Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer LoginsProgress of US auto sales remains unsteady

New light vehicle sales in April are expected to maintain the pace of the preceding months; uncertainty remains for remainder of year

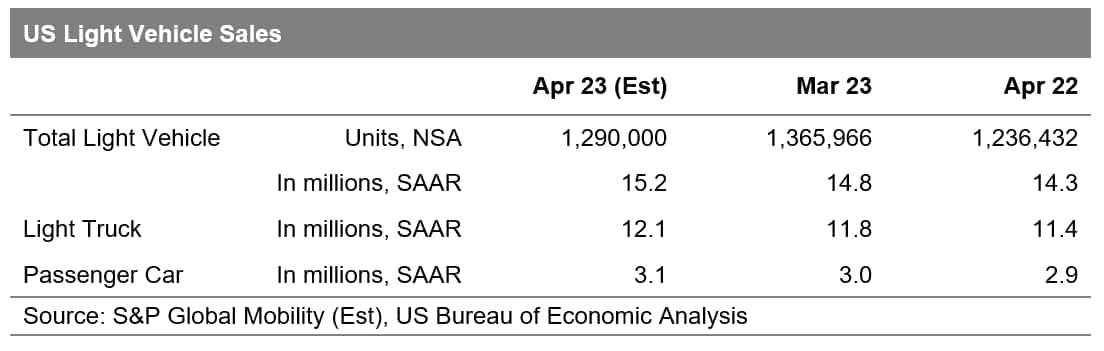

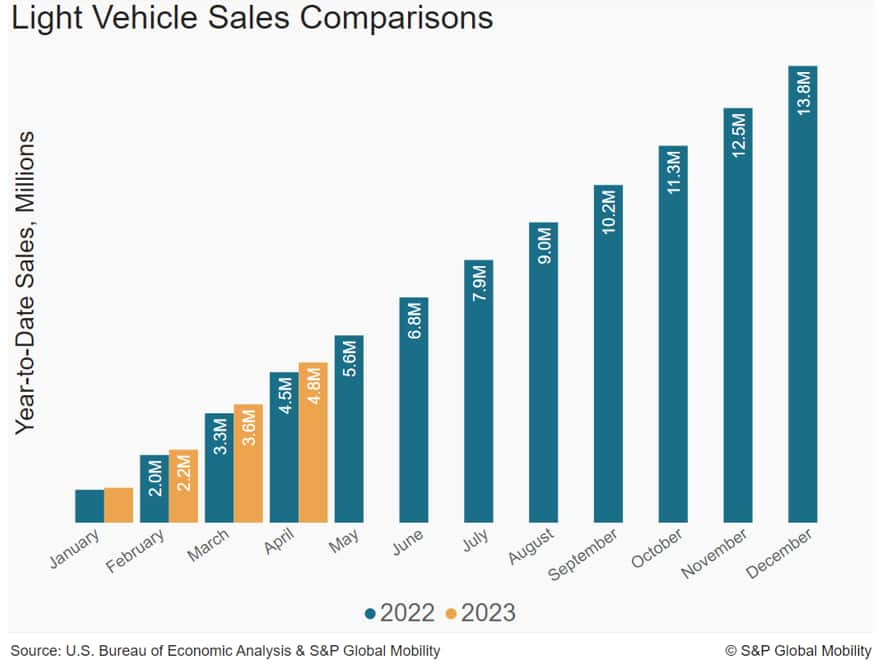

S&P Global Mobility estimates new light vehicle sales volume in April 2023 to reach 1.29 million units, up approximately 4% from April 2022 and representing the ninth consecutive month in which volume has improved from the year-ago level. This volume would translate to an estimated sales pace of 15.2 million units SAAR (seasonally adjusted annual rate), in line with the first quarter 2023 average of 15.3 million units.

"Auto sales remain stuck at current levels," said Chris Hopson, principal analyst at S&P Global Mobility. "With an auto sales environment currently defined by the mixed signals of mildly advancing production, inventory and incentives on one hand, and rising affordability concerns and uncertain consumer confidence levels on the other, expected demand in April falls under the 'no news is good news' category. Auto sales will remain subject to the unsteadiness apparent in the overall economy, with the likelihood of month-to-month volatility ahead."

While sales continue to waver, the supply side of the auto equation is beginning to show some sustained signs of improvement. According to Joe Langley, associate director at S&P Global Mobility, "North American production results for March 2023 (the most recent data available) are estimated to total 1.45 million units, translating into 15.82 million units produced on a SAAR basis. That is the highest level in 30 months."

S&P Global Mobility analysts do not expect sales volumes over the next several months to dynamically change from the current trend. However, demand-level constraints may shift from being inventory-driven to more consumer-facing vehicle affordability challenges, by way of continued high prices, uncertain economic conditions, rising interest rates and tighter credit conditions. That could lead to increasing inventories providing some sustained downward pressure on new vehicle pricing.

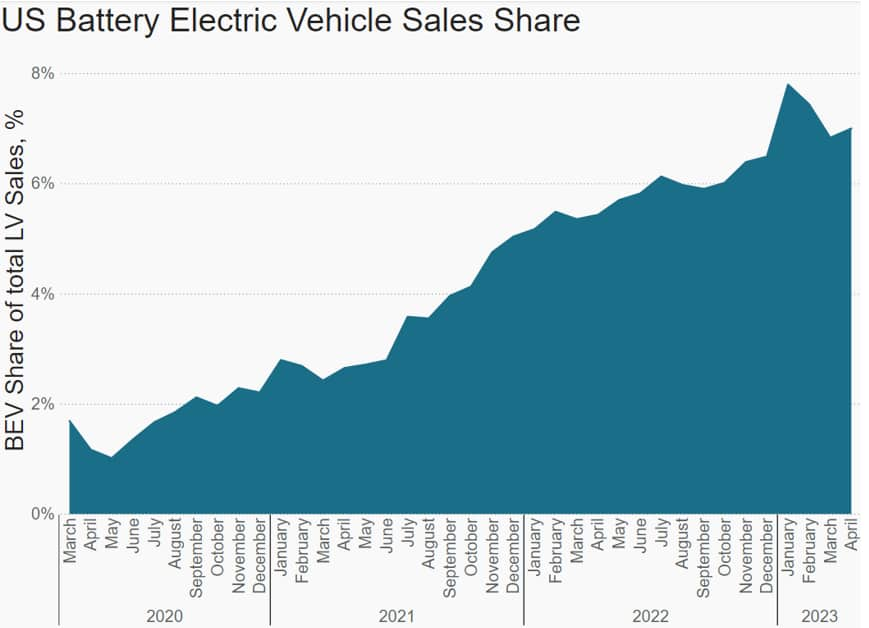

Continued development of battery-electric vehicle (BEV) sales remains a constant assumption for 2023. However, the implementation of the US federal EV incentive eligibility, ongoing price adjustments from Tesla, and the Department of Energy's downward restating of e-MPG ratings for electric vehicles could translate into monthly BEV share becoming a bit more volatile in the upcoming months.

The sales share of BEVs through the first quarter of 2023 is estimated to be above 7%. On a projected level of 7% for April, BEV share is expected to remain on trend. Beyond the pricing developments, a sustained churn of new and refreshed BEVs will continue to promote BEV sales as the year progresses.

Source: S&P Global Mobility, Monthly Light Vehicle Sales Share

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.