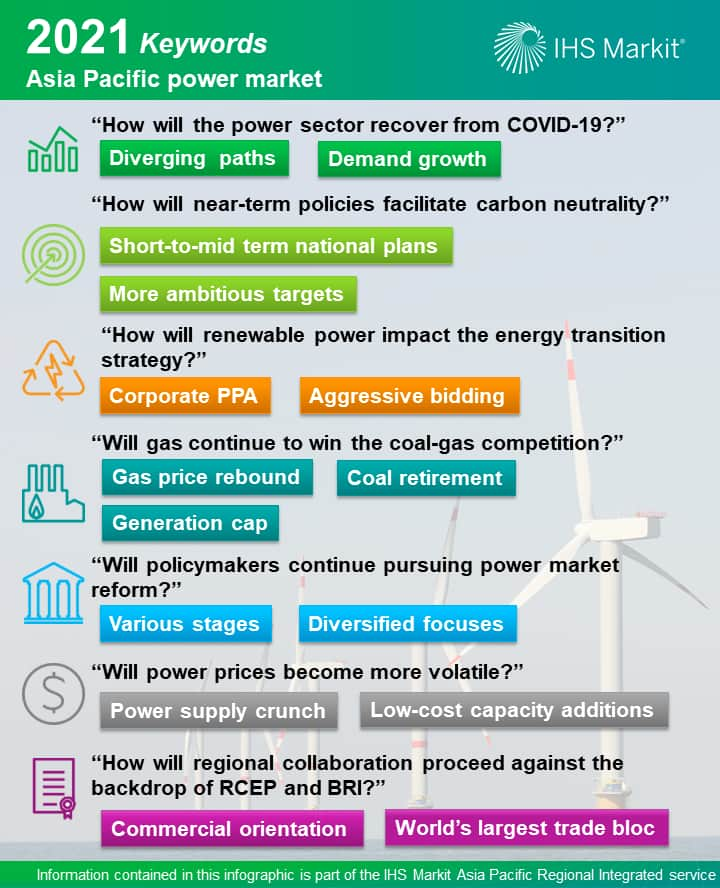

Seven big questions facing the Asia Pacific power market in 2021

Entering 2021, the Asia Pacific (APAC) Power and Renewables research team looked across the regional markets and summarized the key questions and potential signposts. These seven questions reflect the key issues that will shape the power markets in this region and will guide our research agenda for the year.

COVID-19 pandemic led to the global recession during the past year. APAC region was also hit hard, with the power markets affected in multiple ways. In 2020, the power demand in APAC was largely stagnant, compared with an average of 4.7% growth during the past decade. Capacity additions and other market activities also slowed down. As an example, renewables additions in India were lower in 2020 by 60%. The recovery of the power sector in 2021 will most likely diverge in APAC region. While China, Myanmar, and Vietnam have already shown strong recovery and are expected to continue the healthy trajectory, a few other economies are still facing uncertainties in resuming activities to pre-pandemic levels.

