- DATE:

- AUTHOR:

- S&P Global

March 2025 S&P Capital IQ Release Notes

S&P Capital IQ Release Highlights

In this release, we added new enhancements on Capital IQ to improve your daily workflows:

We enhanced reporting efficiency in Portfolio Analytics by adding the ability to export a firm’s exposure data for use in external workflows.

We introduced a Cash Flow data input template in the Project Finance app to streamline inputs for Probability of Default (PD) and Loss Given Default (LGD) assessments.

We launched the ‘Save Progress’ feature in ProSpread, enabling users to save and resume their extraction workflows for greater flexibility.

We introduced GSAC V3 Bond Sector Curves, in the S&P Capital IQ Plug-In, enhancing the precision of bond sector analysis and aligning with the Global Industry Classification Standard (GICS).

Visit S&P Capital IQ and Contact Us for additional details.

Portfolio Analytics

In this release, we added the ability to export a firm’s exposure data for use in external workflows and improved reporting workflows in Portfolio Analytics. Users now have greater control over report changes with the option to update the entire report or only recalculate the changes.

Exporting Exposure

Users can now export the firm’s exposure to a company into a CSV file, for better integration into further analysis.

Find it in the platform:

Portfolios tab

Navigate to the Portfolios tab from the top navigation

Expand the menu and click on the Exposure link

Once the Exposure window is launched, search for the company to analyze

View the exposure information and click on Export on the right-hand side

Portfolio Analytics

Navigate to a report’s top-level navigation menu and click on View Exposure link

Or access it from an individual company within the report, via the left-hand side ellipsis menu, under the View Exposure link

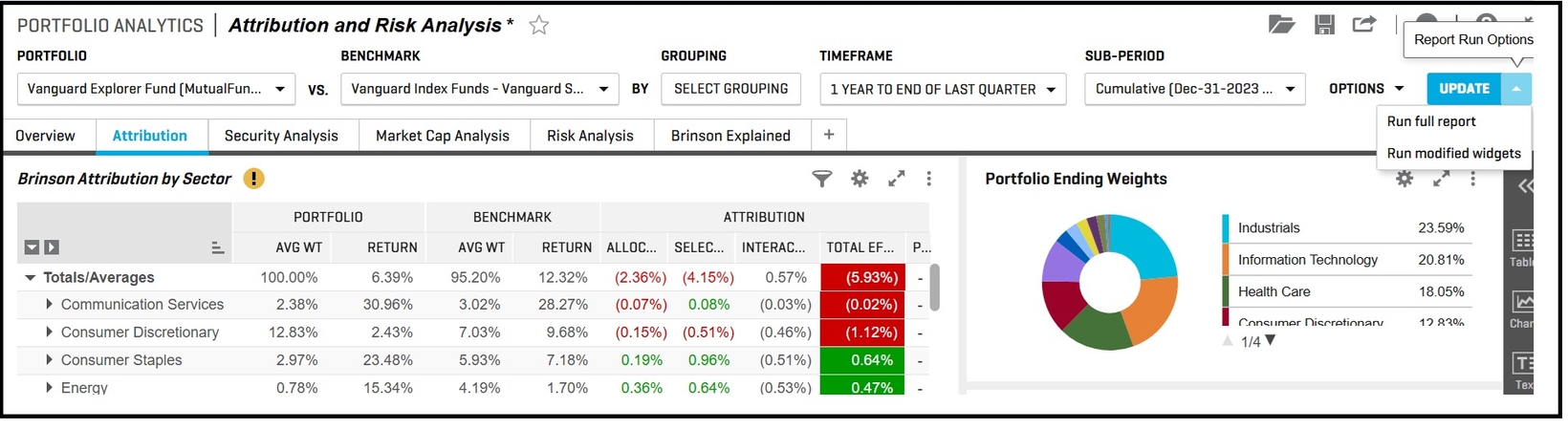

Run Modified Widgets Only

Users now have the option to re-run the full report or only the modified components after making changes to a report. This flexibility saves time in reporting workflows.

Find it in the platform:

Navigate to the Portfolios tab from the top navigation

Go to Reports and open an existing report or create a new report

After updating one or more widgets in a report, click on Update at the top right side of the report and choose to run full report or only the modified widgets

Note: Full reports may need to be re-run when there are updates to portfolio or benchmark constituents in between report runs

Scorecards

In this release, we introduced a Cash Flow data input template for Project Finance, enabling users to streamline their inputs for Probability of Default (PD) and Loss Given Default (LGD) assessments.

Cash Flow Data Input Template on Project Finance

Users can now leverage the Cash Flow data input template to calculate key inputs for PD and LGD assessments of Project Finance assets. This template allows users to calculate key assessment parameters using a standardized methodology, enhancing accuracy and efficiency in the assessment process.

