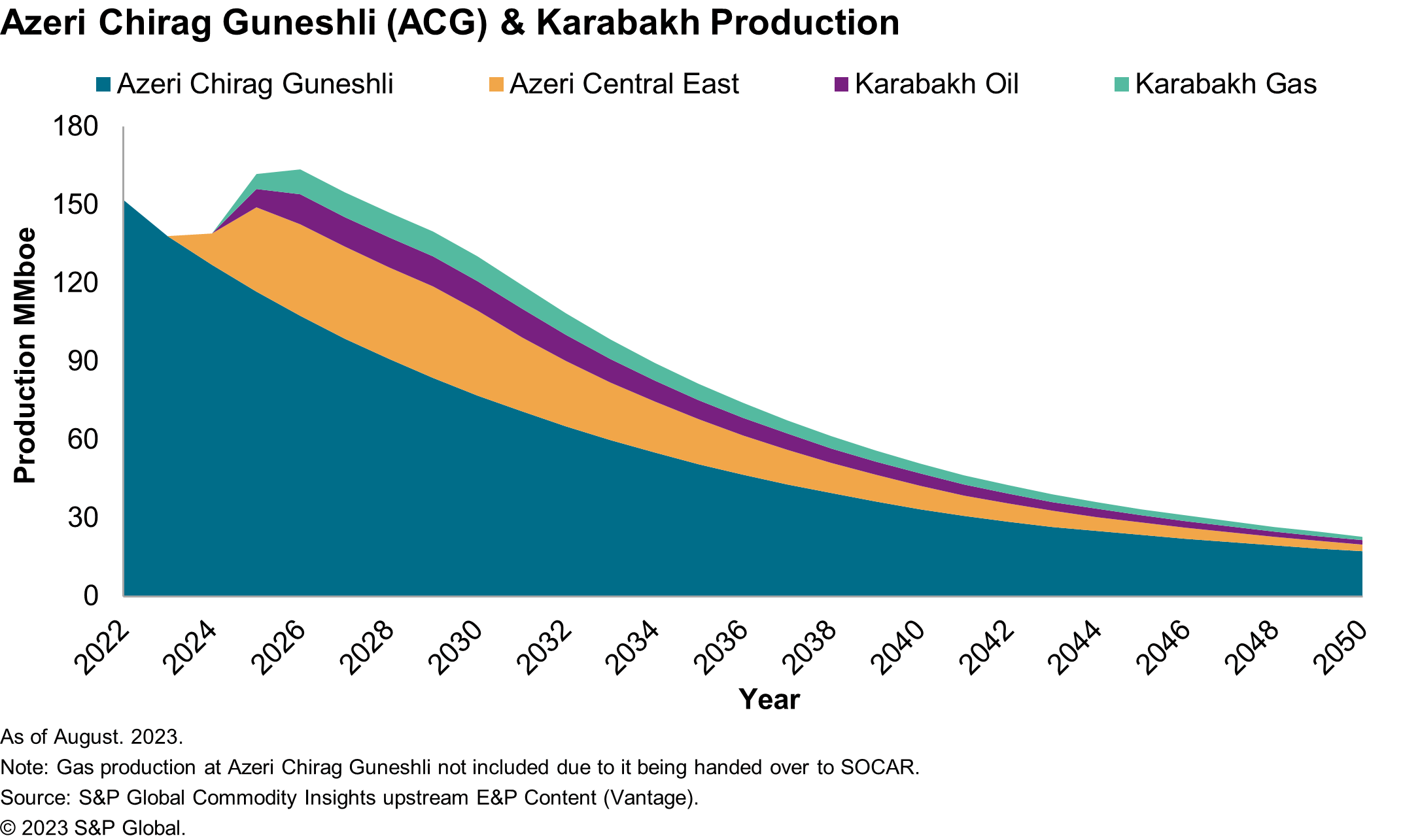

Production at ACG amounted to 375,000 bbl/d in the first half of 2023 (68 million barrels), with all produced gas either re-injected or handed to SOCAR for consumption within the domestic market. The new $6 billion Azeri Central East (ACE) project will look to increase the production from ACG by up to 100,000 barrels of oil a day and recover an additional 300 million barrels from ACG over its lifetime. The new remotely controlled platform was installed at the field at the beginning of August 2023 and is beginning its commissioning activities. Production at the project could span beyond 2050. In July 2023 BP announced it had drilled an exploratory well to a total depth of 4,500 m and made a gas discovery in reservoirs below the existing ACG oil field. The operator confirmed that the new gas discovered is not covered by the existing agreement currently in place for the ACG oil field, and new commercial agreements will be needed with Baku. This could help boost Azerbaijan's energy targets of doubling gas exports to Europe by 2027, an improbable but not impossible target for the country.

The Karabakh development includes the drilling of 12 wells from a platform facility, 6 oil producers, 3 gas and 3 water injectors. It will be connected to the West Chirag platform at ACG and transported to the Sangachal Terminal, both of which are part of the BP-operated ACG development scheme. Reserves at the field are estimated at around 300 million barrels but could grow through further appraisal and development. The initial development however will unlikely recover all the field reserves. The 16,000 ton platform jacket was constructed and installed at the field in 2020, however fabrication on the platform topsides is yet to begin.

