Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ARTICLES & REPORTS

Aug 27, 2020

IBOR Transition and Value Transfer

The recent EUR Price Alignment Interest (PAI) and discounting switch from EONIA to €STR for cleared derivatives is now in the books. From 27 July 2020, any EUR cleared swap or EUR swaption delivering a cleared swap follows the conventions set by the clearing houses (e.g. CME, Eurex, LCH) and €STR is now the standard rate for discounting those instruments.

The new EUR PAI and discounting conventions delivered €STR discounting risk to all parties involved in cleared derivatives. On the switch day, price transparency and compensation calculation were made simpler thanks to the fixed 8.5bps spread between EONIA and €STR. Due to their more complex nature, the case for swaptions required an amendment to the 2006 ISDA Definitions published as Supplement 64 on March 30, 2020.

Link to Supplement 64:

It is expected that the upcoming USD PAI and discounting switch from Fed Funds (or EFFR, Effective Federal Funds Rate) to SOFR planned for 17 October 2020 will be far more complex due to the size of the USD cleared derivatives market, the number of firms involved and the fact that the Fed Funds and SOFR basis is dynamic which complicates compensation mechanisms involving the delivery of basis swaps to address changes in risk profile.

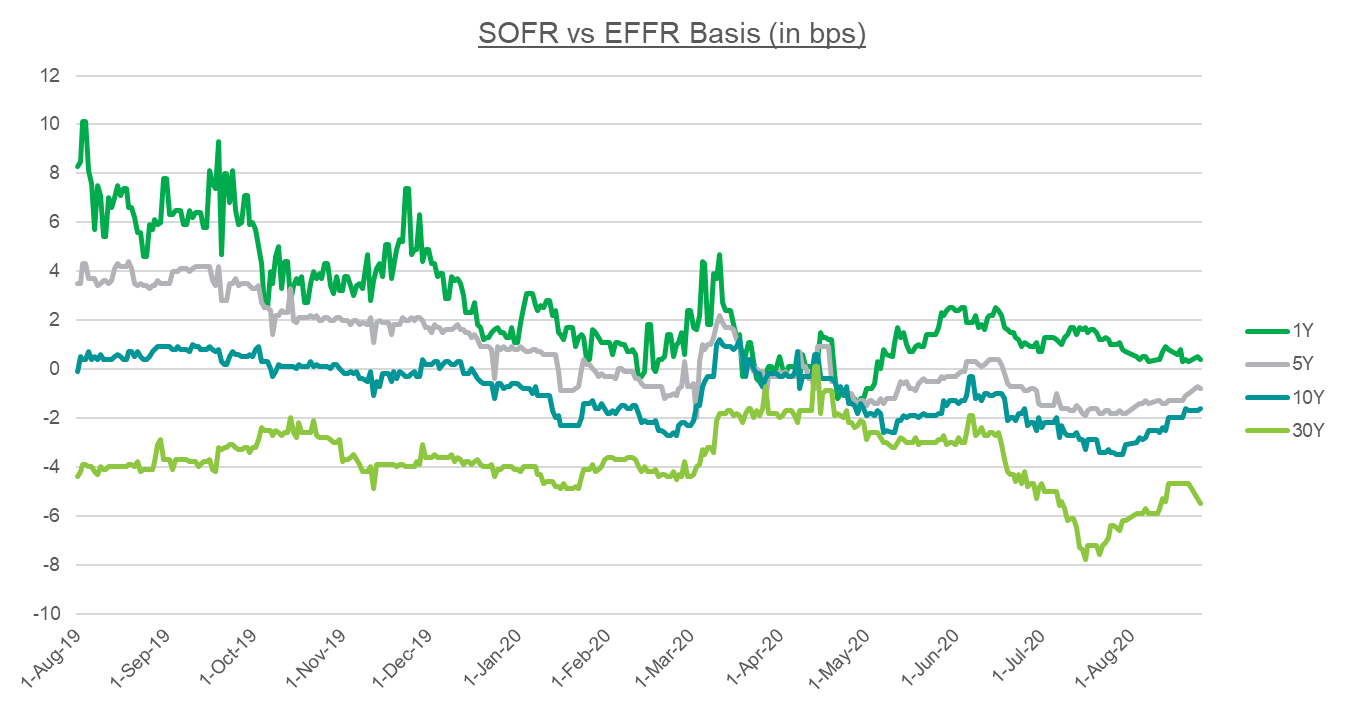

It is critical that firms with significant exposure look at value transfer considerations and assess the impact of this discounting switch on their portfolios. As we can see from the graph above, the magnitude and direction of impact can vary dependent on the portfolio exposure to Fed Funds. Unlike EUR, where the impact could in practice be forecasted in advance, tracking the USD basis will be critical for firms hoping for a smooth transition.

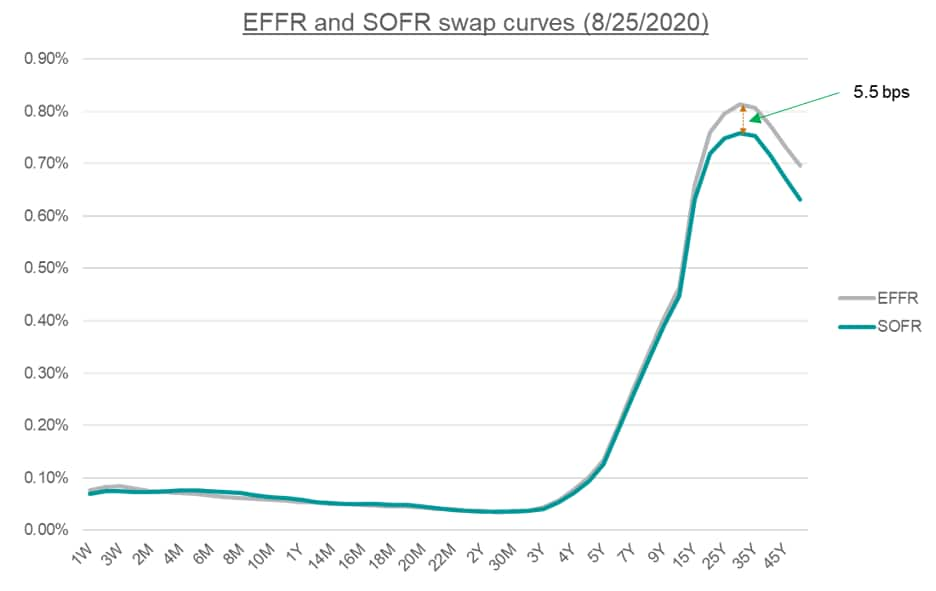