Find it in the platform:

Navigate to the Scorecards menu item in the top navigation

Select Project Finance from the dropdown menu

On the landing page, start a new assessment for an existing project by clicking the + icon next to the project row or create a new project

In the New Assessment form, select Yes for Do you want to use the Cash Flow Data Input Template? before starting the assessment

The template can be accessed and utilized in the Cash Flow Inputs page of the PD assessment

Note: Access to the Cash Flow template requires respective entitlements, please contact your account team for further details.

ProSpread

In this release, we introduced the ‘Save Progress’ feature on ProSpread, enabling users to save and resume their in-progress extraction workflow at their convenience . This feature provides greater flexibility for our clients as they navigate their financial documents.

Save Progress

Users can now leverage the "Save Progress" feature to effortlessly save their work up to a point in time and resume their work at their convenience, all while maintaining confidentiality of their data. Users can save their workflow at any point after starting the verification of extracted data, giving them a local copy of their saved progress. They can then easily upload this saved file to continue their work seamlessly.

Find it in the platform:

Save file:

Navigate to the ProSpread application from the top bar menu

Start a new extraction and continue to Step 3 of the process

Click on the Save option dropdown to access Save Progress on ProSpread

Download the file in JSON format safely and directly onto your local drive

Uploading a saved file:

Navigate to the ProSpread application from the top bar menu

Click on Continue Previous Session in Step 1

Upload the saved file in JSON format to resume progress from the exact step it is saved

Credit Analytics Capital IQ Plug-In

In this release, we introduced the GSAC V3 Bond Sector Curves in the S&P Capital IQ Plug-In, significantly enhancing the precision and depth of bond sector analysis. These enhancements ensure a more accurate reflection of key market factors, incorporating an alignment with the Global Industry Classification Standard (GICS) and offering enhanced transparency to better support users' pricing, risk assessment, and regulatory compliance needs. Additionally, we have added a new metric under the Bond Implied Scoring Model, providing users with an easier way to link issuance scores directly with the corresponding bond issue.

GSAC V3 Bond Sector Curves

The GSAC V3 Bond Sector Curves are now available in the S&P Capital IQ Plug-In, providing essential tools for more informed decision-making in risk management and pricing strategies.

Expanded coverage includes:

GSAC V3 curves: The GSAC V3 curves now cover 50 countries across diverse regions, including Asia Pacific, Eurozone, North America, and Global markets, including data for 23 different currencies and 18 rating classes.

GICS Sector Integration: The addition of GICS sector data enables more granular insights and sector-specific analysis, aligning with global market standards.

Comprehensive Seniority Inclusion: The curves now encompass a full spectrum of bond seniorities, including Senior Secured, Senior Unsecured, and Subordinated bonds, providing users with a holistic view of market conditions.

Enhanced Methodology: The refined methodology ensures that the curves better reflect the true dynamics of the underlying bond markets, improving the accuracy of market assessments.

Curve Transparency: A new transparency feature has been added to clearly identify bonds that match the curve criteria, allowing for better tracking, compliance, and regulatory support in areas such as transfer pricing, valuation, and credit risk analysis.

Below are the 13 new metrics:

GSAC TRANSPARENCY METRICS:

IQ_CURVE_TRANSPARENCY_ISIN_GSAC

IQ_CURVE_TRANSPARENCY_ISSUER_NAME_GSAC

IQ_CURVE_TRANSPARENCY_AMOUNT_OUTSTANDING_GSAC

IQ_CURVE_TRANSPARENCY_ZSPREAD_GSAC

IQ_CURVE_TRANSPARENCY_YIELD_TO_MATURITY_GSAC

IQ_CURVE_TRANSPARENCY_MATURITY_DATE_GSAC

IQ_CURVE_TRANSPARENCY_LIQUIDITY_SCORE_GSAC

IQ_CURVE_TRANSPARENCY_COUNTRY_GSAC

IQ_CURVE_TRANSPARENCY_CURRENCY_GSAC

IQ_CURVE_TRANSPARENCY_SENIORITY_GSAC

IQ_CURVE_TRANSPARENCY_DATE_GSAC

GSAC CURVE METRICS:

IQ_Z_CURVE_CONTINUOUS_GSAC

IQ_FULL_CURVE_CONTINUOUS_GSAC

Find it in the platform:

Launch S&P Capital IQ Plug-in and open Formula Builder

Search for the GSAC Curves metrics and transparency metrics within the GSAC Curves folder

New Metric Added to Bond Implied Scoring Model

Users can now access a new metric 'IQ_BM_ISSUE_ISIN' added under the Bond Implied Scoring Model, allowing them to easily link the issuance score with the corresponding bond issue

Find it in the platform:

Launch S&P Capital IQ Plug-in and open Formula Builder

Find the metric in the existing folder: Bond Model