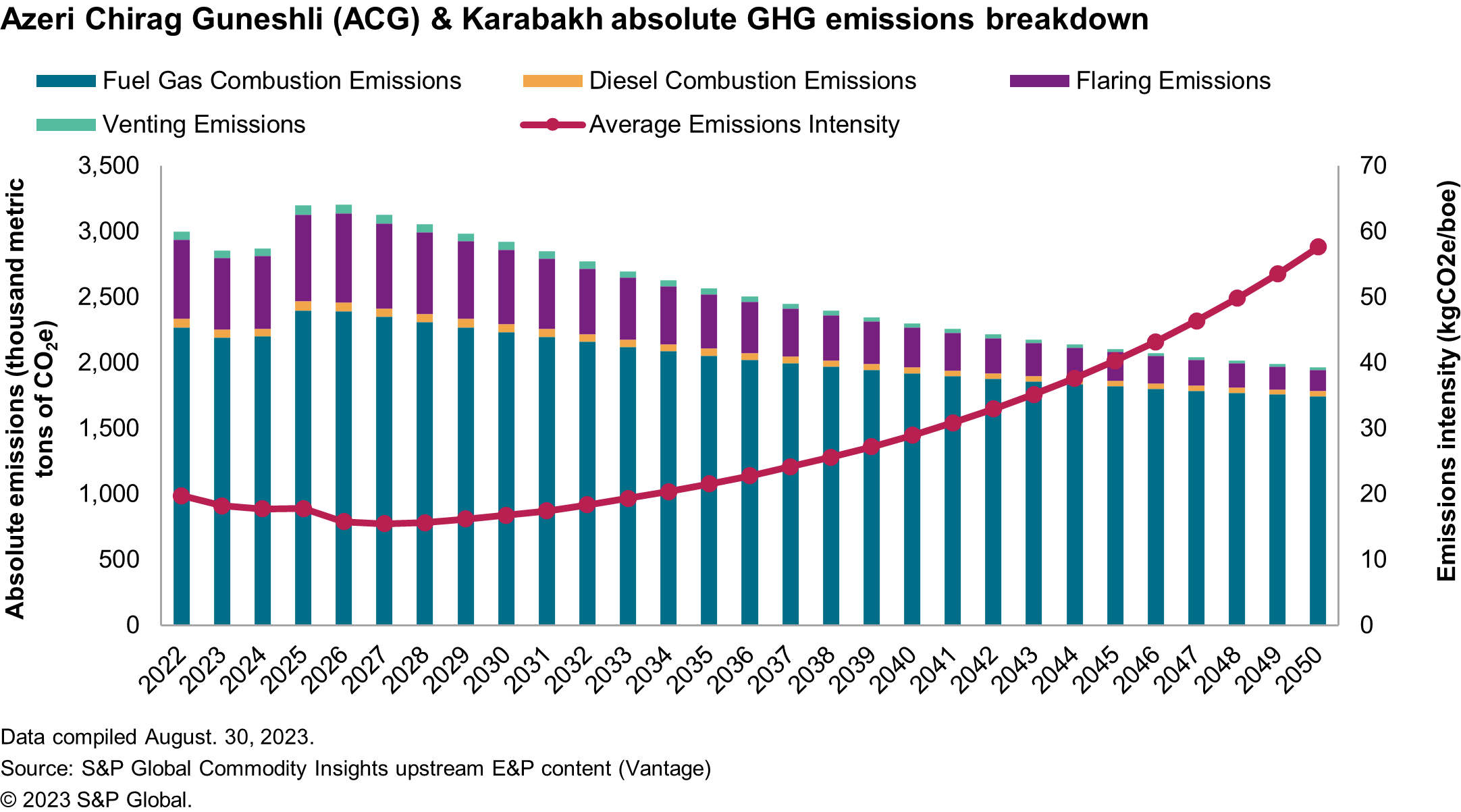

The primary sources of GHG emissions from the Azeri-Chirag-Guneshli (ACG) are the burning of natural gas for electricity generation and gas flaring. These two activities collectively contribute to over 90% of the total GHG emissions produced by the asset. The asset operator has achieved notable improvements in managing gas flaring at both offshore and onshore facilities. Despite an increase in production, the emissions from flaring have been steadily decreasing. However, because the primary source of emissions remains the combustion of fuel, the future emissions profile will directly rely on the volume of production. Additionally, as the production volumes of the asset decrease, we anticipate observing an uptick in the intensity of GHG emissions.

When compared to another significant asset in the Caspian region, namely the Kashagan offshore field operated by NCOC, the ACG displays an emissions intensity for the production lifecycle that is 1.7 times lower. This brings it closer to the emissions intensities of major onshore fields in Kazakhstan like Karachaganak and Tengiz. The difference between onshore and offshore fields, which typically tend to have higher emission intensities, can be attributed to the elevated concentrations of H2S and CO2. These compounds require more energy to reinject or process. In general, the emissions intensity of ACG