October 29, 2015 - Weekly Pricing Pulse

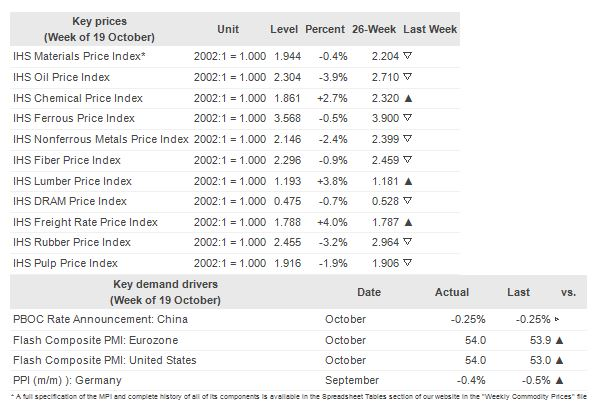

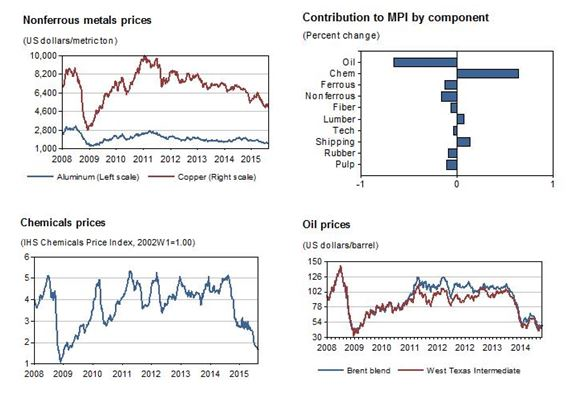

The IHS Materials Price Index (MPI) last week dropped by 0.4%, mostly driven by considerable declines in oil (down 3.9%) nonferrous metals (down 2.4%), rubber (down 3.2%), DRAMs (down 0.7%), fiber (down 0.9%), and pulp (down 1.9%). There was some support from chemicals (up 2.7%) and freight (up 4.0%). We are continuing to see lower oil prices for the second week in a row, following the upward bump from two weeks ago, which is also continuing to boost chemical prices due to lagged effects. Looking ahead, we see further MPI stability to year-end, with next week expected to be down marginally by 0.2%.

The European Central Bank (ECB) made headlines last week following a post-governing council meeting statement from Mario Draghi suggesting the present quantitative easing (QE) program could be expanded in December. This comes despite the Eurozone flash Markit composite PMI having surprised on the upside (54.0, versus 53.4 expected). However, ECB QE could spur a global strengthening of the dollar, thus having a downward impact on commodities. Of importance, the flash US Markit Manufacturing PMI figures also came out stronger than expected, while the Japanese Manufacturing PMI rose to 52.4, versus 50.9 last month. Late in the week, the People’s Bank of China (PBOC) cut interest rates by 25 basis points, to 4.35%, in an attempt to provide more economic stimulus, in addition to further cutting the reserve requirement rates for banks by 0.5%, providing some support for commodity prices.

Subscriber note: We will be altering the MPI methodology to better reflect the relative strengths of the technology component part. Starting from next week, the DRAM component will use a more narrow focus (ISIC 321), so its index weight will be reduced to better reflect its importance to material purchases. Additionally, there’s been a change to DRAM density weights, which will move the subindex higher by approximately 30%. These changes reflect the accelerating adoption of higher density memory modules and will produce a more accurate cost benchmark.

Industrial Materials: Prices - Week of 29 October 2015

Key Prices & Demand Drivers