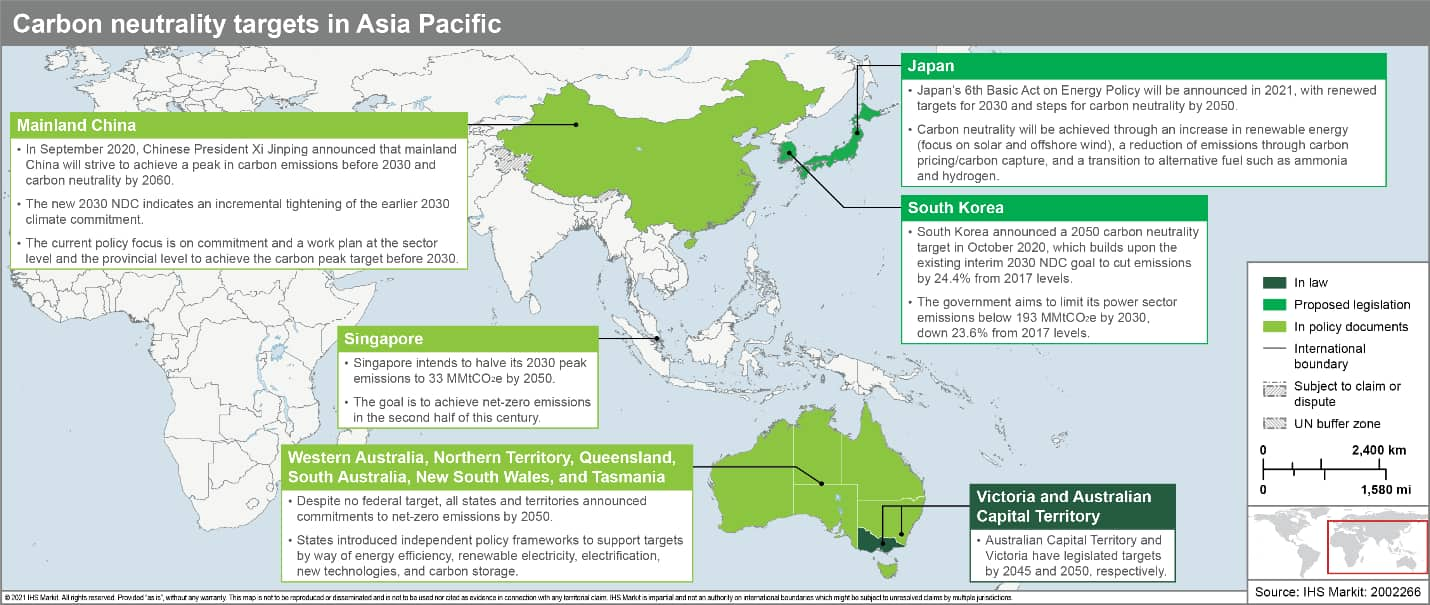

Following the net zero carbon commitment by Europe, China, South Korea, and Japan announced their national long-term climate goals in 2020. The near-term policies are under the spotlight as the markets are awaiting new policies to see how each government plans to facilitate the energy transition process. Renewables play a central role in the decarbonization strategy, even for countries without official carbon neutrality goals. Stronger policy support for renewables is expected in 2021. However, renewable development are also facing challenges including record low tender prices, curtailment issues, as well as the occurrence of negative prices.

In the past year, gas-fired power generation generally emerged stronger than coal plants, when the power markets faced significant demand weakness due to Covid-19 pandemic. Although the recent record-high LNG spot price is unlikely to sustain through the rest of the year, in 2021, average LNG and natural gas prices will rebound from 2020 levels. This will exert downward pressure on gas unit utilization and hence the gas consumption for power generation. However, climate efforts will continue pushing for coal-to-gas and coal-to-renewables switching in the power capacity mix in 2021, enhancing the potential of gas demand increase relative to coal.

Market-oriented reform is considered a key solution to address the power sector issues such as affordable supply security, rising renewables penetration, and environmental concerns. However, different markets are at different stages of power sector reform, and each with different policy focus in 2021. Moreover, how the entire timeline of liberalization will evolve remains a question for many markets.

In 2020, power demand contractions caused by Covid-19 pandemic, increasing renewables penetration, committed coal retirement, and fluctuation of fuel prices gave rise to higher volatility of spot electricity prices. Stepping into 2021, Japan's power market already witnessed record high spot power prices as cold weather coincides with a power supply crunch. New capacity addition and retirement plans will also add uncertainty to the power price outlook, which in turn influences the decision making of power project investment.

For more on power in the Asia Pacific region, visit our Asia Pacific Regional Integrated Energy service page.

Lara Dong is a senior director leading Greater China power and renewables research and is a member of Asia's research and consulting team.

Posted 22 February 2021

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.