Not only the NPV of USD cleared derivatives will change but also the risk profile of the whole portfolio (for those who decide to opt for cash compensation instead of the delivery of basis swaps). Some imbalances could also appear depending on the number of firms that decide to opt for full cash compensation versus cash and physical basis swaps. We are seeing the effects of expected supply and demand imbalance on the long end of the Fed Funds-SOFR basis curve that currently trades at a 5.5bps spread.

The PAI switch dates are big milestones in the IBOR transition plan but they are far from being the only events that firms should have on their radar. The timing of discounting switch for bilateral trades is unclear and largely depends on existing CSA agreements. Assuming liquidity will gradually transfer from IBORs to RFRs, the last firm to transition a CSA will likely pay a hefty liquidity premium to execute the transfer. Taking a proactive approach and monitoring liquidity and PV impact of transitioning trades, portfolios and CSAs is critical. If liquidity is too low and PV impact is unfavorable, it might be preferable to wait. If liquidity is good and PV impact is favorable, the transition should happen now.

If you'd like to discuss further with our team of experts at IHS Markit, please follow this link: https://ihsmarkit.com/topic/ibor.html

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fibor-transition-and-value-transfer.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fibor-transition-and-value-transfer.html&text=IBOR+Transition+and+Value+Transfer+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fibor-transition-and-value-transfer.html","enabled":true},{"name":"email","url":"?subject=IBOR Transition and Value Transfer | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fibor-transition-and-value-transfer.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=IBOR+Transition+and+Value+Transfer+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fibor-transition-and-value-transfer.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}