rose from 16.6 to 19.7 kgCO2e/boe. On the contrary, Equinor's emissions intensity stemming from its upstream activities experienced a gradual reduction from 8 to 6.9 kgCO2e/boe over the same period. The potential for facility electrification could significantly reduce the overall emissions and emission intensity. The World Bank estimate that Azerbaijan has around 157GW of technical offshore wind resource.

The BTC pipeline is 1,768km and runs from the Sangachal terminal in Azerbaijan, across the country through Georgia and Turkey to the marine terminal in Ceyhan. The 42-inch pipeline, capable of carrying around 1.2 million barrels a day, serves as the major export pipeline for Shah Deniz condensate and ACG oil, as well as liquids from other Azeri, Kazakh and Turkmen fields. Oil from the new ACE platform and Karabakh will also be transported through the pipeline. The pipeline has eight pump stations, two in Azerbaijan, two in Georgia and 4 in Turkey. In the first half of 2023, BTC spent around $59 million in operating expenditure and $18 million in capital expenditure. Around 114 million barrels of BTC-exported crude oil was lifted at the port of Ceyhan and loaded onto 158 tankers. Tariff fees for the pipeline are around $25/ton with oil imported through the Baku port experiencing an additional $8/ton tariff. These tariffs have different rates for owners and shippers who aren't owners.

