Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Nov 01, 2021

Climate change initiatives create new dynamics in the North America biofuels market

In 2021, the U.S. and Canada announced ambitious goals to reduce greenhouse gas (GHG) emissions. Both countries pledged to reach net-zero emissions by 2050, with short-term GHG emission reduction targets of 50-52% (U.S.) and 40-45% (Canada) compared to 2005 levels.

Renewables like biofuels play a strategic role in North America climate change initiatives. Biofuels are made from non-fossil sources, including animal, vegetable and cellulosic material. The carbon intensity of these fuels is lower than traditional gasoline, jet fuel and diesel, and varies by feedstock. Biofuels made from used cooking oil have the lowest carbon intensity (20 gCO2e/MJ), while those made from soybean oil and corn ethanol are higher (53 and 80 gCO2e/MJ).

Soybean oil accounts for 48% of the current renewable fuel feedstock. It is a widely produced crop across the U.S. Midwest, with projected 2021 production of 4.4 billion bushels, according to the USDA.

Biodiesel market growth has caused soybean oil futures to skyrocket, peaking at 73 cents per pound in June 2021. Prices for other vegetable oils, including rapeseed oil, beef tallow and palm oil, are also nearing all-time highs.

Renewable fuel usage and production capacity in North America are projected to increase over the next few years. And with the European Union's Renewable Energy Directive (RED II)'s target of 55% emissions reduction by 2030, global demand for renewable fuels is set to increase as well. The big question is: can biofuel feedstock production keep up?

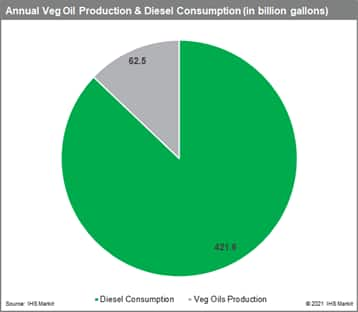

Just as perspective global vegetable oil production, including all major oils, is very small as compared to global diesel fuel consumption, let alone adding in jet fuel. The below chart shows vegetable oil production amounts to only about 15% of diesel fuel consumption in volume and about 40% of that is palm oil, which does not significantly reduce GHGs.

Changing dynamics in the biofuels industry

In 2019, the U.S. consumed 1.8 billion gallons of biodiesel and 900 million gallons of renewable diesel, according to data from the Energy Information Administration. Growth in the biofuels market will be driven by renewable diesel, registering an annual upside of 13% over 2020-2025.

Biodiesel must be blended with petroleum-based diesel to be compatible with existing engines and distribution systems. Blended fuels are typically 10-20% biodiesel. Renewable diesel is easier to work with: it doesn't require blending and can be produced on existing refinery equipment without any modifications.

This gives renewable diesel a competitive advantage. IHS Markit projects that renewable diesel will continue to grow in popularity, accounting for 20% of the combined renewable diesel and biodiesel market by 2025.

Renewable diesel demand is highest in California because the fuel has one of the lowest carbon intensities and is used to meet the state's low carbon fuel standard (LCFS). Demand is expected to rise across the region, with similar programs in place in Washington state and British Columbia. The remainder of Canada has approved a nationwide LCFS policy, and several other U.S. states have proposed similar fuel standard policies.

Increasing renewable diesel refining capacity

By the end of 2022, North America renewable diesel production capacity will be four times what it is today. This growth is in response to increasing demand for clean energy, GHG emission reduction policies, and refinery reconfigurations.

Currently, the U.S. renewable diesel production capacity is just under 1 billion gallons per year, which makes up about half of the country's total biofuel production capacity. Many existing plants have limited production capacity to serve primarily the agriculture industry, and are not sufficient for the large-scale biofuel refining market.

New investment is focused on renewable diesel on the U.S. west coast. Twelve additional renewable diesel plants are expected to come online by the end of 2022. These plants are largely concentrated near the Pacific coast, where they can take advantage of California's LCFS. Several of these plants are existing petroleum refineries that are retrofitting their operations to produce renewable feedstock. With the new plants, annual renewable diesel production capacity will reach 4 billion gallons.

Can biofuel feedstock production keep up?

As biofuel demand grows and production capabilities ramp up in North America, so will demand for renewable feedstocks. Renewable diesel requires more feedstock than biodiesel, and the U.S. is already moving towards a feedstock shortage.

Soybean oil, which already accounts for nearly half of biofuel feedstock, is the best alternative to other feedstocks like used cooking oil and beef tallow. While used cooking oil and beef tallow provide a greater reduction in GHG emissions, they are not available in the huge volumes necessary to meet growing demand. The soybean industry is expanding in response to increased demand and margins. Soybean crushing capabilities are set to increase and new canola oil and soybean oil plants are planned in Canada and the U.S.

But these new projects can't come online fast enough. The majority of crush capacity and vegetable oil plants won't be here until 2023-2025. As a result, U.S. soybean oil may be priced out of the export market. Given the current vegetable oil prices and growing demand for biofuels, we predict that it will be more profitable to use soybean oil to produce domestic fuel. The U.S. may even become a net importer of soybean oil in the near future.

Want the full renewable diesel market outlook?

Demand for renewable fuels and feedstocks is at an all-time high, disrupting the global vegetable oil market. In a recent webinar, our Biofuels Solutions team reviewed the complex dynamics between U.S. biofuels policy and the vegetable oil sector. Our experts provided a detailed biodiesel market analysis and biofuel market outlook.

Request a sample report from our Vegetable Oils Economics Service, or any of IHS Markit's biofuels market services here, to learn more about industry data, prices and forecasts.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fesg%2fs1%2fresearch-analysis%2fclimate-change-initiatives-create-new-dynamics-in-the-north-am.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fesg%2fs1%2fresearch-analysis%2fclimate-change-initiatives-create-new-dynamics-in-the-north-am.html&text=Climate+change+initiatives+create+new+dynamics+in+the+North+America+biofuels+market+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fesg%2fs1%2fresearch-analysis%2fclimate-change-initiatives-create-new-dynamics-in-the-north-am.html","enabled":true},{"name":"email","url":"?subject=Climate change initiatives create new dynamics in the North America biofuels market | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fesg%2fs1%2fresearch-analysis%2fclimate-change-initiatives-create-new-dynamics-in-the-north-am.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Climate+change+initiatives+create+new+dynamics+in+the+North+America+biofuels+market+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fesg%2fs1%2fresearch-analysis%2fclimate-change-initiatives-create-new-dynamics-in-the-north-am.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}