Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Aug 18, 2022

New Configurations: America’s Gas and Power in Net Zero

To learn more about our study, please download the free whitepaper.

Many US states, localities, and corporations have pledged to reduce carbon emissions. While pace and baseline may vary, a common formula is an economy-wide 50% carbon emissions reduction by 2025-30 compared with a baseline emissions year like 2005 or later, and net-zero carbon by 2050. Such a transition will change the way we produce and consume energy. Today's gas pipelines and electric power grid will be key enablers of tomorrow's low-carbon future, delivering green molecules and electrons to the consumers. However that infrastructure will not be enough. Decarbonization requires clean energy technologies that push beyond the limits of existing infrastructure. As infrastructure grows to keep pace with new uses of lower carbon electricity and gas, utilities and other energy providers must still provide reliable service and manage costs. The New Configurations study identifies the costs and characteristics of low-carbon technologies and energies. We argue that investment in electricity and gas assets is necessary to decarbonize.

When we think of net zero, we often start with electrification, energy efficiency, and decarbonizing electricity production. While electrification is an attractive approach for addressing many fossil-fuel uses currently, an all-electric world would be quite costly owing to infrastructure requirements. For example, space heating alone would require massive investments to match the peak heating demand capability present in the current natural gas infrastructure. A "smarter," more cost-effective strategy is to eventually use low-carbon molecules like hydrogen and renewable natural gas to complement electricity, drastically lowering carbon emissions while redeploying existing natural gas pipeline and distribution assets. By examining cases like space heating, we evaluate the challenge of decarbonization holistically—taking into account commercially available end-use technologies, low-carbon energy mediums, and the strengths and weaknesses of current infrastructure. In some cases, market structures need to evolve to enable a "smart" transition to net zero—one that is reliable and manages costs.

The "New Configurations" study builds on IHS Markit's proprietary Fast Transition decarbonization research, which provides a plausible pathway to decarbonizing the US economy by 2050. The underlying premise envisioned in New Configurations is the emergence of a societal will to decarbonize the economy, much different than the political gridlock seen in contemporary US political debate. From power plants to home furnaces, the energy transition involves millions of choices regarding where to invest. Such decarbonization policies will need to provide the economic incentives that allow investors and consumers to create value in the energy transition. This transition contains the following salient features:

- Leverage existing energy assets.

- Focus on commercial and near-commercial technology.

- The scale of the problem requires centralized a profound shift in society's acceptance of economy-side decarbonization combined with policy-making that facilitates decentralized decision-making.

- Maintain flexibility for future technology.

Contours of a smart transition

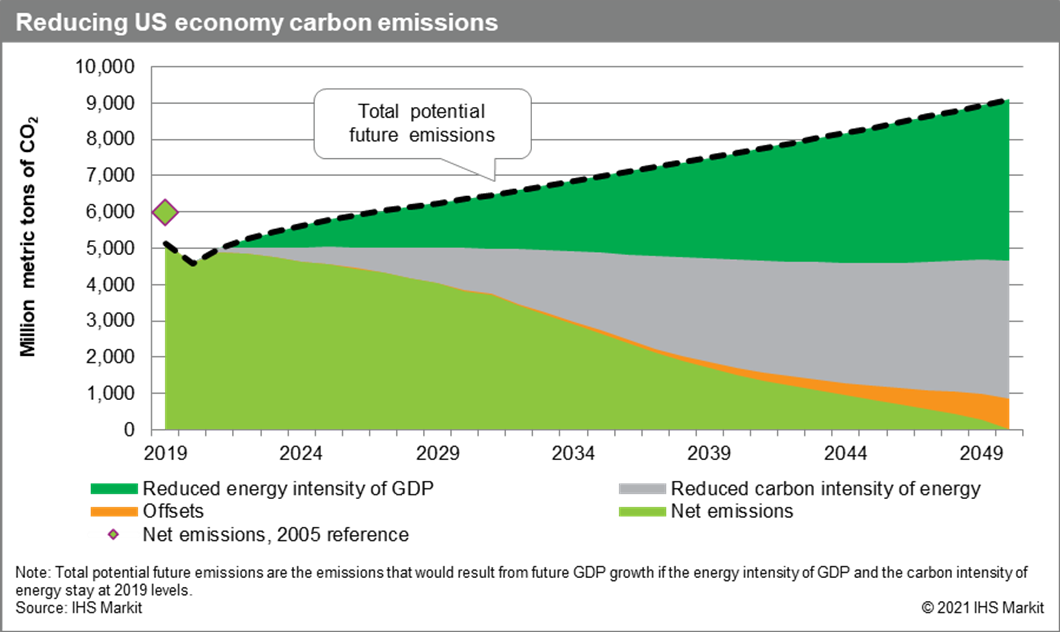

US economy-wide carbon emissions have declined about 12% from a 2005 baseline, mostly owing to the power sector's increased use of natural gas and renewables and its decreased use of coal. If the energy intensity of GDP and carbon intensity of energy stayed at recent levels, carbon emissions (as represented in Figure 1 by "total potential future emission") would grow in tandem with real GDP (about 2% per year). In comparison, carbon emissions reductions in New Configurations are underpinned by a decarbonization pathway defined by these key characteristics:

- Reduced energy intensity of GDP. The energy intensity of the US economy has been declining steadily for decades, driven by a sectoral shift to less-energy-intensive activities, the electrification of some end uses, and increased energy-related process efficiency. New Configurations assumes all these trends continue.

- Reduced carbon intensity of energy. The carbon intensity of energy is already declining as a result of the shift from coal and oil to natural gas, and the expansion of clean energy technologies such as wind, solar, hydro, geothermal, and nuclear.

- Use of carbon offsets. Fossil fuels' high energy density and ease of handling make achieving carbon neutrality by solely eliminating fossil fuel combustion difficult. The remaining carbon emissions in 2050 can be counterbalanced by emissions offsets, which are measures implemented to remove carbon from ambient air (or in some cases reverse the loss of natural carbon sinks).

There are many possible pathways to net zero by 2050. The particular pathway used in the report is not a forecast but a scenario to help quantify the examples.

To find out more about our approach and the key implications, please download the free white paper.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fesg%2fs1%2fresearch-analysis%2fnew-configurations-americas-gas-and-power-in-net-zero.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fesg%2fs1%2fresearch-analysis%2fnew-configurations-americas-gas-and-power-in-net-zero.html&text=New+Configurations%3a+America%e2%80%99s+Gas+and+Power+in+Net+Zero+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fesg%2fs1%2fresearch-analysis%2fnew-configurations-americas-gas-and-power-in-net-zero.html","enabled":true},{"name":"email","url":"?subject=New Configurations: America’s Gas and Power in Net Zero | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fesg%2fs1%2fresearch-analysis%2fnew-configurations-americas-gas-and-power-in-net-zero.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=New+Configurations%3a+America%e2%80%99s+Gas+and+Power+in+Net+Zero+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fesg%2fs1%2fresearch-analysis%2fnew-configurations-americas-gas-and-power-in-net-zero.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}