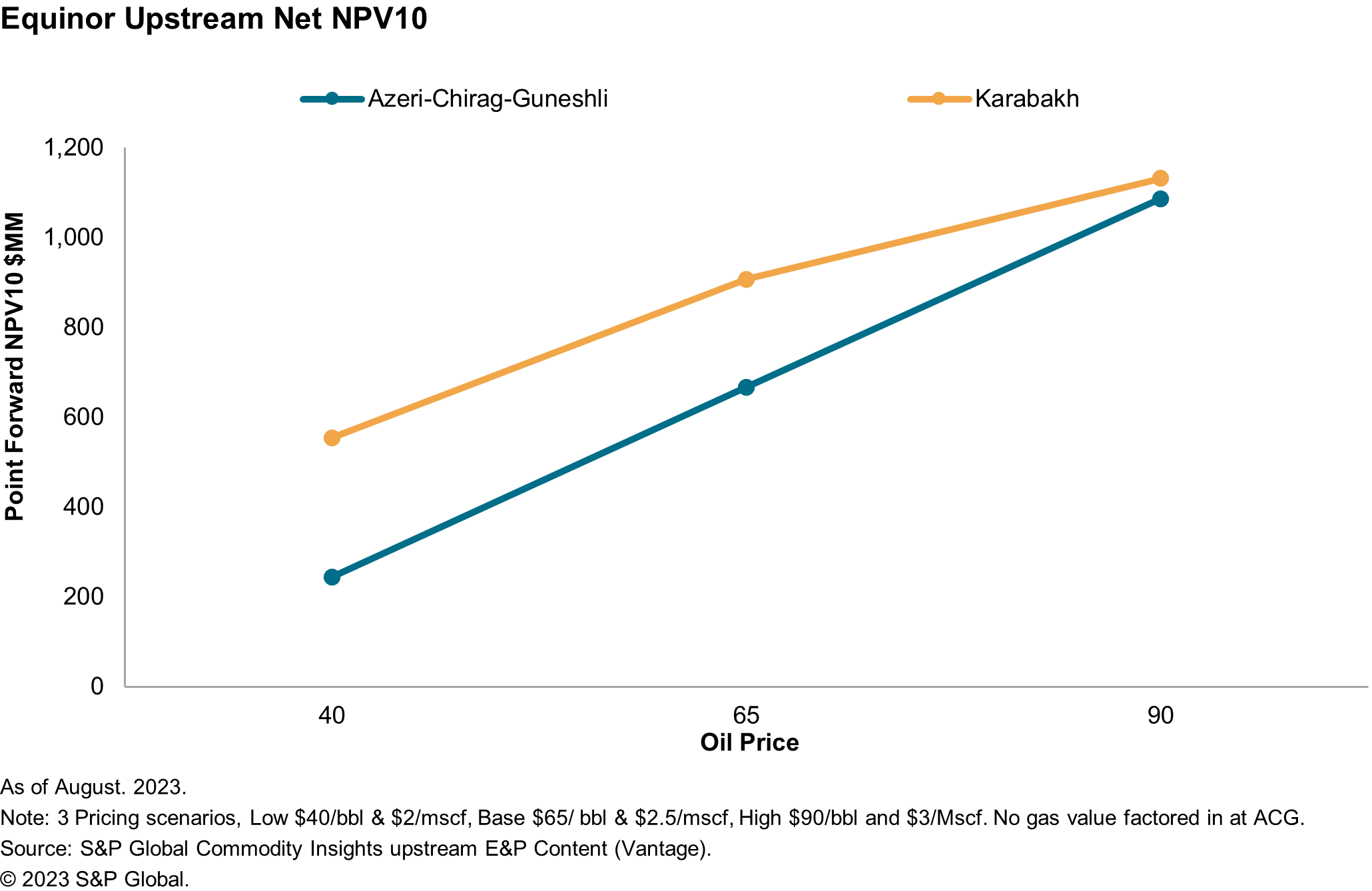

The two fields both show positive economics even at stressed commodity pricing. The Karabakh field which shows a breakeven price around $32/bbl demonstrates that the project has robust economics and will likely be sanctioned further to complete the topside construction and installation. Production from the field could be expected around 2025 or 2026 if the joint venture sanction the project in the next 12 months. Additional exploration around Karabakh could also benefit from its installed infrastructure with scope for expansion if additional resources are discovered.

This article was published by S&P Global Energy and not by S&P Global Ratings, which is a separately managed division of S&P Global.